Centralised Processing Centre

The Centralized Processing Centre (CPC) is a centralized facility set up by India’s Income Tax Department (ITD) to efficiently and swiftly process Income Tax Returns (ITRs). The primary CPC is based in Bengaluru, Karnataka, and operates under different names—CPC (TDS) and CPC (ITR)—depending on whether it handles Tax Deducted at Source (TDS) or Income Tax Return processing.

The Government of India (GOI), based on the recommendations of the Business Process Re-engineering Committee (BPR Committee), approved the establishment of a Centralised Processing Centre (CPC) in February 2009 for the bulk processing of income tax returns (ITRs) at a total project cost of ₹255 crore.

The Finance Act, 2008 amended the Income Tax Act, 1961 by introducing subsection 1A under Section 143. This empowered the Central Board of Direct Taxes (CBDT) to create a scheme for centralised processing of ITRs to expedite the determination of tax payable or refunds due to taxpayers.

Accordingly, the Income Tax Department (ITD) set up the CPC in Bengaluru to handle the centralized processing of income tax returns filed electronically as well as paper returns from Karnataka and Goa.

Key Functions of CPC in Income Tax

Processing of Income Tax Returns (ITRs)

- Electronically processes filed tax returns.

- Generates intimation under Section 143(1) for tax demands or refunds.

Handling TDS Corrections (for Form 26AS)

- Processes corrections submitted by deductors for Tax Deducted at Source (TDS).

- Updates Form 26AS to reflect accurate TDS details.

Issuing Refunds

- Calculates and processes tax refunds.

- Directly credits refunds to taxpayers‘ bank accounts.

Sending Notices & Communications

- Automatically issues notices for discrepancies in filed ITRs.

- Communicates with taxpayers regarding pending actions or corrections.

Advantages of Centralized Processing Center (CPC) in Income Tax

- Faster Processing of Income Tax Returns (ITRs)

- Automated Error Detection & Reduced Manual Intervention

- Quicker Tax Refunds

- Centralized & Uniform Processing

- Seamless TDS Corrections & Form 26AS Updates

- Online Communication & Transparency

- Reduced Compliance Burden

- Cost & Time Savings for Tax Department & Taxpayers

- Faceless & Grievance Redressal Mechanism

Common CPC-Related Terms

- CPC (TDS): Handles TDS-related processing.

- CPC (ITR): Manages Income Tax Return processing.

The CPC plays a crucial role in making tax administration more efficient, reducing manual intervention, and ensuring faster refunds.

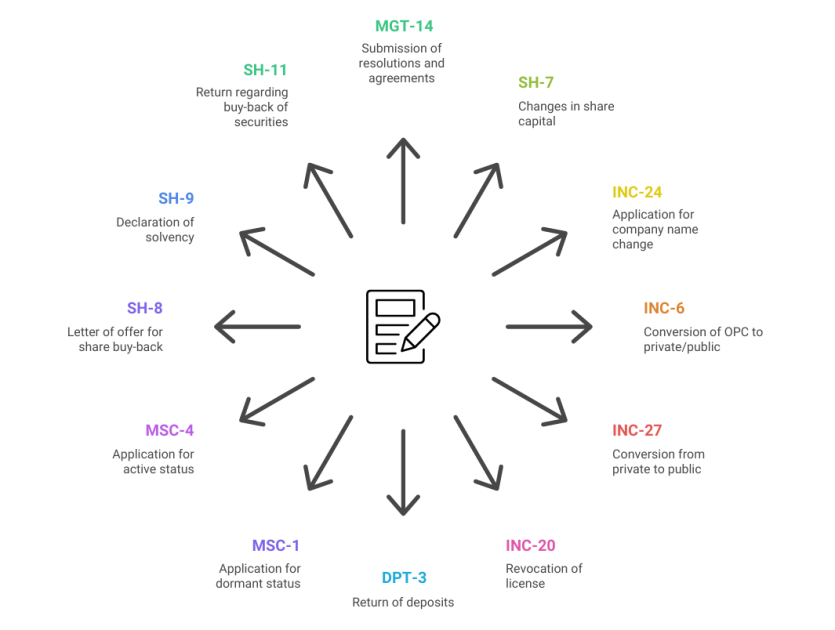

Forms Processed at CPC

Processing of Returns

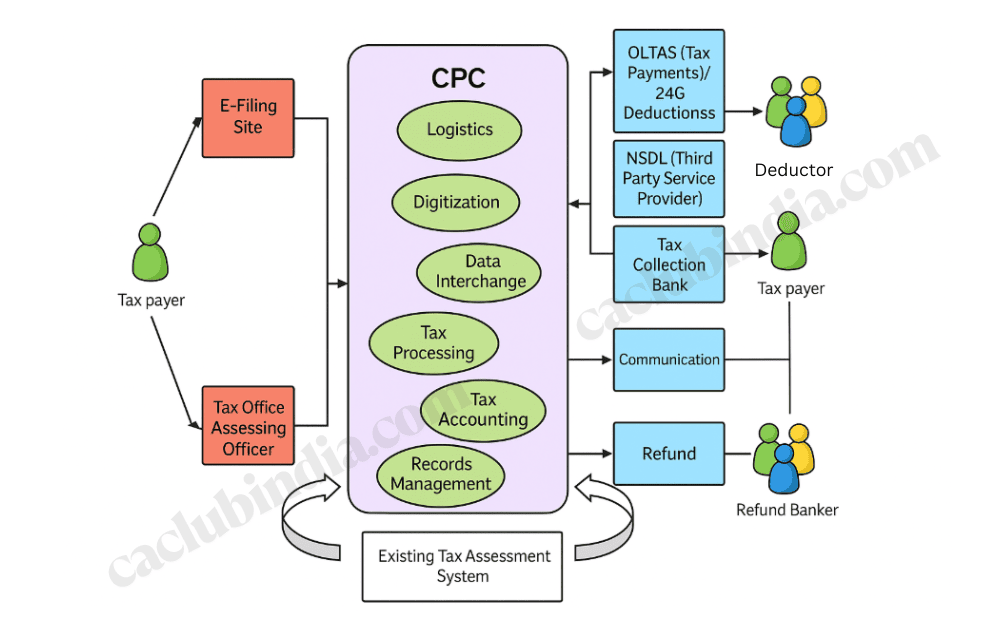

Process flow of existing tax assessment system is given below:

Centralized Processing Centre (CPC) Bengaluru awarded “ISO 9001:2008 standard for Quality Management System” Certificate by British Standards Institution (BSI) on 11 January 2016

The flagship project of Income Tax Department for processing of tax returns, Centralized Processing Centre (CPC) Bengaluru, has been awarded “ISO 9001:2008 standard for Quality Management System” Certificate by British Standards Institution (BSI) on 11 January 2016. The Certificate encompasses all business services and business enabler services of CPC. ISO 9001 is an international standard that specifies requirements for quality management system (QMS) addressing the principles and processes that surround the design, development and delivery of services. Organizations use this standard to demonstrate their ability to consistently provide services that meet customer and regulatory requirements.

This state-of-the-art facility has already been certified as ISO 27001 compliant for its Information Security Management System in 2014 and ISO 15489 for its Records Management System in 2013. With ISO 9001 certification, the CPC Bengaluru has achieved the rare distinction of receiving three ISO certificates.

FAQs

CPC stands for Centralized Processing Centre, a facility set up by the Income Tax Department of India to process income tax returns (ITRs) efficiently.

It is a formal communication from the CPC after verifying your ITR, confirming whether the return is accepted, adjusted, or if discrepancies need resolution.

The processing time varies, but the CPC typically completes verification and issues intimations or refunds within a few weeks to months, depending on the complexity of the return.