Hi

I have registered for TIN(in order to sell products online) in July 2015 and after doing all the documentations and getting that file from CA, VAT Inspector visited my registered address, clicked photographs etc. After that same things happens which is quite common in India(I hope its clear what I am referring to), which I refused to give. The VAT Inspector asked me to collect the RC from the office which I didn't collected yet.

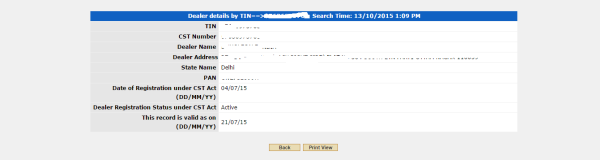

I checked my TIN registration status on this website: https://www.tinxsys.com and its says that my status is Active. PFA snapshot.

Now, I want to know that is their anything that I need to do to get my registration complete or its already completed. If completed, how can I get that RC, is it necessary to go the DVAT Office to collect because I know why that VAT Inspector asked me to do so, he need that same which I refused during his visit.

Secondly, I didn't bought & sold anything yet and I think I need to file that return. Can anyone tell me which forms are required to fill for NIL Sales. I have that online login.

Any help will be highly appreciated!

Abhishek

CAclubindia

CAclubindia