Introduction – Why Choosing the Right ITR Matters

Filing Income Tax Return (ITR) isn’t just about putting numbers and clicking submit – you need to choose to correct ITR form first. Every year, filing ITR might feel a boring task, but there’s one thing you really shouldn’t overlook – picking the right ITR form.

Many people jump straight into filling details without checking whether the form they’re using even matches their income type. And here’s the catch: using the wrong ITR form can get your return rejected, delay your refund, or even attract a notice from the Income Tax Department (ITD).

The government has provided different ITR forms for different types of taxpayers – salaried employees, freelancers, business owners, senior citizens, and even those with foreign income. But don’t worry – you don’t have to read any tax manual to figure it out.

This article will help you break things down into simple points, with real life examples to help you pick your correct ITR form for FY 2024-25 in just a few minutes. No jargon, no confusion – just the clarity you need.

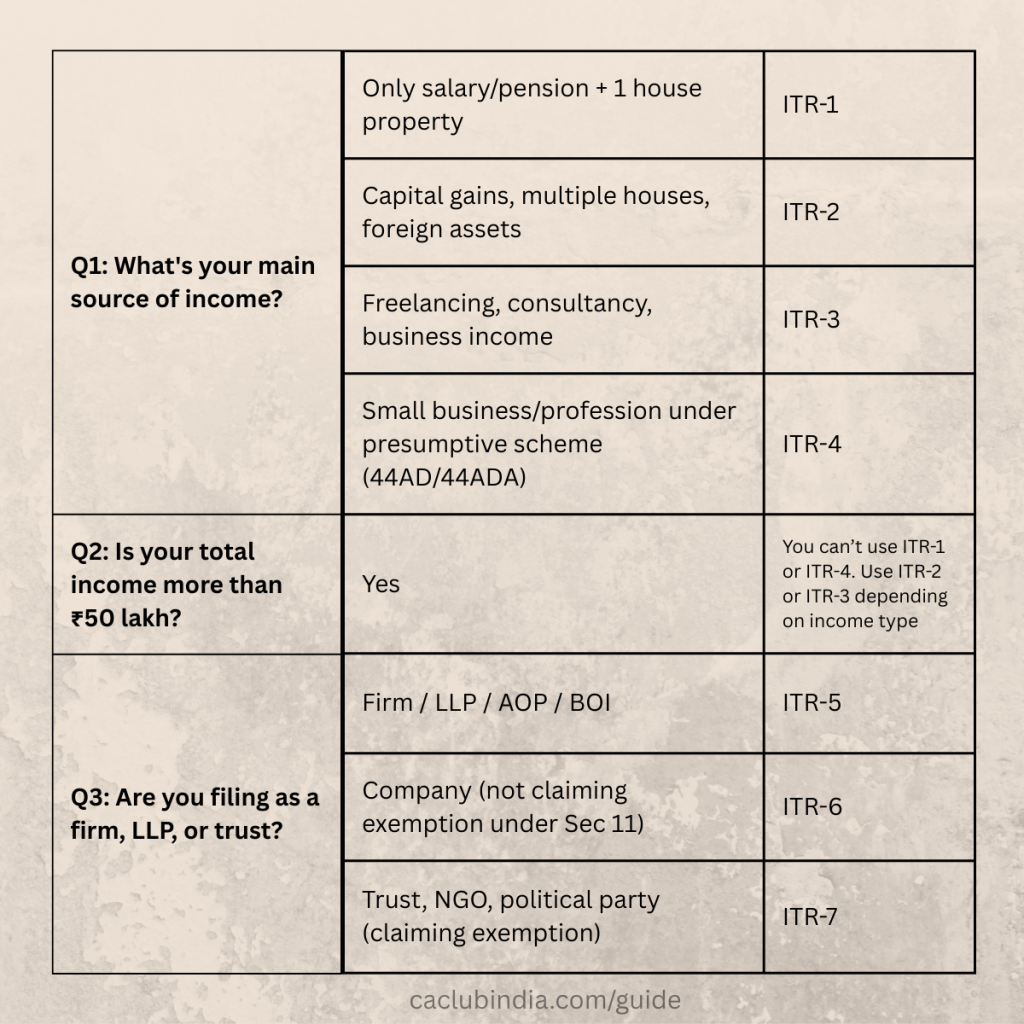

Quick Look – All ITR Forms at a Glance

Before we dive deep, here’s a quick cheat sheet of all ITR forms available for FY 2024-25. Think of this as your menu card – just match your income type and you’re halfway there.

| ITR Form | Applicable To | Key Notes |

| ITR-1 (Sahaj) | Salaried individuals, pensioners | Total income up to ₹50 lakh, 1 house property, no capital gains, no business income |

| ITR-2 | Individuals/HUFs | Capital gains, foreign income, more than 1 house property, no business income |

| ITR-3 | Individuals/HUFs | With business/professional income (freelancers, consultants, etc.) |

| ITR-4 (Sugam) | Individuals, HUFs, Firms (other than LLPs) | Opting for presumptive taxation under Sections 44AD, 44ADA, 44AE |

| ITR-5 | Firms, LLPs, AOPs, BOIs | Not applicable to individuals |

| ITR-6 | Companies | Except those claiming exemption under Section 11 (charitable/religious trusts) |

| ITR-7 | Trusts, Political Parties, NGOs | Claiming exemptions under Sections 11, 12, 13A, or 10(23C) |

Don’t worry if this feels like too much at once – we’ll break down who should use what in the next section, with simple examples.

ITR-1 to ITR-7 – Who Should Use What? (Simplified Guide)

Let’s now break down each form in easy understandable language. No technical overload – just the basics to help you figure out which form fits your income situation.

ITR-1 (Sahaj)

Best for – Salaried people, pensioners, or those with interest income

- Income up to INR 50 Lakh

- Max one house property

- No business, no capital gains

Example: A school teacher with salary, some FD interest, and no other income

ITR-2

Best for – Those with capital gains, foreign income, or more than one house

- No business or professional income

- Includes income from shares, mutual funds, property sales

Example: A retired person who sold property and has mutual fund gains

ITR-3

Best for –Business owners, freelancers, professionals (like doctors, designers, etc.)

- Any income from business or profession

- Also includes capital gains, house property, etc.

Example: A freelance graphic designer who also earns from stock trading

ITR-4 (Sugam)

Best for – Small businesses or professionals using presumptive tax

- Income up to INR 50 Lakh(professionals) or INR 2 Crore(business)

- Follows Sections 44AD, 44ADA, or 44AE

Example: A shopkeeper or a small-town CA who doesn’t maintain books

ITR-5

Best for – Partnerships, LLPs, AOPs, BOIs

- Not for individual taxpayers

Example: A partnership firm running a local restaurant

ITR-6

Best for – Registered companies

- Except those claiming exemption under Section 11

Example: A private limited company in manufacturing

ITR-7

Best for – Charitable trusts, political parties, NGOs

- Claiming exemptions under Sections 11, 12, 13A, etc.

Example: An educational trust registered as a non -profit

So, whether you’re a salaried employee, a freelance or running a trust – there’s an ITR form tailored just for you. Pick the one that matches your income profile, and you’re already halfway done.

Common Mistakes People Make While Choosing ITR Forms

Even if you’re confident about your income details, choosing the wrong ITR form is easier than you think – and it can lead to rejections, delays or even notices from the Income Tax Department.

Some of the frequent goof-ups people make:

Using ITR-1 even when income exceeds INR 50 Lakh

Many salaried folks stick with ITR-1 out of habit, not realizing it’s only for income up to INR 50 Lakh.

Filing ITR-1/2 despite having business/freelance income

Even a side hustle or freelancing gig makes you ineligible for ITR-1/2 – you’ll need ITR-3 or ITR-4 instead.

Choosing ITR-4 without being under the presumptive scheme.

ITR-4 is only for those opting for Sections 44AD/ADA/AE – not for regular business income with full books.

Ignoring Capital Gains while filing ITR-1

Sold shares or property during the year? Then ITR-1 is not for you, even if your salary is within INR 50 Lakh

Selecting ITR-2 for business income just because it looks simpler

ITR 2 may seem simpler, but if you have any business/professional income, it’s the wrong form, and your return may be invalid.

A small mistake in choosing the right form can create big trouble later – so better double check than redo later.

What Happens If You Choose the Wrong Form?

You might think “As long as I paid my taxes, the form doesn’t matter much”. But actually,it does – and choosing the wrong ITR form can create real problems later on.

Here’s what can go wrong:

- Return gets marked as defective

- You may get a notice

- Extra time and stress

Still Confused? Refer this 2-Minute ITR Finder Table

Conclusion – Don’t Overthink, Just Match and File

Choosing the right ITR form doesn’t have to be a headache. You’ve seen that by matching your income type and basic facts – you can pick the correct form in 2minutes.

Remember, filing with the right form means fewer rejections, faster refunds, and zero stress. So grab your income details, refer to the tables above, and file confidently – no overthinking required.

FAQs

- I switched jobs last year — should I still file ITR-1?

Ans. Yes, if your total income is under ₹50 lakh and you have no other complications like capital gains or multiple house properties.

- I did some stock trading — can I use ITR-1 or ITR-2?

Ans. If it’s just occasional investing, use ITR-2. But if it looks like business activity (frequent trades), you may need ITR-3.

- I’m a freelancer but earned less than ₹3 lakh — do I still need to file ITR?

Ans. Yes, if your gross income exceeds the basic exemption limit, or if you want to carry forward losses or claim a refund.