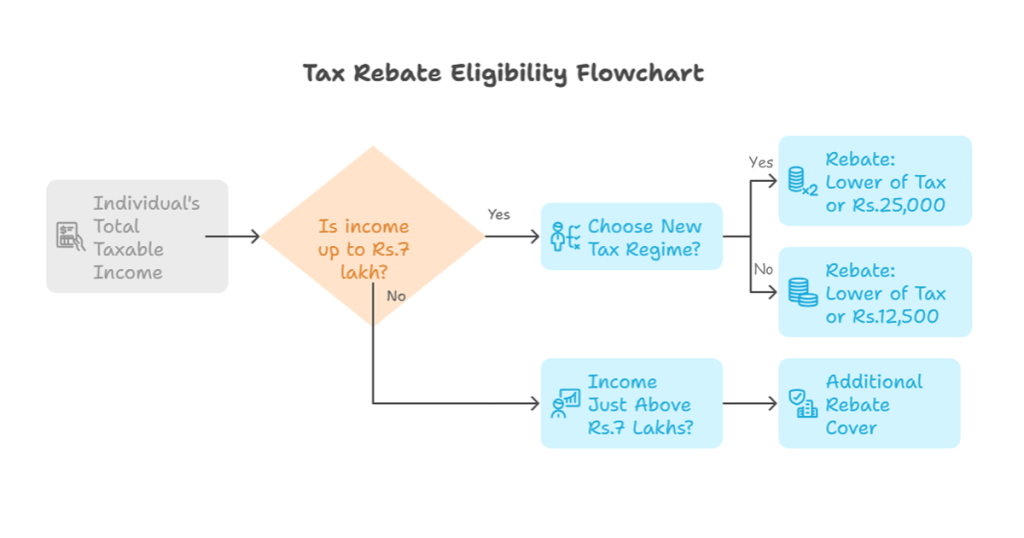

Section 87A of the Income Tax Act offers tax reduction to resident individuals when total income falls within specified limits. For FY 2024-25, individuals under the old tax regime with income up to ₹5 lakh can claim a rebate of up to ₹12,500, resulting in zero tax liability. Under the new tax regime, income up to ₹7 lakh is eligible for a rebate of up to ₹25,000.

| As per budget 2025 rebate limit under new tax regime has been raised to ₹60,000. If an individual’s taxable income is up to Rs.12 lakh, he will be eligible to claim this rebate. Rebate will not apply to income taxed at special rates. |

What is Rebate u/s 87A?

Rebate u/s 87A is a direct tax reduction in your tax payable which is available to resident individuals if the total taxable income falls below specified thresholds.

Eligibility Criteria

Tax regime eligibility for Resident Individuals

| Particulars | New Tax Regime | Old Tax Regime |

| Income Limit | ₹7 lakh | ₹5 lakh |

| Rebate Amount | ₹25,000 | ₹12,500 |

Tax Rebate Eligibility Flowchart

How to Claim Rebate u/s 87A?

- Step 1: File ITR-1 (Sahaj) or ITR-2 (if applicable).

- Step 2: Ensure your taxable income is ≤ ₹7 lakh.

- Step 3: The income tax portal auto-computes the rebate while filing ITR.

- Step 4: If tax liability is ≤ ₹25,000, it will be reduced to zero.

Example

| Income (₹) | Tax Before Rebate (New Regime) | Rebate u/s 87A | Final Tax Payable |

| 6,50,000 | 30,000 | 25,000 | 5,000 |

| 7,00,000 | 25,000 | 25,000 | 0 |

| 7,50,000 | 37,500 | 0 (Income > ₹7L) | 37,500 |

Who cannot claim the Rebate u/s 87A?

- Non-resident Indians (NRIs)

- HUF, Firms, Companies, etc.

- Income > ₹5L (old regime) or > ₹7L (new regime)

Which Tax Liabilities Qualify For Rebate u/s 87A?

The rebate u/s 87A helps to reduce your tax liability, but it applies to specific types of income not on any special rate incomes:

- Normal income: If you have your regular income such as salary taxed at standard slab rates. You are eligible to claim the rebate.

- Long-term capital gains (Section 112): If you sell assets such as property or bonds (but not equity shares or equity mutual funds), the tax on those gains qualifies for the rebate.

- Short-term capital gains (Section 111A): If you sell listed equity shares or equity mutual funds within one year, the tax on these gains (at a flat 15% rate) also qualifies for the rebate.

| The rebate cannot be used against tax on LTCG from equity shares or equity mutual funds u/s112A. |

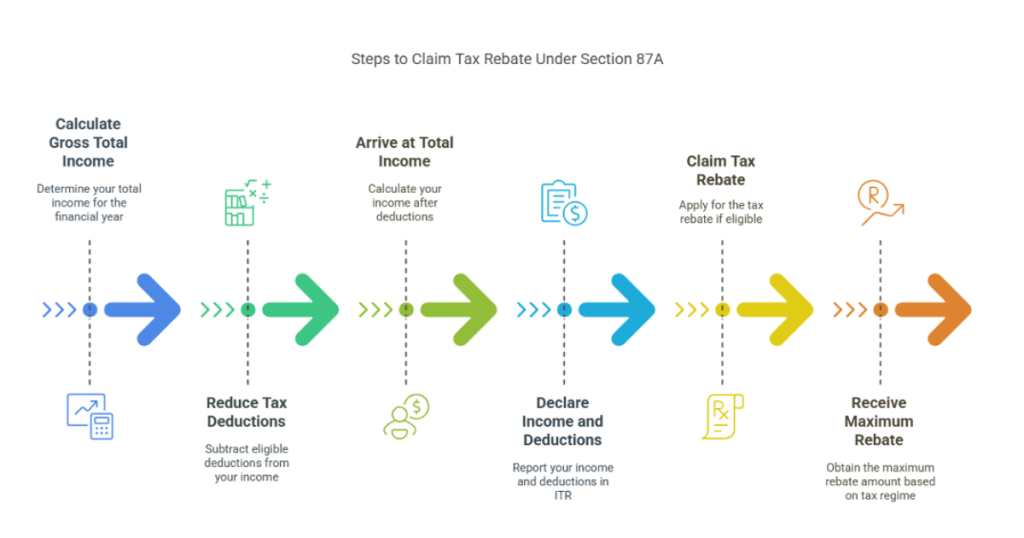

Steps to Claim Tax Rebate Under Section 87A

- First calculate gross total income for the financial year.

- Subtract eligible deductions such as LIC and tax savings investments from your gross total income.

- Calculate your total income after reducing the tax deductions.

- If your total income does not exceed Rs 7 lakh under the new tax regime or Rs 5 lakh under the old tax regime, you can claim the rebate.

- The maximum rebate for the Assessment Year 2025-26 can be claim in the new tax regime.

Marginal Relief Alongside Rebate u/s 87A (FY 2024-25)

Under the new tax regime, two different provisions apply at different income levels:

- For income up to ₹7 lakh: You can claim the full Section 87A rebate (maximum ₹25,000), which may reduce your tax to zero.

- For income above ₹7 lakh:

- The Section 87A rebate no longer applies.

- Instead, marginal relief protects you by ensuring that any extra tax you pay won’t exceed the amount by which your income exceeds ₹7 lakh.

Example

Case 1: Income = ₹7,00,000 (Rebate Applies, No Marginal Relief)

- Tax before rebate = ₹25,000

- Rebate u/s 87A = ₹25,000

- Final Tax = ₹0

Case 2: Income = ₹7,10,000 (Rebate Lost, Marginal Relief Applies)

- Under the new regime, tax on ₹7L is ₹0 (due to rebate).

- If income = ₹7,10,000:

| Tax = 5% of (₹7,10,000 – ₹3,00,000) = ₹20,500 Excess over ₹7L = ₹10,000 Marginal Relief = ₹20,500 – ₹0 – ₹10,000 = ₹10,500 Final Tax = ₹20,500 – ₹10,500 = ₹10,000 |

To claim the tax rebate under Section 87A for FY 2024-25, resident individual taxpayers must ensure their total taxable income does not exceed ₹7 lakh under the new default tax regime (or ₹5 lakh if opting for the old regime).

The rebate amount is limited to ₹25,000 under the new regime or ₹12,500 under the old regime, whichever is applicable, and it is automatically applied when filing income tax returns, potentially reducing the tax liability to zero for eligible taxpayers.

However, this benefit is exclusively available to resident individuals and cannot be claimed by NRIs, HUFs, trusts, companies, or any other type of taxpayer entity. The rebate provision serves as a significant relief for individual taxpayers with moderate incomes, effectively eliminating their tax burden if their income falls within the specified thresholds.

Rebate Limit for the Previous Years

| Financial Year | Limit on total taxable Income | Rebate allowed u/s 87A |

| 2025-26 | Rs. 12,00,000 (New tax regime) Rs. 5,00,000 (Old tax regime) | Rs. 60,000 Rs.12,500 |

| 2024-25 | Rs. 7,00,000 (New tax regime) Rs. 5,00,000 (Old tax regime) | Rs. 25,000 Rs.12,500 |

| 2023-24 | Rs. 7,00,000 (New tax regime) Rs. 5,00,000 (Old tax regime) | Rs. 25,000 Rs.12,500 |

| 2019-20 to 2022-23 | Rs. 5,00,000 | Rs. 12,500 |

| 2017-18 to 2018-19 | Rs. 3,50,000 | Rs. 2,500 |

| 2016-17 | Rs. 5,00,000 | Rs. 5,000 |

| 2013-14 to 2015-16 | Rs. 5,00,000 | Rs. 2,000 |

FAQs

- Who can claim this rebate?

Ans. This rebate is only allowed to Resident individuals in India.

- Is the Section 87A rebate applicable to special rate incomes?

Ans. No, the rebate will not apply to income taxed at special rates, such as long-term capital gains under Section 112A.

- Can NRIs claim the rebate u/s 87A?

Ans. No, NRI cannot claim this rebate.

- What happens if my tax liability is less than the rebate amount?

Ans. If your tax payable is less than the rebate, you won’t have to pay any tax.