Background

The tax litigation relating to Transfer Pricing has been the area of concern for the assessees as well as tax authorities. The determination of Arm’s Length Price (ALP) covers not only financial but also the economic analysis of the transaction. The outcome of the analysis is dependent on the approaches used by the individuals where standardization of different approaches may not be feasible. To control the increasing litigation relating to Transfer Pricing, there was need for safe harbor rules.

Section 92CB was inserted in Finance Act 2009 w.r.e.f. 1st April 2009. The said section gave powers to Central Board of Direct Taxes (CBDT) to make Safe Harbour Rules.

The sub-section 1 of Section 92CB is:

(1) The determination of arm’s length price under section 92C or section 92CA shall be subject to safe harbor rules.

The Explanation to section 92CB is:

“safe harbour” means circumstances in which the income-tax authorities shall accept the transfer price declared by the assessee.

The section 92CB and the explanation thereto clearly indicate that section 92CB has overriding effect on section 92C and section 92CA. CBDT issued Draft safe harbor rules on 14th August 2013 seeking comments from various stake holders. The comments received from various stake holders were considered and finalized Safe Harbour Rules are notified on 18th September 2013.

Introduction of Safe Harbour Rules (SHR)

CBDT has issued a Notification on 18th September 2013 for insertion of Rule 10TA to Rule 10TG in the Income Tax Rules, 1962. The structure of the rules framed is as follows:

| Rule | Particulars |

|

10TA |

Definitions |

|

10TB |

Eligible Assessee |

|

10TC |

Eligible International Transaction |

|

10TD |

Safe Harbour |

|

10TE |

Procedure |

|

10TF |

Safe Harbour Rules not to apply in certain cases |

|

10TG |

Mutual Agreement Procedure not to apply |

Definitions:

Rule 10TA contains important definitions of the terms like contract research and development services, core auto components, Information Technology Enabled Services (ITES), Knowledge Process Outsourcing Services (KPOS), Operating expenses, Operating revenue, Operating profit margin, Software development services etc. The clarity in the terms defined under Rule 10TA will certainly help in reduction of the potential litigation.

Eligible Assessee:

Rule 10TB contains the eligibility criteria for the assessee. The basic criterion is that the assessee has exercised a valid option for application of SHR in accordance with Rule 10TE. Further the assessee is engaged in rendering services or manufacturing and supplying goods, with insignificant risk, to a nonresident associated enterprise. The important term here is ‘insignificant risk’. The said term is explained in sub-rule (2) and (3) of Rule 10TB. These sub-rules appear to be based on the Circular No.6 dated 29th June 2013 issued by CBDT which contains conditions relevant to identify development centers engaged in contract R & D services with insignificant risk. As always the FAR analysis in the Transfer Pricing Study Report will play very crucial role to justify that the assessee is rendering services or supplying goods with ‘insignificant risk’ to non-resident associated enterprise.

Eligible International Transactions

Rule 10TC contains the eligible international transactions. It actually covers the nature of transactions which are eligible to avail benefits under SHR viz. provision of software development services, ITES, KPOS, advance to intra group loan, corporate guarantee contract research and development services etc.

Safe Harbour:

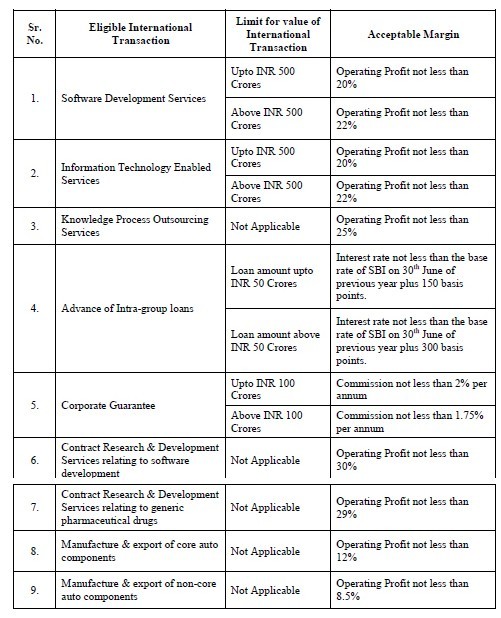

Rule 10TD covers that where an assessee is eligible under Rule 10TB and has entered in to eligible transactions under Rule 10TC then the transfer price declared by the assessee within limits prescribed under Rule 10TD shall be accepted by the Income Tax Authorities. The eligible international transactions and respective acceptable margin is tabulated below:

The eligible assessees can avail benefits of these margins under SHR for five assessment years starting from assessment year 2013-14. The provisions of Section 92D and Section 92E relating to maintenance of documentation relating to international transaction and filing of Transfer Pricing Audit Report respectively are applicable irrespective of the fact that the assessee exercises his option for safe harbor.

Procedure:

Rule 10TE prescribes the procedure to claim benefit of SHR. According to the said rule, assessee shall furnish Form 3CEFA to the Assessing Officer on or before due date of filing return of income specified under section 139(1) of IT Act. The period for which option under safe harbour shall be exercised is to be mentioned in Form 3CEFA. The period shall not exceed five assessment years starting from the assessment year 2013-14. The assessee can also furnish an application with Assessing Officer (AO) to opt out of safe harbour. On receipt of Form 3CEFA, AO shall verify the eligibility of the assessee as well as that of the international transaction. AO can also refer the case to Transfer Pricing Officer (TPO) to check validity of the application within expiry of two months from the end of the month in which Form 3CEFA is received by him.. TPO can reject the application within expiry of two months from the end of the month in which reference from AO is received. The application can be rejected only after giving reasonable opportunity of being heard to the assessee. On rejection by TPO, the assessee can file his objections with respective Commissioner within fifteen days of receipt of order from TPO. Commissioner shall pass the order within expiry of two months from the end of the month in which objections are filed by the assessee. If the order of rejection is held valid then arm’s length price in respect of such international transactions shall be determined in accordance with provisions of sections 92C and 92CA.

Non Applicability of Safe Harbour:

Rule 10TF contains that SHR shall not apply even for the eligible international transactions if such transactions are entered into with an associated enterprise located in any country or territory notified under section 94A or in a no tax or low tax country.

Non Applicability of Mutual Agreement Procedure:

Rule 10TG contains that once the transfer price under SHR is accepted by tax authorities then assessee shall not be entitled to invoke Mutual Agreement Procedure.

These rules as notified on 18th September 2013 with effect from assessment year 2013-14, are likely to reduce tax litigation. However compiling and maintaining the documentation as prescribed under section 92D is critical as the Safe Harbour Rules are applicable to specified transactions with insignificant risk. The quantum of risk can be justified only through effective Transfer Pricing Study Report.

Challenges & Road ahead:

Safe Harbour Rules will certainly reduce the tax litigation as the rules have reduced the margin of personal discretion to great extent. There are some key points which need attention:

a. Nature of International Transaction:

The definitions of different services/business activities are covered under Rule 10TA. The selection of correct category of activity for Safe Harbour is a tough task as it requires sound technical knowledge about the business activity of the assessee. Hence thoroughly understanding the business activity of the assessee is of utmost priority for correct categorization for Safe Harbour. As certain definitions contain terms which are open for interpretation which is going to be the challenge to categorize the assessee in the correct industry.

b. Insignificant Risk:

The benefit of Safe Harbour will be available only to the eligible assessee. The important eligibility criterion is the business having ‘insignificant risk’. To justify the level of risk assumed by the assessee, risk assessment from different perspectives is required. The process of risk assessment shall not only consider financial angle but thorough economic study of the transaction.

c. Procedure:

The filing of 3CEFA by due date of filing return of Income is one of the eligibility criterion mentioned in the SHRs. As SHR benefit can be claimed from 5 years starting from Assessment Year 2013-14, Form 3CEFA is to be filed by 30th November 2013. Considering the available time, compilation of details to justify business and risk profile of the assessee to claim eligibility under SHR is going to be the challenge for assessee as well as for the professionals.

d. Safe Harbour is not the benchmark for others:

Those who do not opt for Safe Harbour, can not use the safe harbor margin as a benchmark percentage to justify arm’s length price. According to the rules, safe harbour is for the eligible assessees who apply under the scheme and are considered as eligible by tax authorities. Hence the percentage under Rule 10TD is not to be considered as the benchmark margin for others.

e. Documentation:

The Safe Harbour Rules does not have any effect on Section 92D and 92E of I.T.Act. Hence the documentation requirements are to be complied with even if the assessee is covered under Safe Harbour Rules. Further, the voluntary disclosure of operating margin to avail Safe Harbour Benefits may affect the pending transfer pricing assessments as well as the assessments for the period after expiry of Safe Harbour period of five years. The documentation will play very critical role not only for the assessees opting Safe Harbour but also for the assessee out of Safe Harbour.

Article authored by:

CA Sagar S.Tilak

Email: sagar.tilak@sstca.com

CAclubindia

CAclubindia