Hello,

Please advice if merchant navy person not resident in INDIA Recd salary in NRE A/C maintain in India.

IS THIS INCOME TAXABLE IN INDIA.

please also advice effect of following judgement , if applicable effective date of the same.

Please find the following link to the Latest Order on 01/06/2016 by the Income Tax Appellate Tribunal C Bench (International Taxation 3(1), Kolkata, Date of Hearing: 18/04/2016)

*NRI Seafarer's Salary Credits in to his NRE Accounts held in India for his services rendered outside India and in Foreign waters shall be TAXED in India*

ORDER DATED 01/06/2016:

https://wwwtaxassistindia.blogspot.in/2016/06/landmark-judgement-for-indian.H T M L?m=1

IN THE INCOME TAX APPELLATE TRIBUNAL "C" BENCH: KOLKATA

(Before Shri N. V. Vasudevan, JM & Shri M. Balaganesh, AM),

I.T.A No.70/Kol/2016,

Tapas Kr. Bandopadhyay (Appellant) Vs. Deputy Director of Income-tax, (PAN: ADZPB9416H) International Taxation 3(1) Date of Hearing: 18.04.2016

Date of Pronouncement: 01.06.2016

For the Appellant: Shri Manoj Kataruka, Advocate

For the Respondent: Shri A. H. Choudhury, JDIT

If you download this Order and read in full, you'll find that although this Seafarer is an NRI, he still needs to *pay tax* in India for his Salary Credited in Foreign Currency to his NRE Account in India.

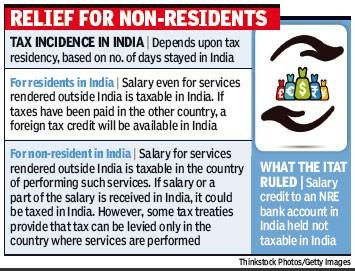

In *International Taxations* with the new FATCA Compliance (Foreign Account Tax Compliance Act) and DTAA (Double Taxation Avoidance Agreement) in place, one may either be a *Tax Resident* Indian or *Tax Non Resident* Indian

In view of the above Order, and this one being the latest one with respect to Seafarers and International Taxations, it might be inferred by the Income Tax AO that Seafarers do not pay tax elsewhere outside of India and as per the latest International Taxations, Tax Compliance and DTAA, Seafarers might be assumed as *Tax Resident* Indians since they do not pay tax elsewhere

"DTAA" was seen to be quoted in that Order dated 01/06/16 and this one being the *latest order*, ITO might infer this as the latest case law on this subject

The order seems to quote the DTAA, Double Taxation Avoidance Agreement and since the Seafarer doesn't pay tax elsewhere in any other country, he is assumed as a *Tax Resident* Indian and needs to be taxed here in India in the absence of any other tax liability elsewhere.

However if the same salary was *First Credited* to the Seafarer's Account held in a country outside of India, then keeping in mind the DTAA and this latest Order by this Bench, it might not be taxed by the Indian Tax Authorities as the Seafarer becomes liable to be taxed in that country of *First Credit*

The Order further states that the Seafarer's Salary Income is in International Waters and for the sake of convenience, he instructed the foreign employer to send the monies to his NRE account in India.

It was argued by the assessee that income was actually earned by the assessee outside India and assessee had only brought those amounts into India and hence not to be taxed in India.

However the Order specifically mentions that if this argument of the Assessee is to be accepted, then the Assessee goes scot free from not paying tax anywhere in the world on his salary income.

The Bench further observes that the provisions of section 5(2)(a) of the IT Act are probably enacted keeping in mind that Income has to suffer tax in some tax jurisdiction. It believes that such provisions would exist in tax legislation of all countries.

The bench holds that if the argument of the assessee is accepted, then it would make the provisions of section 5(2)(a) of the Act redundant. It is only elementary that a statutory provision is to be interpreted "ut res magis valeat quam pereat", i.e. to make it workable rather than redundant.

CAclubindia

CAclubindia