Dear Friends,

I'm not a chartered account nor an expert in accounting. I'm just an entrepreneur in a startup who's trying to pay taxes.

In regards to the same, I have tried to learn how service tax filing works and as far as I have understood, small scale providers like us have an exemption of 10 Lakhs under notification 33/2012-S.T. I filed a NIL return this time too but later realized that the exemption notification needs to be selected too. So I went over to aces.gov.in yesterday and logged in and began revision.

Under field A11.1 (Has the asseesse availed any exemption?), I seleected YES. And then i proceeded to select the respective amemnded notification number i.e., 033/2012-S.T. and selected 1 under Sl. No.

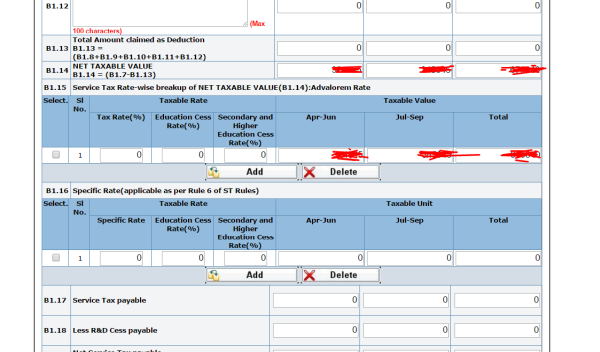

However, when I click next and enter the amounts into the respective quarters for the period April - September, the net taxable value in B1.14 shows the same amounts as entered in the quarter. What all should happen in consideration that I have seletected the exemption notification and the income is below 10L and no service tax was applicable nor collected in the last year either (income was below 10L last year as well)?

CAclubindia

CAclubindia