Menu

Sale proceeds of rural agricultural land- income from other sources?

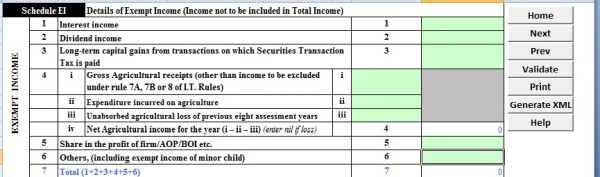

I understand that rural agricultural land is specifically excluded from the definition of a Capital Asset under section 2(14). Hence capital gain does not arise. Also, these sale proceeds cannot be regarded as agricultural income. But then, how do we declare it in the return? Also, is it taxable under the head Income from Other sources?

Replies (2)

Recent Threads

- SPOM FOR CA FINAL

- Are AI tools like ChatGPT actually useful for CA w

- UK TAX (HMRC) HELP WITH INVESTIGATIONS, DISPUTES,

- Payment processor not transferring or refunding pa

- Form 16 format

- 17(5) Blocked ITC

- Transfer of equity shares to original owner

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

Related Threads

CAclubindia

CAclubindia