I find it useful so like to share

Filing of Income Tax returns is a legal obligation of every Individual/HUF whose total income for the previous year has exceeded the maximum amount that is not chargeable for income tax under the provisions of the I.T Act, 1961(Income tax rates charts ,deduction exemption useful charts for Ay 2012-13). Income Tax Department has introduced a convenient way to file these returns online using the Internet.

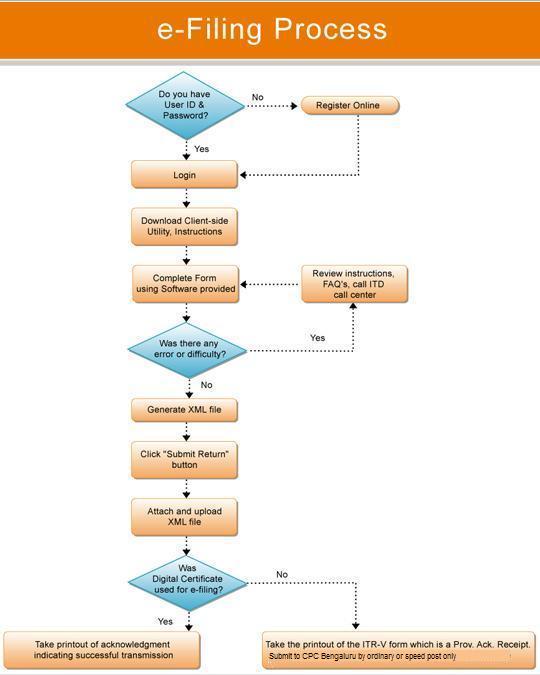

Every new user has to register at this website in order to avail the e-Filing facility. After completing the registration process and logging in, the user may download the software tools from here. Based on all the relevant information the required ITR Form should be filled using the software provided. The software would generate the XML format of the return which should be uploaded on this website. On successful transmission of the return a receipt will be generated in the form of a provisional acknowledgement.

E filing of Income Tax return for ITR-1 Sahaj has just been Started (27.04.2012) so download free software t e file your Income tax return on ITR-1 Sahaj

Download all income tax return form For efiling software free in excel For ay 2012-13

Before filing of Income Tax return you must have done some Home work.Following thing must be with you before filing of Income Tax return .

- A copy of last year's tax return

- Bank Statement

- TDS certificates Form 16 from employer and Form 16A from Bank or against other deduction of Income Tax

- Savings certificates/Deductions Details to be claimed

- Interest statement showing interest paid to you throughout the year.

- Form 26AS (details of Tax deducted /collected /deposited against your PAN number)

For business addition information is

- Balance sheet

- Profit and loss account

- Audit report if applicable.

You can file manual income tax return(ITR FORM ITR-1Sahaj , ITR_ @ , ITR-3, ITR-4,ITR-4S in PDF format is available here) except in case defined under mandatory e-filing of Income Tax return .(list is given below)

Taxpayers are advised to verify the tax credits available in 26AS statement before filing the Income Tax Return. It will facilitate faster processing and quick refunds. In order to avoid the TDS mismatch i.e if your claim of TDS is higher than the tax credits available in 26AS statement, please contact the Deductor for filing of the correction TDS statement.

- How to check Form 26AS three different manner read here

- Why there is difference in Form 16/16A and Form 26AS ,what to do Now .How Can I remove these Differences read here

- The process of electronically filing Income tax returns through the internet is known as e-filing.

- It is mandatory for companies and Firms requiring statutory audit u/s 44AB to submit the Income tax returns electronically for AY 2007-08 onwards.

- E-filing is possible with or without digital signature.

There are three ways to file returns electronically.

- Option 1: Use digital signature, in which case no further action is required.

- Option 2: File without digital signature, in which case the duly signed ITR-V form is to be submitted to CPC Bengaluru using Ordinary Post or Speed Post within 120 days of transmitting the data electronically. This completes the Return filing process for non-digitally signed returns.

- Option 3: File through an e-return intermediary who would do eFiling and also assist the Assessee file the ITR -V Form.

STEP BY STEP E FILING OF INCOME TAX RETURN FOR ASSESSMENT YEAR 12-13

1. Select appropriate type of Return Form

2 Download Return Preparation Software for selected Return Form.

3 Fill your return offline and generate a XML file.

3 Fill your return offline and generate a XML file.

4 Register and create a user id/password

5 Login and click on relevant form on left panel and select "Submit Return"

6 Browse to select XML file and click on "Upload" button

7 On successful upload acknowledgement details would be displayed. Click on "Print" to generate printout of acknowledgement/ITR-V Form.

8 Incase the return is digitally signed, on generation of "Acknowledgement" the Return Filing process gets completed. You may take a printout of the Acknowledgement for your record.

9 Incase the return is not digitally signed, on successful uploading of e-Return, the ITR-V Form would be generated which needs to be printed by the tax payers. This is an acknowledgement cum verification form.

- A duly signed ITR-V form should be mailed to “Income Tax Department – CPC, Post Bag No - 1, Electronic City Post Office, Bengaluru - 560100, Karnataka, ” BY ORDINARY POST OR SPEED POST ONLY within 120 days of transmitting the data electronically.

- ITR-V sent by Registered Post or Courier will not be accepted.

- No Form ITR-V shall be received in any other office of the Income-tax Department or in any other manner. In case, Form ITR-V, is furnished after the above mentioned period, it will be deemed that the return in respect of which the Form ITR-V has been filed was never furnished and it shall be incumbent on the assessee to electronically re-transmit the data and follow it up by submitting the new Form ITR-V within 120 days. This completes the Return filing process for non-digitally signed Returns.(do and Don'ts for printing of ITR-V)

10 To reset the password, click on the forget password link from the login page. In the password reset page, enter either of the following data :

- Enter your secret question and answer which you entered during registration (OR)

- Enter the assessment-year and acknowledgement number of any of the e-returns filed by you since assessment year 2007-08.

- Then enter the new password twice and then the text from the image below. Click on Reset Password to reset the password of your user.

This is explained below with the help of a flow chart.

Which Income Tax return form Should you use.

In following Case E filing of return is mandatory.Now Individual /HUF Income exceeding 10 Lakh have to file their return Online mode only . .However salaried person having taxable Income up to 500000 (including saving Bank interest up to 10000) is exempted from income tax return filing for assessment year 2012-13.

Compulsory / Mandatory E filing of Return with digital signature and without digital signature

Filing of e-return by Legal Heir (LH) using DSC: Revised Process

This is regarding cases where the assessee has expired but a return has to be filed by LH using his DSC. Following process is suggested in above regard :

- The legal heir (LR) has to get a DSC in his own name.

- LH is required to make a request by sending a mail to ask @ incometaxindia.gov.in mentioning the name, PAN,Date-of-Birth of deceased as well as that of the LH along with scanned attachment of the death certificate of the deceased.

Read more: https://www.simpletaxindia.net/2012/04/how-to-e-file-your-income-tax-return-ay.html#ixzz21oUsw6oH

CAclubindia

CAclubindia