The most expensive share which is India’s first registered Small and Medium Real Estate Investment Trust (SME-REIT) that plans to carry on the activity of a small and medium real estate investment trust through one or more Schemes. The investment strategy is focused exclusively on completed and revenue-generating real estate properties through SPVs.

Full Name Of Share

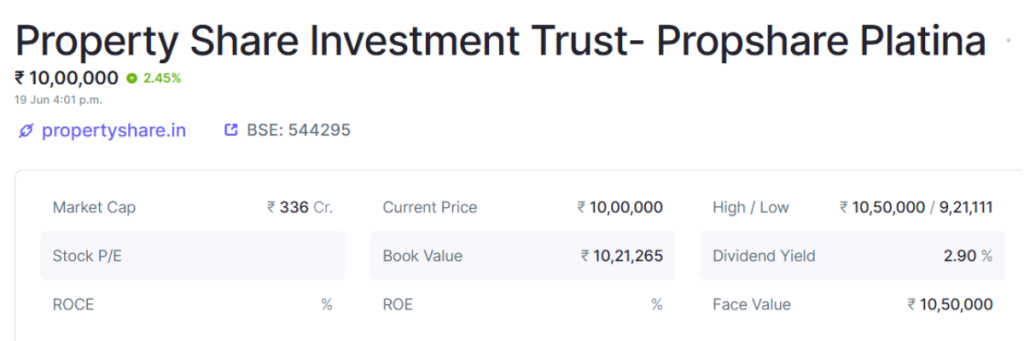

Property Share Investment Trust- Propshare Platina.

Incorporation

The Property Share Investment Trust is incorporated in 2024.

Why Are This Shares So Expensive?

Propshare Platina is a first Real Estate Investment Trust (REIT) scheme that is currently considered the most expensive share/unit available for investment in India as:

- It is designed to include commercial office spaces located on Outer Ring Road Bangalore that allows investors to invest in the Prestige Tech Platina, a prominent commercial office space with a total leasable area of 246,935 square feet.

- The property is proposed to be fully leased to 24/7 Customer Private Limited, a U.S.-based technology company, under a 9-year lease agreement. This long-term lease is a positive indicator of stable cash flow for the REIT.

- The scheme aims to make investment in completed commercial properties and will manage cash flows effectively through SPVs and other investments.

- The Real Estate Investment Trust will hold amounts pending investment or distribution as net distributable cash flows to unit holders.

Projected Distribution Yields

The scheme offers a projected distribution yield of:

| FY26 | 9% |

| FY27 | 8.7% |

| FY28 | 8.6% |

IPO Listed Details

The company launched its IPO for a fresh issue of 3361 Platina Units aggregating to ₹353 crore and got listed on BSE on 10th Dec, 2024

| IPO Date | Mon, 2nd Dec 2024 to Wed 4th December 2024 |

| Face Value | Rupees per share |

| Issue Price | Rs.1050000 per share |

| Lot | 1 |

| Share | 1 |

About Prestige Tech Platina

It is a LEED Gold building developed by the Prestige Group with established multinational tenants including JP Morgan Chase, Adobe, Oracle and Juniper Networks.

Conclusion

The Property Share Investment Trust represents a strategic advancement in India’s real estate investment sector by providing a structured and regulated avenue for investing in commercial real estate. With a focus on completed properties, a robust leasing strategy, and an emphasis on sustainability, it aims to attract investors looking for stable returns.