Under Indian tax laws, Tax Collected at Source (TCS) provisions require certain sellers to collect tax from buyers at the time of sale.

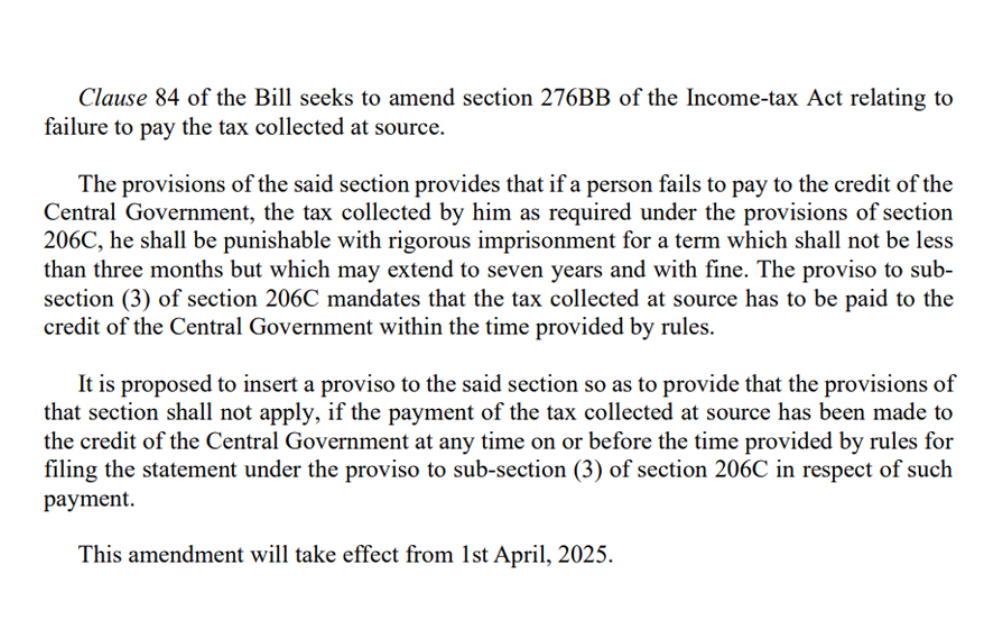

The Finance Bill 2025 has introduced a significant relief measure for taxpayers who collected Tax at Source (TCS) but failed to deposit it on time.

Key Points About TCS Payment Relief

Prosecution Relief

The Income Tax Department may provide relief from prosecution for delayed TCS payments if:

- The delay was due to reasonable cause.

- The taxpayer voluntarily discloses the default.

- The taxpayer pays the outstanding amount with applicable interest.

Conditions for Relief

- The taxpayer must file all required TCS returns

- Any short payment must be rectified with interest (currently 1% per month under Section 206C(7))

- The delay should not be willful or indicative of tax evasion

Recent Developments

- The Finance Act 2023 made several changes to TCS provisions

- New TCS rates and rules apply from October 1, 2023, for certain transactions

- The CBDT may issue specific circulars regarding prosecution relief for FY 2025-26

Other Penalties for Late TCS Compliance (which still apply)

Late Filing Fee (Section 234E)

A fee of ₹200 per day is charged for late filing of TCS returns, capped to the total TCS amount.

Penalty for Non-Filing or Incorrect Filing (Section 271H)

A penalty ranging from ₹10,000 to ₹1,00,000 may be imposed for failure to file TCS statements within the prescribed time limits or for furnishing incorrect information.

TCS Return (Form 27EQ) Due Dates (Quarterly)

- Q1 (April – June 2025): July 15, 2025

- Q2 (July – September 2025): October 15, 2025

- Q3 (October – December 2025): January 15, 2026

- Q4 (January – March 2026): May 15, 2026

Recommended Actions

- Pay any outstanding TCS amounts immediately with applicable interest

- File revised returns if previous filings were incorrect

- Maintain proper documentation showing reasonable cause for any delay

- Consult a tax professional for case-specific advice

Click Here To Know About TDS TCS Non-Filers Rule w.e.f 1st April 2025

FAQs

After the decriminalisation of delay in payment of TDS, delay in TCS payments has now been decriminalised. Encouraging voluntary compliance, the Budget extends the time limit to file updated returns for any assessment year, from the current limit of two years, to four years.

In case the tax collector who is accountable for collecting the tax and depositing it to the government fails to collect the tax or, after collecting, does not pay it to the government within the stipulated due dates, then he/she will be liable to pay interest of 1% per month or a part of the month.

Under section 206C (1H) of the Income Tax Act, TCS is mandated if the seller’s annual turnover exceeds Rs. 10 crore. Sellers must also deduct TCS if the aggregate sale amount received from a single buyer exceeds Rs. 50 lakh in a financial year.

Late Deduction occurs when TDS (Tax Deducted at Source) is deducted after the payment has been made to the deductee. This can happen due to an error in recording the transaction or an actual delay in deduction.

Late Payment arises when the deducted tax amount is not deposited to the government within the stipulated due date, which is generally within seven days from the end of the month in which the tax was deducted.