As per sections 44AA of the Income-tax Act, 1961, a person engaged in business or profession is required to maintain regular books of account under certain circumstances. To give relief to small taxpayers from this tedious work, the Income-tax Act has framed the presumptive taxation scheme under sections 44AD, sections 44ADA, sections 44AE, Section 44BB and Section 44BBB.

Professions Eligible for Presumptive Taxation under section 44ADA

A person adopting the presumptive taxation scheme can declare income at a prescribed rate and, in turn, is relieved from the tedious job of maintenance of books of account.

The presumptive taxation scheme of sections 44ADA can be adopted by a resident assessee being individual or HUF, carrying on specified profession whose gross receipts do not exceed fifty lakh rupees in a financial year. Following professions are specified profession:

- Legal

- Medical

- Engineering or architectural

- Accountancy

- Technical consultancy

- Interior decoration

- Film Artists

- Any other profession as notified by CBDT

- Turnover limit: Gross receipts should not exceed ₹75 lakhs in a financial year (raised from ₹50 lakhs in FY 2023-24 onwards).

How Does Section 44ADA Work?

Presumptive Income

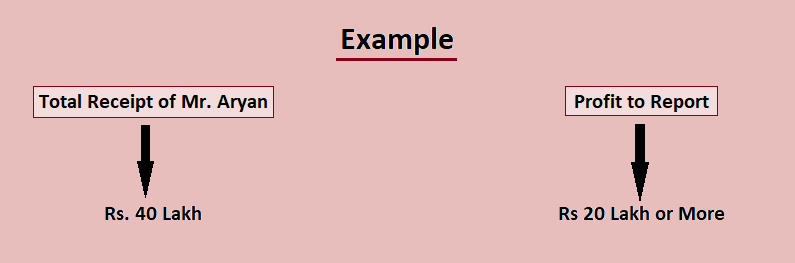

- 50% of the total gross receipts are deemed as income.

- No need to claim further expenses separately (except depreciation for asset calculation purposes).

Taxation

- The deemed income is taxed at normal slab rates.

- Professionals can still claim deductions under Chapter VI-A (like 80C, 80D, etc.).

Advance Tax

- Advance tax must be paid if the liability exceeds ₹10,000.

- But only one installment by 15th March is required under presumptive taxation.

Books & Audit

- No need to maintain detailed books of accounts.

- No tax audit required if declaring 50% or more of receipts as income.

Computation of minimum profit

Income will be calculated at 50% of the total gross receipts of the profession.

What to do if the income is declared lower than 50%?

If income declared is lower, than tax audit is mandatory.

Can a person who has adopted presumptive taxation scheme claim further deduction?

No, a person who adopts the presumptive taxation scheme is deemed to have claimed all deduction of expenses. Any further claim of deduction is not allowed after declaring profit @ 50%. However the assessee can claim deduction under chapter VI-A.

Professional Persons Covered u/s 44ADA

Advocates, Bloggers, Youtubers, Engineers, Chartered Accountants, Architect, Artist, Doctors, Interior Decorates, Actors etc.

Key Benefits of Section 44ADA

- Simplified tax filing

- Lower compliance burden

- No audit hassle if conditions are met

- Helps professionals focus more on work than paperwork

Related Articles

44AD of Income Tax Act – Click Here

Section 44AB of Income Tax Act – Click Here

Tax Audit Report – Click Here

FAQs

Yes. Doctors, being part of the medical profession (a specified profession under Section 44AA), can opt for Section 44ADA if their gross receipts are within ₹75 lakhs.

No. It is optional. Professionals can either opt for the presumptive taxation scheme or maintain regular books of accounts and declare actual income.

No. Only resident individuals, HUFs, and partnership firms (other than LLPs) can opt for it.

Yes, unlike Section 44AD (for businesses), there is no restriction on switching in and out of Section 44ADA from year to year.

NRI cannot claim the benefit of this scheme.

Section 44AD: Applies to small businesses with a turnover up to Rs. 2 crore, excluding professional services.

Section 44ADA: Applies to specified professionals like doctors, lawyers, etc., with gross receipts up to ₹50 lakhs.