You might have read the news of GST applicability for food delivery apps a couple of months back. Food delivery platforms have been issued tax notices demanding payment of differential tax amounts due to the categorisation of their delivery fees.

- The DGGI argues that delivery charges bundled with food supplies should be treated as part of the food supply, attracting a higher GST rate of 18%. Hence, the delivery charges come under the purview of mixed supply under GST.

- Previously, in the year 2023, these big giants had received GST notices regarding the taxability issues on delivery charges to pay Rs 500 crore each on the total amount collected by them as delivery charges.

- However, in the year 2022, “restaurant services” and “cloud kitchens” were added to section 9(5) of the CGST Act, which led these E-commerce operators like Swiggy, Zomato, Ola or Uber etc., to pay 5% GST without input tax credit (ITC) on the services they offered (45th GST Council meeting, press release dated September 17, 2021). This was introduced to make sure the ECOs are collecting taxes and paying them to the government.

- There was no mention of delivery charges in the council meeting or the press release, leading to confusion about these incidental charges.

As per the statement given by one of the officials of the food-delivery platform, “Ours is a platform that brings the rider and the customer close to each other. The delivery fee is not our revenue. Instead, it goes directly to the rider. This is an interpretation of guidelines and we have a clear go-ahead from the tax consultants. Aggregators account for the delivery fees in their revenues and then show the payouts (to delivery partners) as part of their expenses. This is perhaps where the confusion with GST authorities has arisen.”

“Food delivery platforms do not provide food delivery services on their own account but enable these services from delivery partners through their platform. Most, if not all, of these delivery partners, are below the GST threshold limit of Rs 20 lakh per annum (of earnings), and therefore not registered, or liable to do so under GST.” a member from the Internet and Mobile Association of India (IAMAI) had made a representation seeking clarity on the matter from the GST council.

The issue of delivery charges has been a topic of discussion in the news since the implementation of GST. It was likely to be addressed in the 55th GST Council meeting scheduled for December 21, 2024, in Jaisalmer, Rajasthan.

The tax structure and liability distribution under GST for Indian food delivery platforms like Zomato and Swiggy continue to maintain their existing format in 2025, ensuring regulatory consistency and transparency.

Current GST Structure – Who Ultimately Bears the GST Cost?

- Food ordered via delivery platforms is taxed at 5% GST without Input Tax Credit (ITC), whether ordered directly from restaurants or through apps like Zomato and Swiggy.

- The delivery apps function as intermediaries by gathering the applicable tax from restaurants and transferring it to governmental authorities.

- Supplementary offerings from these delivery platforms, including membership programs and platform usage charges, attract an 18% GST rate.

- The end consumer shoulders the tax burden, with food orders incurring a 5% GST and platform-related fees carrying an 18% GST component. Consequently, ordering through these delivery apps results in higher total costs compared to direct restaurant purchases or dine-in options.

- All eateries partnering with food delivery apps must adhere to GST guidelines. Even small food businesses with yearly revenue under ₹20 lakh, which were earlier GST-exempt, now need mandatory GST registration when they choose to sell through these delivery platforms.

- The delivery platforms serve as tax collection agents, gathering 5% GST from restaurant sales and forwarding it to tax authorities. While they are liable for 18% GST on their service charges, this tax burden is transferred to the end customers.

- Following deliberations at the 55th GST Council meeting in December 2024, authorities confirmed that food delivery platforms won’t face additional GST charges. Though the council explored implementing a distinct GST rate for delivery services, the proposal remains under evaluation without immediate implementation plans. This stance helps maintain reasonable pricing for online food orders while fostering growth in digital commerce and smallscale enterprises.

- Despite the absence of new tax impositions, regular users of food delivery services face increased expenses due to the combined impact of current GST rates. The dual application of 5% tax on food items and 18% on platformrelated charges results in elevated total costs when compared to alternative dining methods.

Current GST Rates for Food Delivery in India (as of April 2025)

| Component | GST Rate | Input Tax Credit | Responsible Entity for Collection |

| Restaurant Services (Food) | 5% | Not Available | Food Delivery App (ECO) |

| Delivery Fees | 18% | Generally Available | Food Delivery App (ECO) |

| Platform Fees | 18% | Generally Available | Food Delivery App (ECO) |

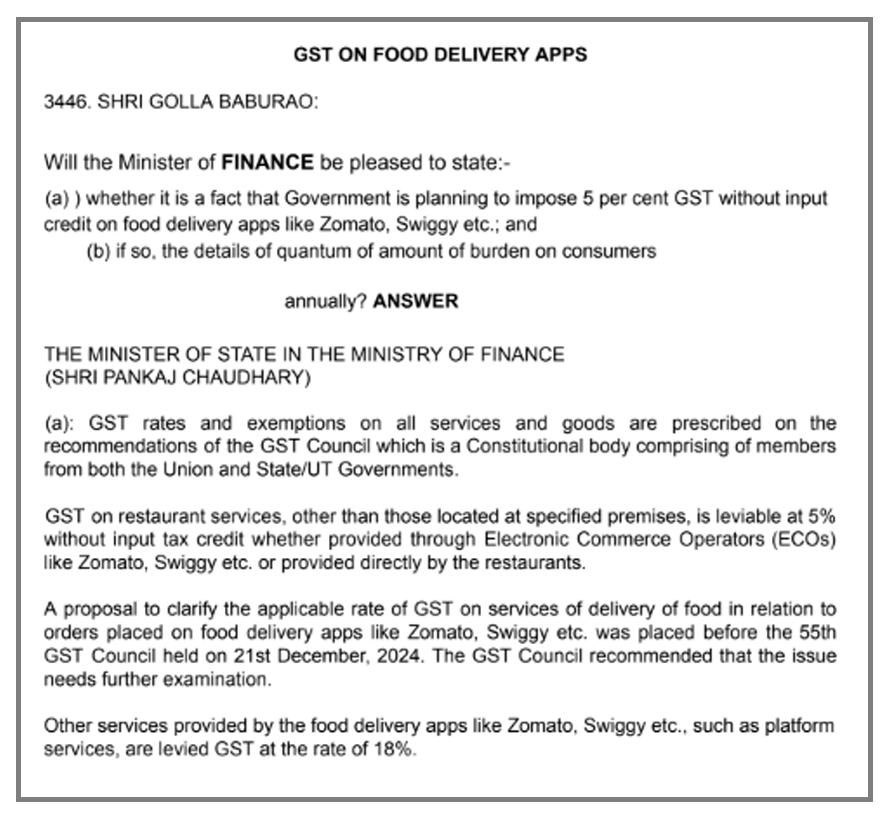

Government Officials Verify: Additional 5% GST Will Not Be Imposed on Food Delivery Platforms

Pankaj Chaudhary, the Minister of State for Finance, confirmed in a Rajya Sabha session on Tuesday that the government has no plans to implement an additional 5% GST without input tax credit on food delivery services like Zomato and Swiggy.

According to Minister Chaudhary’s statement, the GST Council has determined that the proposal requires additional analysis, suggesting that immediate implementation of new taxes on food delivery services is not forthcoming, while the topic continues to be evaluated.

The confirmation brings reassurance to delivery platforms and their customers, maintaining current pricing structures for online food orders. Stakeholders will monitor future GST Council discussions regarding potential tax modifications in this sector.