Capital Gains Tax in India has seen major updates, especially with the Union Budget 2024. A key aspect in calculating these taxes—particularly for long-term capital gains (LTCG)—is the principle of “Indexation.” Understanding this concept is essential for accurate tax computation.

What is Indexation?

Indexation is a tax benefit under Indian income tax laws that adjusts the purchase price (or cost of acquisition) of a long-term capital asset to account for inflation. Since inflation reduces the real value of money over time, indexation helps by increasing the asset’s acquisition cost using the Cost Inflation Index (CII). This adjustment lowers the taxable capital gain, reducing the overall tax liability on long-term investments.

When is Indexation Applicable? (Post-Budget 2024 Update)

The applicability of indexation has undergone major changes with the recent budget. Here’s a clear breakdown of when it is (or isn’t) allowed:

General Rule (Effective from July 23, 2024)

- Indexation has been removed for most capital assets.

- Long-term capital gains (LTCG) will now be calculated based on the actual purchase price (no inflation adjustment).

- A flat 12.5% tax rate applies to LTCG across most asset classes (reduced from the earlier 20% with indexation).

Cases Where Indexation May Still Apply (Transitional Provisions)

Land & Building (Immovable Property)

If purchased on or before July 22, 2024:

On sale (after July 23, 2024), you can choose:

- 12.5% tax (no indexation) OR

- 20% tax (with indexation)

Select the option that results in lower tax.

If purchased after July 23, 2024:

- Only 12.5% tax (no indexation) applies.

Debt Mutual Funds

Purchased before April 1, 2023 (held >36 months):

- Previously taxed at 20% with indexation.

Purchased after April 1, 2023:

- Gains treated as short-term capital gains (taxed as per income slab) – no indexation benefit.

Assets Where Indexation is NOT Applicable

- Listed Equity Shares & Equity-Oriented Mutual Funds:

- LTCG > ₹1.25 lakh/year taxed at 12.5% (no indexation).

- (Exemption limit increased from ₹1 lakh to ₹1.25 lakh).

- Unlisted Shares (including foreign shares): 12.5% tax (no indexation).

- Movable Assets (gold, silver, art, etc.): 12.5% tax (no indexation).

When Indexation is NOT Required?

- For short-term capital gains (STCG) (assets held ≤ 36/24/12 months, depending on type).

- If the asset is tax-exempt (e.g., gains from selling equity shares after 1 year in India are taxed at a flat 10% without indexation).

- If the taxpayer chooses the straight purchase price (but this usually results in higher taxes).

Cost Inflation Index (CII) is published annually by tax authorities (e.g., India’s CBDT).

Indexation reduces taxable gains by increasing the acquisition cost.

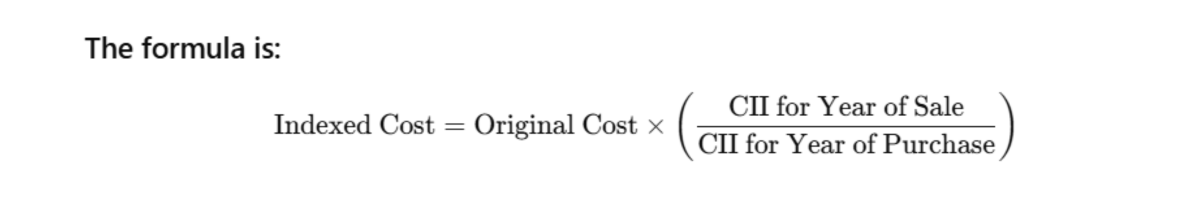

Formula:

Where:

- Original Cost: The actual cost at which the asset was purchased.

- CII (Cost Inflation Index): A number that is published by the government each year to reflect inflation.

- CII for Year of Sale: The index value in the year you sold the asset.

- CII for Year of Purchase: The index value in the year you purchased the asset.

FAQs

CII used for calculating long-term capital gains on assets like property, shares, or mutual funds.

To adjust the asset’s purchase cost for inflation, lowering your taxable capital gains.

The Central Board of Direct Taxes (CBDT) releases the CII annually.

The CII for FY 2024-25 is 363.