The Indian Income Tax (IT) Department uses advanced tools like data analytics and Artificial Intelligence (AI) to track high-value financial transactions effectively. This extensive monitoring system helps to prevent tax evasion and promotes compliance with tax regulations. Financial institutions—including banks, mutual fund companies, and property registrars—are required to submit annual reports of such transactions to the IT Department. These reports are filed either as a Statement of Financial Transaction (SFT) in Form 61A or as a reportable account in Form 61B.

Additionally, taxpayers can access a consolidated summary of their financial transactions through the Annual Information Statement (AIS) and Form 26AS. These documents help individuals verify and reconcile their reported income with their Income Tax Returns (ITR), promoting transparency and voluntary compliance.

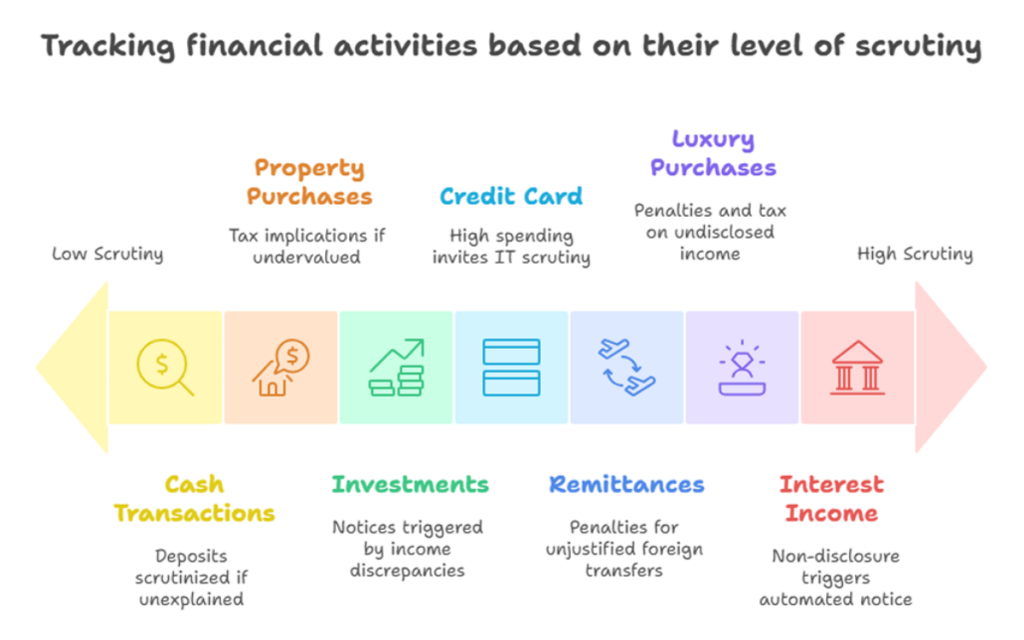

To prevent tax evasion and enhance compliance, the Income Tax (IT) Department tracks the following major financial activities along with their tax consequences:

Cash Deposits/Withdrawals

- Cash deposits of ₹10+ lakhs (savings) or ₹50+ lakhs (current accounts) in a year are reported.

- Cash withdrawals exceeding ₹1 crore annually are flagged.

- Unexplained cash deposits may be taxed as income under Section 68 or treated as undisclosed money under Section 69A.

- Banks report these transactions to the IT Department; taxpayers must disclose and justify them in filings to avoid scrutiny.

Click to Know About – Scrutiny on ITR Refunds if Claimed via Common Contact Details.

Property Transactions

- Buyers must provide PAN for property purchases of ₹30 lakhs or more.

- If the sale price is 10% below the circle rate, the difference is taxable:

- Buyers under Section 56(2)(x) (income from other sources)

- Sellers under Section 50C (deemed sale consideration).

High-Value Investments

- Mutual funds, bonds, or stock purchases of ₹10+ lakhs annually are reported.

- Fixed deposits exceeding ₹10 lakhs (across a bank’s branches) are flagged.

- Discrepancies between income and investments may trigger notices for unexplained investments (Section 69).

Credit Card Payments ≥ ₹10 Lakhs

- Banks report annual credit card payments exceeding ₹10 lakhs.

- Unexplained high spending compared to declared income may trigger IT scrutiny.

Foreign Travel & Remittances

- Banks report foreign transfers of ₹10+ lakhs (under Liberalised Remittance Scheme) annually.

- Unjustified remittances may invite penalties under the Black Money Act.

Jewellery & Luxury Purchases

- Jewellery purchases ≥ ₹10 lakhs require PAN submission.

- Cash transactions ≥ ₹2 lakhs are prohibited (Section 269ST).

- Discrepancies may trigger penalties + tax on undisclosed income.

Bank TDS on Interest Income

- Savings interest ≥ ₹50,000 or FD interest ≥ ₹40,000 attracts TDS.

- Non-disclosure may trigger an automated notice under Section 143(1).

The Income Tax Department tracks high-value transactions through multiple sources. Financial institutions submit Annual Information Returns (AIR), while Form 26AS and AIS consolidate all reported transactions. Advanced data analytics and AI further detect discrepancies between declared income and financial activity.

To ensure compliance, taxpayers should maintain proper records, file accurate ITRs, and reconcile Form 26AS/AIS before submission. Any large transactions (e.g., loans, gifts, inheritance) must be supported with documentation. Failure to comply may result in tax notices, heavy penalties (up to 200%), or even prosecution. If dealing with significant transactions, consulting a CA or tax advisor is advisable for correct reporting.