Table of Contents

What is a Salary slip?

A salary slip or a pay slip is a document provided by an employer to an employee, with a detail list about the salary components such as HRA, LTA, bonuses, and deductions for a specific period, typically a month. It's exclusively for salaried employees, and the employer responsible for issuing it monthly. In some cases smaller companies don't provide regular slips, employees can request a Salary Certificate from their employer as an alternative.

Importance of a Salary Slip

A salary slip is essential for various reasons:

- It helps to calculate taxes and determining refunds or liabilities for the employee.

- The format allows employees to access benefits like medical insurance or subsidized food grains.

- It serves as evidence of employment, which can be crucial in legal matters.

- Details on the slip help in assessing financial health, aiding in credit card, loan, or mortgage applications.

- Understanding the components helps in evaluating job offers and negotiating salaries effectively.

Components of a Salary Slip

The components of salary slip are in two main categories:

Income

Basic Salary: This is the primary component of salary which usually constitutes 35% to 40% of your total salary.

Dearness Allowance (DA): DA is a percentage of 30% to 40% of basic pay and is given to offset the impact of inflation. It's fully taxable and is common in government employee salary slips.

House Rent Allowance (HRA): HRA helps employees with their house rent expenses. The amount varies based on location and is typically 40%-50% of the basic pay. You can claim tax deductions on a portion of HRA based on certain conditions.

Actual rent paid minus 10% of salary or,

50% of the basic salary for those living in metro cities and 40% for those living in non-metro cities

Leave Travel Allowance (LTA): LTA covers travel costs for employees and immediate family members while on leave. It's tax-exempt within certain limits and conditions.

Conveyance and Medical Allowance: Conveyance allowance covers travel costs to and from work, while medical allowance covers medical expenses. These allowances have tax implications based on specific limits and conditions.

Performance and Special Allowance: Given to incentivize better performance, these allowances are fully taxable.

Other Allowances: Additional allowances provided by the employer for various reasons.

Deductions

Employees Provident Fund (EPF): A compulsory deduction from your salary, usually at least 12% of your basic salary. It's diverted to an EPF account and is tax-exempt under Section 80C of the Income Tax Act.

Professional Tax: Levied in some states, professional tax is based on an individual's income tax slab and is deducted from the salary.

Tax Deductible at Source (TDS): The amount of tax deducted by the employer on behalf of the Income Tax department. TDS can be reduced by investing in tax-saving schemes and submitting appropriate documents to the employer.

What are the details included in the salary slip format?

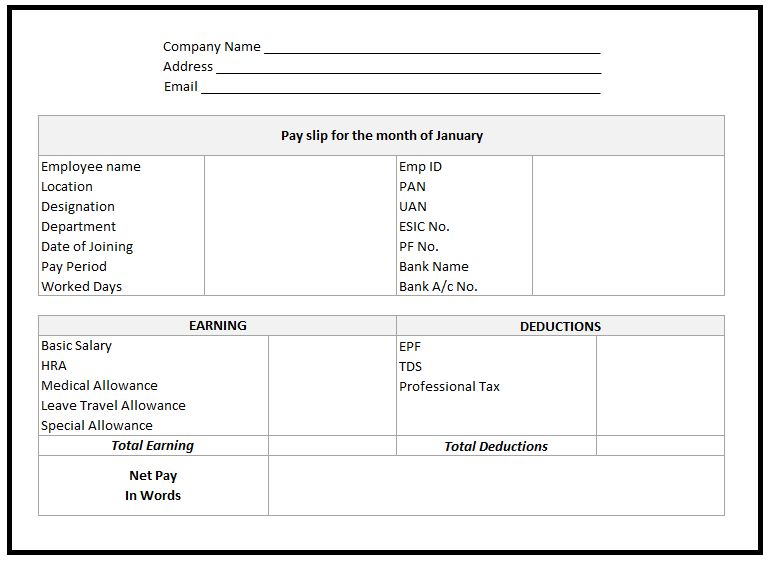

The format of a salary slip includes:

- Company Information: Name, logo, and address, along with the month and year of the payslip.

- Employee Details: Name, ID, designation, and department.

- Personal Identification: PAN, Aadhaar Number, Bank Account Number, EPF Account Number, and UAN.

- Attendance Information: Working days, number of leaves taken, including leave without pay if applicable.

- Earnings and Deductions: Detailed lists of components such as basic salary, allowances, and deductions like EPF and professional tax.

- Gross and Net Pay: Total earnings before deductions (gross pay) and after deductions (net pay), presented in both numerical and written formats.

Simple Format of Salary Slip

What is CTC?

CTC (Cost to the Company) represents the total expenditure an employer incurs on an employee. It encompasses various components like HRA, special allowances, EPF, gratuity, and more. The formula for CTC is Gross Salary plus EPF, gratuity, and other variable pay.

What is Gross Salary?

Gross Salary refers to the amount an employee receives before any deductions, excluding EPF and gratuity.

What is Net Pay?

Net pay is the salary after deductions like TDS and professional tax are subtracted from the gross salary.

Taxable/Non-Taxable details Components on a salary slip

| Basic pay, Dearness Allowance, City Compensatory Allowance, Special Allowance | Fully taxable |

| Conveyance Allowance | Partially taxable |

| Allowances paid by Government to employees posted abroad, Allowances accorded to UN workers, Compensatory Allowances remitted to judges of Supreme Court and High Court | Non-taxable |

CAclubindia

CAclubindia