Dear Sir

I have received intimation under143(1) on my ITR in which they have dissallowed Rs.3994/- which was claimed by me towards TDS in schedule 2 of TDS in ITR1. Reason given is that the amount is not there in form 26AS!

I am Pensioner and recive my pension through SBI. SBI deducts TDS on my pension and also on some interest paid.

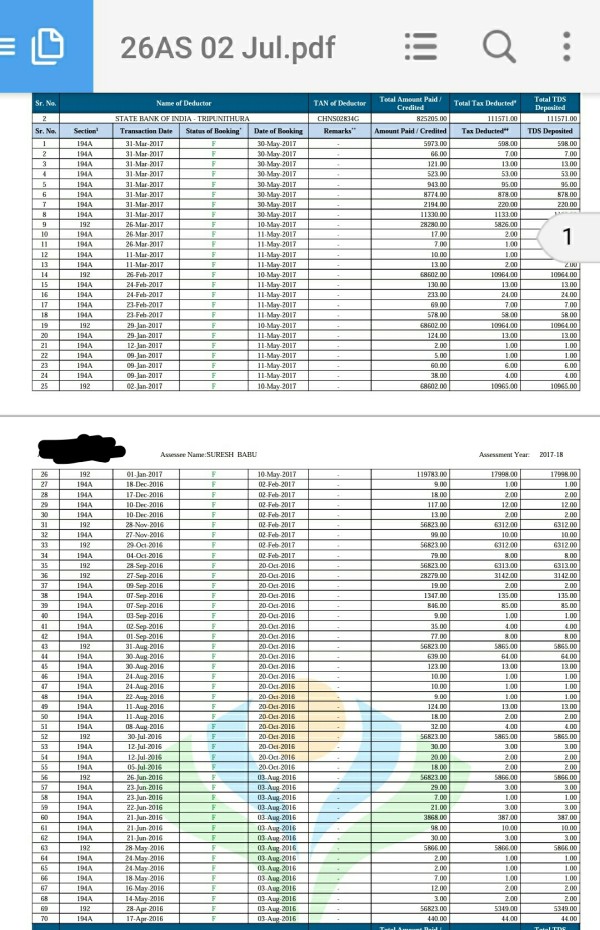

When I compared the IT intimation under 143(1) with 26 AS, I found probable reason for disallowance of TDS as per my ITR. SBI has filed a combined TDS return for my salary and interest whereas I received separate form 16! In form 26 AS, all the TDS of SBI is appearing in one category under single TAN. Rs.3994 disallowed is of TDS on interest which is deducted in several installments over the FY 16-17. There are about 50 odd TDS entries of small denominations totalling Rs.3994 in form 26AS and it is appearing along with TDS on my pension! I could figure it out easily because I received sepaerate for 16 for pension and interest. In my ITR, I showed TDS on salary in Schedule 1 and this Rs.3994(Total of of about 50 entries) in Schedule 2. How do I prove it to Assessing Officer online that these 50 odd entries in form 26AS is pertaining to my claim of Rs.3994 in Schedule 2? Kindly advise.

CAclubindia

CAclubindia