Others

1212 Points

Joined July 2015

Since ur mother received email under "Non-filers Monitoring System" You need to respond to that

1) Log in to her Income tax efiling account

2) Click on "view and Submit compliance

3) It lists the assessment years for which return has not been filed. The tax payer needs to provide a response – (a) ITR has been filed OR (b) ITR has not been filed

4) When option selected is (b) ITR has not been filed

In this case tax payer (ur mother ) has to choose one of the following options

- Return under preparation

- Business has been closed

- No taxable income

- Others

Choose s.no 3 if it is applicable

Now click on second tab

On the second tab of ‘Related Information Summary’ details are provided of the source based on which compliance email has been sent to you. This is the information received from third parties such as banks, TDS returns, post offices

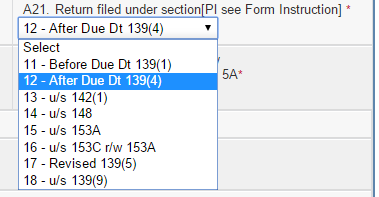

There are various options - select the relevant one

After that click "submit" button and keep a copy of response

For AY 2014-15 - u have to say return already filed. Give comm no.

If your submission is found to be satisfactory the case will be closed.

hope this helps

CAclubindia

CAclubindia