Hello Financial Experts

This is the first time I am filing my tax returns by myself. I am trying to understand the process and new to this area so please allow me to ask a very basic question.

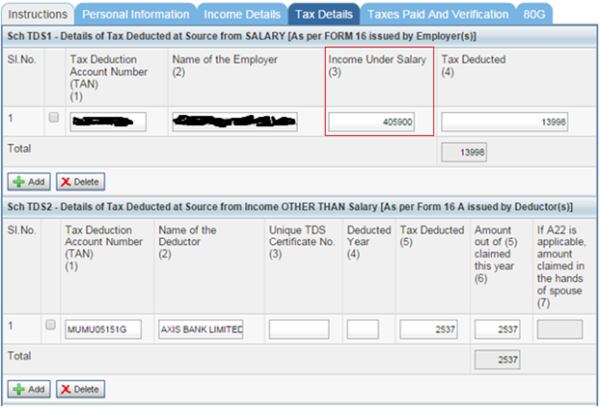

Consider the below screenshot. I was confused at one point i.e., at Tax Details tab. I have a question regarding the Tax Details tab.

As shown in the above image, what value should be entered in the red highlighted part?

Below are the answers in my mind(Not sure which one is correct)

1. Income Under Salary(3) value should be same as in Total Income (8-10) component in your Form 16. Below is the image for the same.

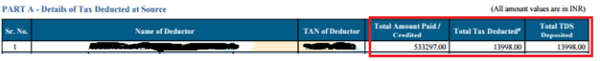

2. Income Under Salary(3) value should be same as the value in your Form 26AS Total Amount paid or credited. Below is the image for the same.

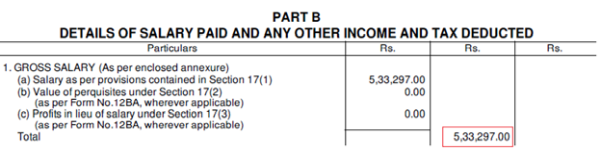

This value is again can be cross checked in Form 16 at Point 1 of Form 16 Total Gross Salary as shown below.

Finally, what value should I enter in the Income Under Salary (3) field 1 or 2?

Menu

A basic common question on tds tab in tax filing

Replies (3)

Recent Threads

- Transfer of equity shares to original owner

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

- Form 26QB – Section 194-IA: TDS on Full Cons

- Indexation Benefit available or not on Calculation

- Documents for return exhibition material

- Can I set off equity losses(both short term loss a

- Input tax credit on rent to rent

- Family Pension Army

Related Threads

CAclubindia

CAclubindia