Dear Sir,

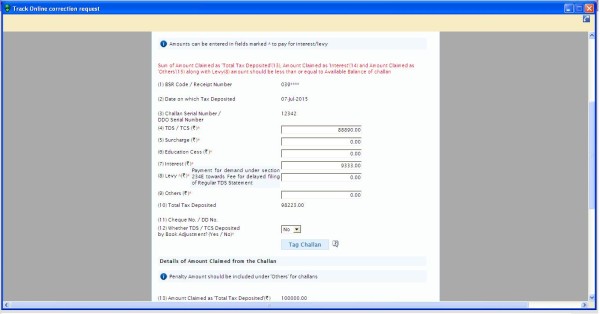

Un-matched challan was found in 2014-15 26-Q2 Amount Rs.1,03,000/- (TDS 1,00,000+Int 3,000).

Now we want to tag/replace the challan with 2015-16 paid challan amount.

But two different challans available for replace. (Amt Rs.55,500 + 85700)

In TRACES one challan is only we can replace at a time. So error was found as "Amount not matched".

How replace the two available challans.

Regards,

M.Shanmugasundaram

CAclubindia

CAclubindia