Biggest Benefit

| •In Budget 2025, Finance Minister made an announcement that an individual earning up to ₹12 Lakh annually will not have to pay income tax. •This change is expected to benefit millions particularly the middle class taxpayers. •The rebate extends up to ₹12.75 Lakh with standard deductions under new tax regime, making it most significant relief since 1997. |

Who are Eligible to Pay Zero Tax on ₹2 lakh p.m. Income?

- If you are a specified professional such as:

- Doctor

- Lawyer

- Interior Decorator

- Technical consultant

- Chartered Accountant

- Engineers

- Youtubers

- Bloggers

- Company Secretary etc. are eligible to pay Zero tax if your salary ₹24 lakh p.a. salary

Only Applies To:

Resident Individuals, HUFs and Partnership Firms excluding LLPs.

How is this possible?

This is possible if you opt for presumptive taxation under Section 44ADA.

If you are resident professional in India, you can estimate 50% of your income as profit under presumptive taxation

This means when you do not maintain any books such as:

- No Balance Sheet.

- No Income/Expenditure.

You need to pay tax only on 50% of your total income.

So, for ₹24 lakh income, taxable income becomes ₹12 lakh.

Up to ₹12.75 lakh income is exempt in the new tax regime, so effectively “zero tax” on ₹24 lakh income if you qualify.

When you can Opt for Presumptive Taxation u/s 44ADA?

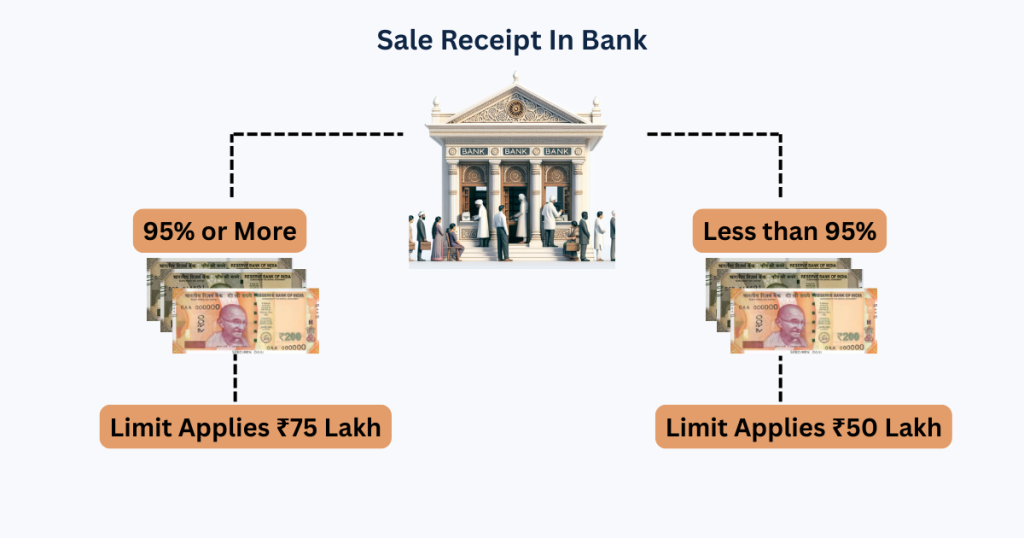

A Professional having a turnover up to ₹50 lakh which has been increased to ₹75 Lakh in budget 2023 can opt for presumptive taxation u/s 44ADA with certain condition.

This means-

- The limit of ₹75 Lakh is only available if 95% of the total receipts are in bank.

- The limit of ₹50 Lakh continues to apply, if cash receipt is more than 5% of the total receipts.

Points To Remember

- 50% of the gross receipts or turnover is deemed as income.

- The deemed income is taxed under the head ” Profit and Gains of Business or Profession.

- No deductions for expenses are allowed further u/s 30 to 38 such as rent depreciation et.

- But, taxpayer can claim deduction under chapter VI-A and rebate 87A if selected old tax regime.

ITR-4 shall be applicable provided that taxpayer meet the eligibility and don’t have income from speculative business, capital gain or foreign assets.