Hi Fellas -

I am an NRI and this is for AY 2014 - 2015. I am filing the belated return. I would like to know where ( which section ) to report the below two income credited to my bank account.

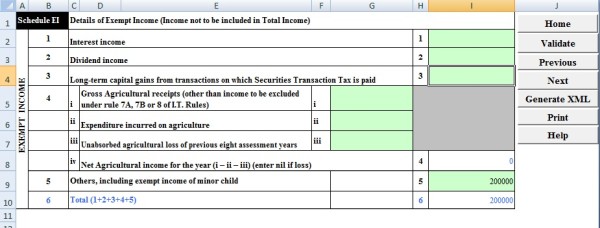

1. Around 2Lacs of EPF withdrawan ( after 5 + years of service ) credited to my savings account . I know this is not taxable. But just want to make it a clean return. Currently I have it listed in the Excepted Income ==> Others field. Please confirm if its the correct place. Do i need to provide any additional details?

2. I have had around 1.91 Lacs of LONG term capital LOSS on equities which I held for more more than 4 years. At the end when I closed the position , my bank account shows a credit of 32,000 from the proceeds. I paid all the taxes to Reliance money when doing the trancactions. Per IT rules, I dont think Long term capital GAIN OR LOSS on equities is taxable. However, in the compliance section ofd the IT site it shows this income being reported. Just wanted to know how to report it on the ITR2. Which section. An example would be great.

Thanks in advance.

CAclubindia

CAclubindia