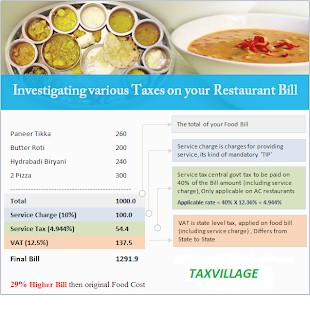

1. Service Charge

Service Charge is a charge levied by restaurant for the service provided to customers. This is generally 5%-10% of the bill and restaurant owner is free to charge whatever amount he/she wants as service charge. The service charge has to be displayed in Menu, only then it can appear in the final bill. If you do not see it on Menu, it means it was not communicated to you and it cant not be charged.

Actually service charges are to be distributed among waiters and staff and it’s kind of compulsory “tip” to be paid. So if there is service charge on the bill, you are not supposed to tip officially to anyone. So don’t feel awkward not paying the tip, because you have already paid it in form of service charge, however most of the hotels and restaurants never tell you this explicitly.

2. Service Tax

The important thing, you should be aware about is how service tax is calculated! Do you know that, Service tax is only applicable on 40% of the bill amount, not the total amount? As the service tax is around 12.36% at the moment, the final tax you need to pay is only 4.944% (12.5% X 40%) on the bill (inclusive of service charge).

The next important thing you should know is that, only AC restaurant can charge service tax. If there is no AC in restaurant (fully or partially), they cant charge service tax at all. This service tax goes to Govt of India. The service tax is payable on the bill amount + service charge. So if Bill amount is Rs 1,000, and service charge was Rs 100 (10%), then your subtotal would be Rs 1,100. And your service tax will be computed on Rs 1,100 (not Rs 1,000). 4.944% of Rs 1,100 will be Rs 54.38 and your total bill after service tax would be Rs 1154.38.

3. VAT – Value Added Tax

VAT is Value added Tax collected by State Govt. VAT is only applicable to the food items which are prepared inside the restaurant, because they “added some value” and then hand it over to you. So make sure you do not pay it on packaged items which are not prepared by Restaurant like packaged food items, water bottles etc. A lot of times you eat at restaurant and also take a lot of packaged items, in which case VAT should be applicable not on final bill, but only subtotal of the food items you consumed.

VAT Charges vary from state to state, but generally lie in the range of 10% – 15%. Like in Maharashtra its 12.5%, and in Karnataka its 14.5% . VAT is to be charged only on the main bill + service charges. It CANT be charged on the amount after service tax. So in the same example we looked about, the final bill after service charge was Rs 1,100 , so VAT at 12.5% will be Rs 137.5. Now total bill amount would be

· Food Bill – Rs 1,000

· Service Charge – Rs 100

· Service tax (4.944% of 1,100) – Rs 54.38

· VAT (12.5% of 1,100) – Rs 137.5

· Total – Rs 1,291

Source : Internet

Regards,

RAJESH CHOUDHARY

CAclubindia

CAclubindia