While the ITR-1 Java/Excel utility does all these automatically, how to achieve the same in paper filing with correct rounded figures for income and total tax fields?

Scenario: Senior Citizen, ITR-1 (paper filing mode), AY 17-18

Calculations

PART B – GROSS TOTAL INCOME

B1 - Income From Salary /Pension = 2,88,000

B2 - Income from One house property = 0

B3 - Income from Other Sources = 2,78,945

B4 - Gross Total Income (B1+B2+B3) = 2,88,000 + 2,78,945 = 5,66,945

PART C – DEDUCTIONS AND TAXABLE TOTAL INCOME

80C = 1,50,000

80TTA = 10,000

C1 - Total deductions = 1,60,000

C2 - Taxable Total Income (B4-C1) = 4,06,945 ==> 4,06,950 ??? (Sec 288A ?)

Senior Citizen ==> 4,06,950 - 3,00,000 (exempt income) = 1,06,950

PART D – COMPUTATION OF TAX PAYABLE

D1 - Tax payable on total income = 10,695

D2 - Rebate u/s 87A = 5,000

D3 - Tax after Rebate = 10,695 - 5,000 = 5,695

D4 - Cess on D3 = 170.85 = 171 ??? (Cess should be rounded or not?)

D5 - Total Tax and Cess = 5,695 + 171 = 5,866 or 5,870 ??? (Sec 288B ?)

D6 - Relief u/s 89(1) = 0

D7 - Interest u/s 234A = 0

D8 - Interest u/s 234B = 0

D9 - Interest u/s 234C = 0

D10 - Total Tax and Interest (D5+D7+D8+D9–D6) = 5,866 or 5,870 ??? (Sec 288B ?)

D11 - Total Taxes Paid = 5,866 or 5,870 ??? (Sec 288B)

D12 - Amount payable (D10 –D11) (if D10 > D11) = 0

D13 - Refund (D11 – D10) (if D11 > D10) = 0

Can anyone help me out with the rounding procedure in C2, D4, D5, D10 and D11 marked in red/yellow? What needs to be the correct figures?

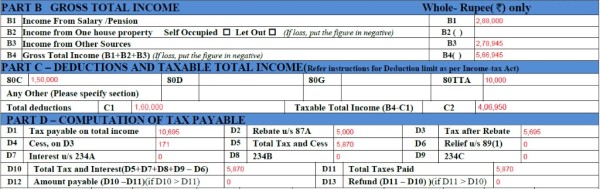

Check image/sceernshot below, ... Is this correct? :

CAclubindia

CAclubindia