In my first part of the Article “Excise on Ready Made Garments and Made Ups-Post Budget-2016” we had presented a brief note on applicable Central Excise with effect from 1st of March, 2016 on Readymade Garments and Made Ups. In this part, we are sharing further clarifications on the issue including who is to obtain registration under central excise, the job working units or the brand name owners and have exemplified the calculation of Central Excise Duty under different options.

COMPULSORY COVERAGE UNDER CENTRAL EXCISE

Readymade garments and made up articles of textiles falling under Chapters 61, 62 and 63 (heading Nos. 6301 to 6308) of the Central Excise Tariff except those falling under 6309 and 6310* (these articles/garments may be of cotton or any other textile material)

- of retail sale price (RSP) of Rs.1000 and above

- and

- when they bear or are sold under a brand name

VOLUNTARY COVERAGE UNDER CENTRAL EXCISE

Readymade garments and made up articles of textiles falling under Chapters 61, 62 and 63 (heading Nos. 6301 to 6308) of the Central Excise Tariff except those falling under 6309 and 6310

- of retail sale price (RSP) of less than Rs.1000

- or

- when they do not bear the brand name or are not sold under a brand name

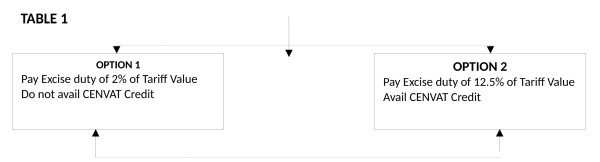

Thus the first category, i.e. ‘Branded’ Readymade garments and made up articles of Retail Sales Price of Rs. 1000/- or more of textiles falling under Chapters 61, 62 and 63 (heading Nos. 6301 to 6308) Excise Duty has now COMPULSARILY been covered under Central Excise with effect from 1st of March, 2016. Two options have been given pay Excise duty, i.e. either pay 12.5% excise and take CENVAT OR pay 2% excise and don’t avail CENVAT. (TABLE 1)

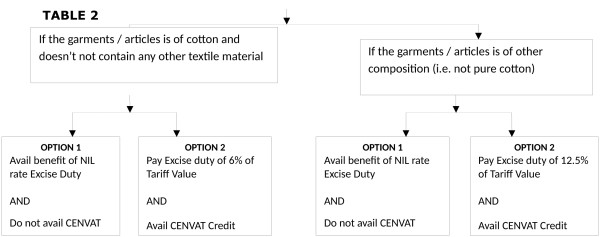

In respect of ‘Unbranded’ Readymade garments and made up articles or Readymade garments and made up articles of Retail Sales Price of ‘less than Rs. 1000/-‘, there is still an option available either to be covered under Central Excise or not to be covered under Central Excise.(TABLE 2)

Who to obtain registration, Brand Name Owner or the Job Worker

When Registration is to be taken by the Job Worker

Vide Notification No. 214/86 – CE dated 25th of March, 1986, “job work” means processing or working upon of raw materials or semi-finished goods supplied to the job worker/ so as to complete a part or whole of the process resulting in the manufacture or finishing of an article or any operation which is essential for the aforesaid process. “

In context with Readymade Garments and Made Ups, keeping in view the above explanation and Rule 4 (1A) of the Central Excise Rules, 2001, the job working units that carry job on the material supplied by the Brand Owner, shall be Job Workers. These units will not be required to obtain Central Excise Registration if they don’t use their own material and rather use the material supplied by the brand name owner.

Exception: It is to be noted that as per Proviso to rule 4 (1A) of the Central Excise Rules, 2001 and proviso to Para 1, clause (vi) of notification No.36/2001-C.E. (N.T.), dated 26.06.2001, the Job Worker may be authorised by the Brand Name Owner to pay the duty leviable on the goods. If that case, the job worker would have to obtain registration.

In case, they use their own material and carry work on that material, they cease to be the beneficiary as job workers. In this case, they will have to obtain Central Excise Registration.

For the sake of brevity, we are not here discussing the provisions and conditions relating to availability of SSI benefits/basic exemption limit to Job Work Units.

When Registration to be taken by the Brand Owner

In case, the brand name owner, supplies the raw material/goods to the job workers and gets the goods manufactured on his own account on job work, the brand name owner shall pay the duty leviable on such goods as if the goods were manufactured by him as per the Rule 4 (1A) of the Central Excise Rules, 2001 and Para 1, clause (vi) of notification No.36/2001-C.E. (N.T.), dated 26.06.2001 refers.

Though as per Proviso to rule 4 (1A) of the Central Excise Rules, 2001 and proviso to Para 1, clause (vi) of notification No.36/2001-C.E. (N.T.), dated 26.06.2001 the brand name owner has the option to authorise his job-worker to pay the duty leviable on the goods. If that case, the job worker would have to obtain registration

Further an explanation has been provided by the Tax Research Unit , Ministry of Finance, Department of Revenue, Government of India in its post budget letter dated 29-02-2016 that “In cases where the brand name owner gets goods bearing its brand manufactured from other manufacturers (normally small units) without providing the raw materials or inputs, and if the RSP is not affixed or marked on such goods when they are cleared in the course of sale from the factory of a manufacturer to the brand owner, then no excise duty would be payable by such a manufacturers since the RSP of such goods is not disclosed to them by the brand owner. However, since the process of labeling or re-labelling constitutes a process of “manufacture”, duty on the tariff value (based on the RSP) would be payable as and when the brand owner labels the goods with the RSP of Rs.1000 or above and clears them for further sale”

It is to be noted that Tailoring Establishments are not covered

Keeping in view, the tiny scale of operations of retail tailoring establishments, the same have been kept out of preview of compulsory coverage under Central Excise. These tailoring units stitch garments in a customized manner,(as per the demand of the customer), to the size and style specifications of individual customers. These units shall be exempt even in cases, the fabric out of which readymade garment made, is purchased by the customer from the same establishment or fabric is supplied by the customer.

Calculation of Excise Duty is to be made on Tariff Value

Central Excise Duty on Readymade garments and made up articles Duty is to be paid at the specified rate of 2% or 6% or 12.5% as the case may be on the “Tariff Value”.

“Tariff Value” shall be 60% of the “Retail Sales Price”.

“Retail Sales Price” finds its definition in Explanation 1 to Section 4A (pertaining to Valuation of excisable goods with reference to retail sale price) of Central Excise Act, 1944 defines it to mean

“the maximum price at which the excisable goods in packaged form may be sold to the ultimate consumer and includes all taxes, local or otherwise, freight, transport charges, commission payable to dealers, and all charges towards advertisement, delivery, packing, forwarding and the like and the price is the sole consideration for such sale:”

Examples on Calculation of Central Excise Duty

Calculation of Excise Duty on

Readymade Garments/Made Ups

Branded and RSP equal to or more than Rs. 1000/-

that are compulsorily covered

Option 1, Without CENVAT (Table 1)

|

Option 1 , Without CENVAT |

||

|

1 |

Retail Sales Price |

Rs. 1200 |

|

2 |

Tariff Value 60% of RSP |

Rs. 720 |

|

3 |

2% Excise Duty of Rs. 720 |

Rs. 14.40/-* |

|

4 |

CENVAT |

ZERO |

|

5 |

EXCISE DUTY PAYABLE |

Rs. 14.40/-* |

|

Any Item Cotton or Not |

BRANDED & RSP = or > Rs. 1000 |

Without CENVAT |

* 2 percent of the tariff value

Calculation of Excise Duty on

Readymade Garments/Made Ups

Branded and RSP equal to or more than Rs. 1000/-

that are compulsorily covered

Option 2, With CENVAT (Table 1)

|

Option 2 , With CENVAT |

||

|

1 |

Retail Sales Price |

Rs. 1200 |

|

2 |

Tariff Value 60% of RSP |

Rs. 720 |

|

3 |

12.5% Excise Duty of Rs. 720 |

Rs. 90 |

|

4 |

CENVAT(presumed) |

Rs. 30 |

|

5 |

EXCISE DUTY PAYABLE |

Rs. 60/- |

|

Any Item Cotton or Not |

BRANDED & RSP = or > Rs. 1000 |

With CENVAT |

Calculation of Excise Duty on

Readymade Garments/Made Ups whether of cotton or not

Non Branded Or RSP less than Rs. 1000/-

that are not compulsorily covered

Option 1, Without CENVAT (Table 2)

|

Option 1 , Without CENVAT |

||

|

EXCISE DUTY PAYABLE |

NIL* |

|

|

Any Item Cotton or Not |

UNBRANDED OR RSP |

Without CENVAT |

* as no CENVAT is availed, rate of duty will be NIL

Calculation of Excise Duty on

Readymade Garments/Made Ups of PURE COTTON ITEMS**

Non Branded Or RSP less than Rs. 1000/-

that are not compulsorily covered

Option 2, With CENVAT (Table 2)

|

Option 2 , With CENVAT |

||

|

1 |

Retail Sales Price |

Rs. 1200 |

|

2 |

Tariff Value 60% of RSP |

Rs. 720 |

|

3 |

6% Excise Duty of Rs. 720 |

Rs. 44 |

|

4 |

CENVAT(presumed) |

Rs. 30 |

|

5 |

EXCISE DUTY PAYABLE |

Rs. 14/- |

|

PURE COTTON |

UNBRANDED OR RSP |

With CENVAT |

Calculation of Excise Duty on

Readymade Garments/Made Ups OTHER THAN PURE COTTON ITEMS**

Non Branded Or RSP less than Rs. 1000/-

that are not compulsorily covered

Option 2, With CENVAT (Table 2)

|

Option 2 , With CENVAT |

||

|

1 |

Retail Sales Price |

Rs. 1200 |

|

2 |

Tariff Value 60% of RSP |

Rs. 720 |

|

3 |

12.5% Excise Duty of Rs. 720 |

Rs. 90 |

|

4 |

CENVAT(presumed) |

Rs. 30 |

|

5 |

EXCISE DUTY PAYABLE |

Rs. 60 |

|

Other than PURE COTTON |

UNBRANDED OR RSP |

With CENVAT |

This document is based on interpretation of the law. Therefore, the views expressed above are matters of opinion based on the laws prevalent at the time the view being expressed, which may change as the law evolves from time to time. We have no responsibility to update these comments for events and circumstances occurring after the date of this note, unless specifically requested. This note is for the specific purpose of serving as an informative guide and is meant for general guidance and no responsibility for loss arising to any person acting or refraining from acting as a result of any material contained in this presentation will be accepted by us.

The author can also be reached at rks9814214503@gmail.com

CAclubindia

CAclubindia