I HAD SOME CAPITAL GAINS DURING FY 2013-14. SINCE I COULD NOT FINALIZE INVESTMENT BY DUE DATE OF RETURN FLINING, I DEPOSITED THE ENTIRE RECEIPTS IN CAPITAL GAIN ACCOUNT SCHEME. SUBSEQUENTLY I INVESTED THE ENTIRE AMOUNT IN SEPT 2014.

WHILE FILING RETURN FOR 2013-14 I HAD SHOWN DEPOSIT IN CAPITAL GAIN ACCOUNT SCHEME.

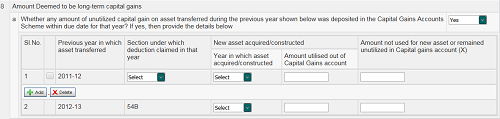

NOW IN 2014-15 I NEED TO SHOW THAT I HAVE WITHDRAWN FROM CAPITAL GAIN ACCOUNT SCHEME AND HAS INVESTED BUT THE FORM ITR 2 HAS PROVISION TO SHOW CAPITAL GAIN ACCOUNT SCHEME WITHDRAWAL PERTAINING TO CAPITAL GAIN OF FY 2011-12 AND 2012-13 ONLY. HOW DO I SHOW MY GAIN OF 2013-14 AND ACCOUNT OF 2014 IN THE RETURN.

CAclubindia

CAclubindia