Hello experts,

I am working in a company whose business is foeign exchange dealing. i am preparing for the service tax return of company for the month Oct-march 2016. we collects service tax from customer as per rules mentioned in 7B ie.

(a) 11 [0.14 per cent. of the gross amount of currency exchanged for an amount up to rupees 100,000,

subject to the minimum amount of 12[rupees 35] and;

(b) rupees 13[140 and 0.07 per cent. of the gross amount of currency exchanged for an amount of rupees

exceeding rupees 100,000 and up to rupees 10,00,000; and

but i am in dilema which value will be mentioned in return (Actual value of service ie invoice value or Value calcuated by grossing up of service tax liablity).

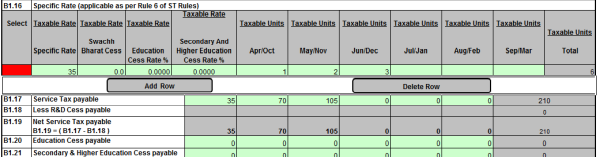

and in rate column of return form ie. B1.15 which rate will be mentioed as that coulmn is not taking valule 0.14%

Please advise me and clarify this situation.

Thanks and regards

CA Piyush Kabra

CAclubindia

CAclubindia