An Income Tax Officer (ITO) is an authority in the Income Tax Department whose job is to check financial documents, assets, liabilities, look for tax fraud and to make sure that every individual and businesses pay the correct taxes.

Who Can Become an Income Tax Officer?

To become an Income Tax Officer you must have bachelor’s degree, citizenship proof and an eligible age limit as specified by the government.

| Educational Qualification | Citizenship | Age Limit for candidates |

| Bachelor’s degree (any stream) from a recognized university. | You can apply if you are: A citizen of India, Nepal, or Bhutan A Tibetan refugee who came to India before 1962 and settled in India permanently Non-Indian candidates must have a certificate of eligibility from the Indian government. | For General -21 to 30 years For OBC – 21 to 33 years For SC/ST – 21 to 35 years For Ex-servicemen – 21 to 38 years For Physically Handicapped – 21 to 40 years |

How to Become Income Tax Officer?

You can become an Income Tax Officer by securing a position in the Staff Selection Commission Combined Graduate Level exam or Indian Revenue Service via the UPSC Civil Services Examination.

SSC CGL Exam

SSC CGL (Staff Selection Commission Combined Graduate Level) is a conducted by the Staff Selection Commission (SSC) to recruit officers for various government departments, including the Income Tax Department.

Exam Stages

| Tier 1 | Tier 2 |

| Preliminary (Computer-based) with 100 questions and subjects including General Intelligence, General Awareness, Quantitative Aptitude, English | Main exam (Computer-based) with 100 questions and subjects including English Comprehension, Quantitative Aptitude, General Studies, Computer Applications, etc. |

Selection Process

Based on performance in Tier 1 and Tier 2, followed by document verification and post allocation.

UPSC Civil Services Exam

This exam is a high-level competitive exam conducted by the Union Public Service Commission (UPSC) for government positions like IAS, IPS, and IRS (Income Tax falls under IRS).

Exam Stages

- Preliminary Exam – Objective-type (for screening)

- Main Exam – Descriptive written exam

- Interview – Personality Test . If you choose IRS (Income Tax) as your preference and score well, you can become an ITO.

Post-Selection Process

Once you cleared exam authorities will check your documents and ensure that you meet all the requirements.

Based on your rank and preferences, you will be assigned a post as an Income Tax Officer.

You receive your official appointment letter with job details and location.

Responsibilities of an Income Tax Officer

- To verify whether individuals or business have correctly declared their income.

- To detect tax evasion and fraud.

- To ensure taxpayers follow the rules and take action against those who do not follow tax laws.

- To monitor and collect taxes which is owed to the government..

- To represent the department during tax disputes.

- To educate taxpayers in understanding their tax duties.

- To implement changes in tax policies, rules and procedures.

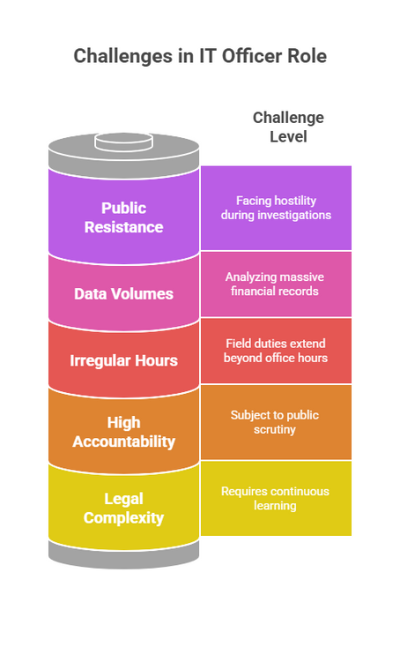

Challenges in the Role of an Income Tax Officer

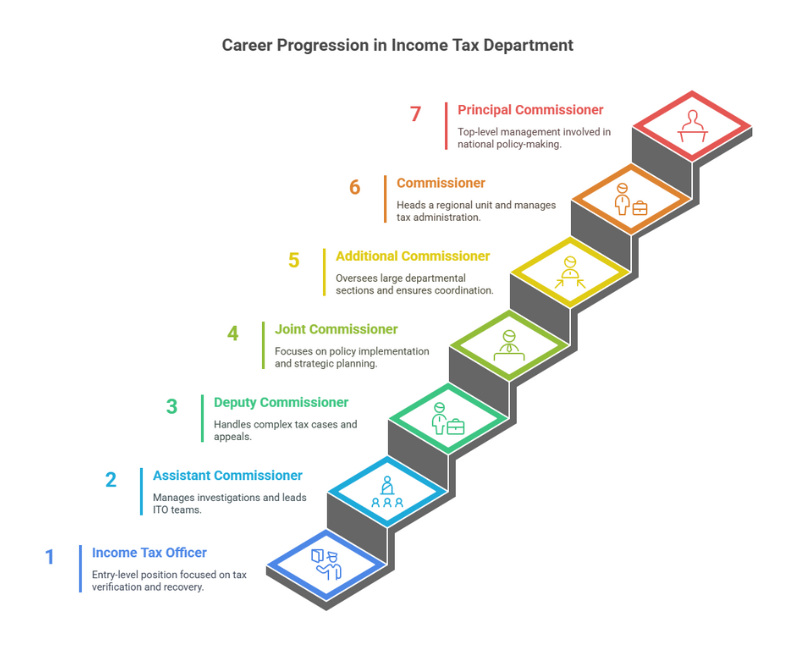

Career Growth for Income Tax Officers

Conclusion

Becoming an Income Tax Officer is responsible government job but it also requires hard work, preparation and a strong understanding of financial and legal systems.

FAQs

A bachelor’s degree in any discipline from a recognized university and must be an Indian citizen (or meet specific criteria for Nepal, Bhutan, or Tibetan refugees) within the age limit of 18-30 years (with relaxations for certain categories).

You can become an Income Tax officer by passing Staff Selection Commission (SSC) Combined Graduate Level (CGL) exam or through UPSC Civil Services exam.

Pass SSC CGL exam – Tier I to Tier II.

Secure a good rank to get posted in the Income Tax Department.

Undergo training and complete probation before full confirmation.