pecial purpose vehicle:-

• Formed for a special purpose

• powers are limited to what might be required to attain that purpose

• Life ends when the purpose is attained

• SPVs are also referred to as a "bankruptcy-remote entity" whose operations

are limited to the acquisition and financing of specific assets

Special purpose vehicle concept in India:-

Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (Invits) have been proposed as a “Special purpose vehicle” of investment in real estate and infrastructure . It is expected that these structures will help mobilize public Funds from India & abroad for various capital intensive projects.

The concept is similar to mutual fund where investors can participate in the funds. The funds will have investments in either SPVs owning project; or directly in the real estate or infrastructure projects. The funds will earn income from the SPV/ projects and the income will be distributed to the investors. The units of the trust will be listed on the stock exchange. Investors will be able to sell the units on the stock exchange also.

REIT is designed for “completed” real estate project. Thus those projects which can earn incomes post completion, can be considered for investment.

Invit is for infrastructure projects which are completed and also for those that are not yet completed.

Already many companies in India mobilizing funds through Special purpose vehicle.

Latest example:-

Ratnagiri Gas and Power Pvt Ltd (RGPPL) is a special purpose vehicle (SPV) formed by GAIL (India) and NTPC to revive the 2,184 MW Dabhol power plant. The SPV will have an equity of Rs 1,500 crore.

What is the difference between a company and an SPV?

Although both these entities are established as per Company Act and also follow the all the regulations in the Company Act, the difference lies in the purpose. The company, as distinguished from an SPV, may be called a general purpose vehicle. A company may do several things which are mentioned in the memorandum of association (MoA) or permitted by the Companies Act. An SPV may also do the same, but its scope of operation is limited and focused. The MoA is quite narrow in the case of an SPV. This is primarily to provide comfort to lenders who are concerned about their investment.

REIT STRUCTURE

Example to understand the concept of Business Trust :

XYZ is a company into infrastructure projects. It has already invested Rs. 20,000 crores in projects and has projects worth Rs. 30,000 crores .It needs substantial finance. Some of the projects may be on Public Private Partnership (PPP) basis. In these cases, Government does not pay for the costs of the projects. XYZ has to raise its own finances. Similarly, there will be some other large infrastructure companies that need to raise finances from within India and abroad. The Business Trust structure is for such large finance companies.

To continue the example

XYZ may have nine completed projects – all together costing Rs. 20,000 crore. Projects are completed and revenue flows have started. However, XYZ’s capital is blocked in these projects. It needs funds to finance newer projects.

Hence XYZ, as a sponsor, settles a Business Trust. It has one company – SPV – holding a few projects totaling investment of Rs. 1,500 crores. SPV has share capital of Rs. 750 crores and loans of Rs. 750 crores. XYZ transfers the shares and loans to XYZBusiness Trust (GBT). In return, GBT issues units of Rs. 1500 crores to XYZ. XYZ will hold 25% of the units and sell the balance units in the stock exchange.

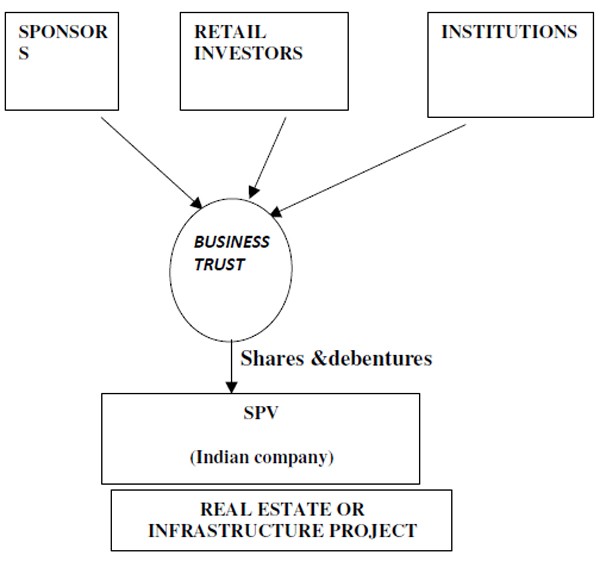

Parties in the structure:

Sponsor – The person who develops the projects and sets up the business trust. The sponsor can own the shares of the SPV which will own / operate the real estate / infrastructure project.

Business trust – The sponsor may settle a Business Trust in which investors will invest funds.

SPV – Indian company which will be the owner of the project.

Financial Institutions - They may buy/ subscribe units from the sponsor or the business trust.

Retail Investors – Resident and non-resident persons who will invest in the business trust.

A chart is given below explaining the ownership structure.

The Institutions or retail investors will be the unit holders in the business trust. The trust will be shareholder in the SPV.

XYZ will get finance.

Now the tax treatments are discussed in some details:

Tax treatment is at four levels:

Sponsor – shareholder of SPV.

SPV – Operating Projects.

Business Trust – Investment Intermediary.

Unit Holders – Retail Investors + Sponsor + institutions.

Taxation of sponsor:

Income distribution will be taxed in similar manner as investors.

However capital gain will be taxed differently.

When the sponsor transfers his shares to the trust, it will not be considered as transfer. Only when the units of the business trust are sold, there will be capital gains. It has also been provided that the period of holding of share will be considered as period of holding of units also. The cost of shares in the SPV will be considered as the corresponding cost of the units. Thus in essence the sponsor does not lose the benefit of holding period of shares in the SPV.

Holding shares in SPV versus holding units in the business trust:

When the sponsor holds units of the trust, there is no difference in the taxation compared to his holding in the SPV. However in a situation where the SPV is unlisted, there could be a benefit by transferring the holding to the trust. If the SPV is unlisted, there is no relief in case of capital gain. However capital gain on listed units can give the benefit of lower / Nil taxes on capital gain.

SPV’s income & tax:

The SPV earns its profits on its projects and pays normal corporate tax on the profits. It may get S.80 IA and other tax reliefs. When it declares dividends, it again pays Dividend Distribution Tax. The interest paid to the Business Trust is deductible expenditure for the SPV.

Taxation of business trust:

The business trust is mainly considered as a pass through vehicle for investment by the investors. Tax is levied only at one place – business trust or investor.

The business trust can invest in equity capital and debt of the SPV. It will normally have dividend income or interest income. Further it may sell the shares of the SPV and earn capital gain. Apart from the above, the trust may have other miscellaneous income like bank deposit interest, money market fund income, etc.

The investors will receive distribution of income (dividend) from the trust.

They may also earn capital gain from sale of units of the business trust.

The tax treatment will be as under:

Dividend - Dividend declared by the SPV will be liable to Dividend Distribution Tax (DDT). DDT is payable by the SPV @ 15% (plus surcharge and education cess). The business trust will not pay any tax. This is the normal provision.

Capital Gain - On capital gain, the business trust will pay tax as per normal provisions. (e.g. On long term gain on shares of the SPV sold on the stock market, it will not pay any tax.)

Interest – On interest received (or interest accrued) from the SPV, there is no tax payable by the trust. The SPV is also not required to deduct tax at source. Interest is taxed in the investor’s hands whenever the business trust distributes income to the investors.

Other miscellaneous income – Any other income of the Trust is taxed at maximum marginal rates. The maximum marginal rate is 30% (plus education cess and surcharge). If the trust has a foreign company as the investor, proportionate income will be taxed @ 40% (plus surcharge and education cess).

In the hands of investors:

Income distribution to investors – Income of the trust will comprise of various kinds of income (discussed above). At the time of distribution of income to the investors, a break-up of the different components will be given.

Interest component of the income distributed is taxable in the hands of the investor when the same is distributed by the trust. If the investor is a nonresident, interest component is taxable @ 5%. The trust will deduct tax at source.

Resident investor is taxed normally. However when the trust declares the income, it will withhold tax @ 10%.

Other components of income distributed by Trust are not taxed in the hands of the investors.

Thus investors are not taxed on distribution except on interest component of income. Trust is taxed on capital gain and other income. On dividend from the SPV, DDT is paid by the SPV. (As far as Trust & Unit Holders are concerned, there is only one level of tax between the trust and investors.)

Capital gain on sale of units:

On sale of units of the business trust, normal capital gain provisions will apply. (e.g. if the units are sold on stock exchange, there is no tax on Long Term Capital Gain. Short term gain will be taxed @ 15%.)

Issue – The holding period for units of business trust to be considered as Long Term, will be 36 months. Whereas for equity oriented mutual fund, the period of holding is only 12 months for the same to be considered as Long Term. Hence an investor in a Business Trust is in a disadvantageous position to this extent.

Borrowing by the business trust:

The business trust may borrow from residents and non-resident (External Commercial Borrowing). Interest earned by non-residents will be taxed @ 5% which will be deducted at source by the business trust. Residents will be taxed normally.

Present assessment Procedure:

Under the present Income-tax Act, Sections 161 to 164, etc. determine taxability of a trustee and the beneficiaries. A trustee is taxable in his own name but in the like manner and to the same extent as the beneficiaries. While making new tax provisions for FIIs and Business Trusts, this well settled scheme of taxation has been forgotten. It can give rise to some complications.

Value of REIT assets, Initial offer size, offer of units to Public and listing of units

REIT shall raise funds through an initial offer, follow-on offer, rights issue, qualified institutional placement Value of the assets owned/proposed to be owned by REIT shall be of value not less than INR 500 crore

Minimum issue size for initial offer shall be of INR 250 crore Minimum subscripttion size for units of REIT - INR 2 lakhs

Units offered to the public in initial offer shall not be less than 25% of the number of units of the REIT on post-issue basis

Units of REITs shall be mandatorily listed on a recognized Stock Exchange, and REIT shall make continuous dis-closures in terms of the listing agreement. Trading lot for such units shall be INR 1 Lakh

Investment conditions

REIT shall invest in commercial real estate assets, either directly or through Special Purpose Vehicles ('SPVs'). In such SPVs, a REIT shall hold or proposes to hold controlling interest and not less than 50% of the equity share capital or interest Further, such SPVs shall hold not less than 80% of its assets directly in properties and shall not invest in other SPVs (i.e. SPV layered investments are prohibited)

i. At least 80 per cent of the money mobilised by an REIT shall be invested in completed revenue-generating properties. Further, note more than 20% of the value of REIT assets shall be invested in following : Devel-opmental properties (Investment restriction : Maximum 10% of the value of the REIT assets can be invested in developmental properties);

ii. Mortgaged-backed securities;

iii. Listed / unlisted debt of companies / body corporates in real estate sector;

iv. Equity shares of companies listed on a recognised stock exchange in India which derive not less than 75% of their operating income from Real Estate activity;

v. Government securities; and

vi. Money market instruments or Cash equivalents

Real Estate Project Mix

REIT shall invest in at least 2 projects with not more than 60% of value of assets invested in one project. De-tailed investment conditions will be provided in the final Regulations

Multiple Sponsor concept & Sponsor's skin-in the game requirement

A REIT may have multiple sponsors, not more than 3, subject to each holding at least 5% of the units of the REIT

Skin-in the game : Sponsors shall collectively hold minimum 25% of the units of the REIT for a period of mini-mum 3 years from the date of listing of units Continuing interest: After 3 years, the sponsors, collectively, shall hold minimum 15% of the units of REIT, throughout the life of the REIT

Frequency of Valuation and NAV declaration

Full valuation to be undertaken on a yearly basis o Half yearly updation in the valuation

NAV to be declared within 15 days from the date of such valuation/updation Borrowing and deferred payments

Borrowings and deferred payments of the REIT at a consolidated level shall not exceed 49% of the value of the REIT assets

o Borrowings/ deferred payments exceeding 25% of the value of REIT assets :

Approval from unit holders and credit rating shall be required

Key Benefits of SPV:-

• Asset owner ship:- An SPV allows the ownership of a single asset often by multiple parties and allows for ease of transfer between parties.

• Minimal red tape – Depending on the choice of jurisdiction, it is relatively cheap and easy to set up an SPV. The process may take as little as 24 hours, often with no governmental authorisation required

• Clarity of documentation – It is easy to limit certain activities or to prohibit un authorised transactions within the SPV documentation

• Freedom of jurisdiction – The firm originating the SPV is free to incorporate the vehicle in the most attractive jurisdiction from a regulatory perspective whilst continuing to operate from outside this jurisdiction

• Tax benefits – There are definite tax benefits of SPVs where assets are exempt from certain direct taxes.

• Legal protection – By structuring the SPV appropriately, the sponsor may limit legal liability in the event that the underlying project fails.

SPVs on or off-balance sheet?

IFRS requirements demand that an SPV’s assets are consolidated if the vehicle is ‘controlled’ by the main entity. In this case the SPVs assets and associated funding are shown as assets and liabilities respectively.

SIC 12 gives the following four tests as indicators to determine whether the originator is in ‘control’:

1. It is undertaking activities on its behalf and it benefits from this

2. It effectively controls the SPV

3. It has the majority of the risks of the SPV

4. It receives the majority of the benefits of the SPV

Disclosures relating to Securitisation

The Notes to Accounts of the originating banks should indicate the outstanding amount of securitised assets as per books of the SPVs sponsored by the bank and total amount of exposures retained by the bank as on the date of balance sheet to comply with the Minimum Retention Requirements (MRR). These figures should be based on the information duly certified by the SPV's auditors obtained by the originating bank from the SPV. These disclosures should be made in the format given below.

*Only the SPVs relating to outstanding securitisation transactions may be reported here

About Authors:-

Naveen & Akhila

You can reach us on: - naveencaaspirant @ gmail.com

Thanks for reading!!

CAclubindia

CAclubindia