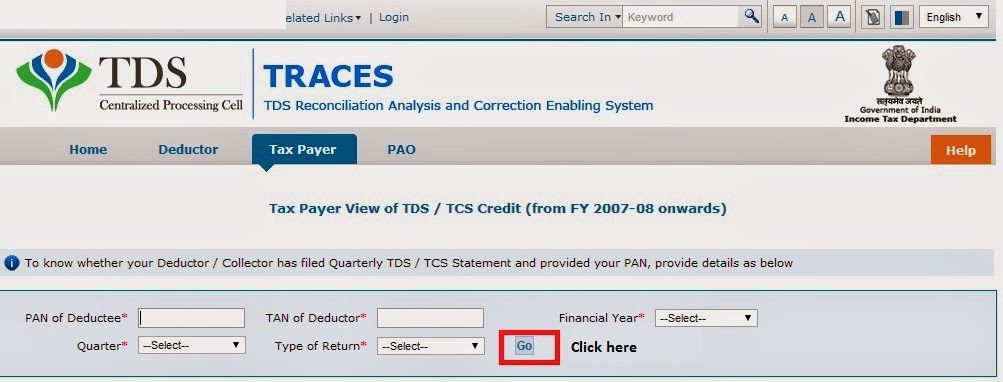

No need to register PAN No. to view Tax Credit Statement

TRACES has provided advance features, to view 26AS Statement or Tax Credit Statement for AY: 2014-15 without registering PAN No. With this feature, Taxpayee can view their Tax Credit or Form 26AS Statement by the providing the details of mandatory field i.e. PAN of Deductee*, TAN of Deductor*, Financial Year*, Quarter* and Type of Return* etc.

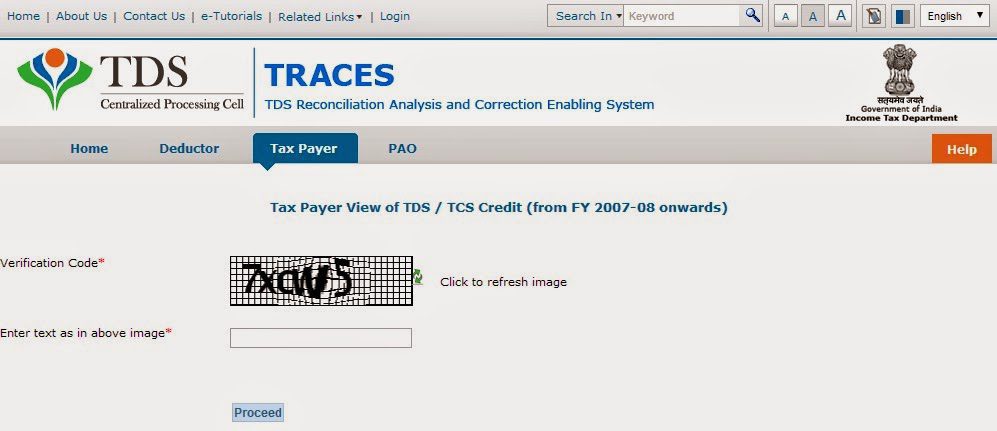

Tax Payer can view their TDS/TCS credit from FY 2007-08 onwards.

Details provided by TRACES in Form 26AS are as under:

• Details of tax deducted on behalf of the tax payer by deductors

• Details of tax collected on behalf of the tax payer by collectors

• Advance tax / self-assessment tax / regular assessment tax etc. deposited by the tax payers (PAN holders)

• Refund received during the financial year

• Details of transactions in Mutual Fund, Shares and Bonds, etc. (as reported by AIR filer)

CAclubindia

CAclubindia