What Happens in SAP?

Contents:-

1. Pre-Procurement Process

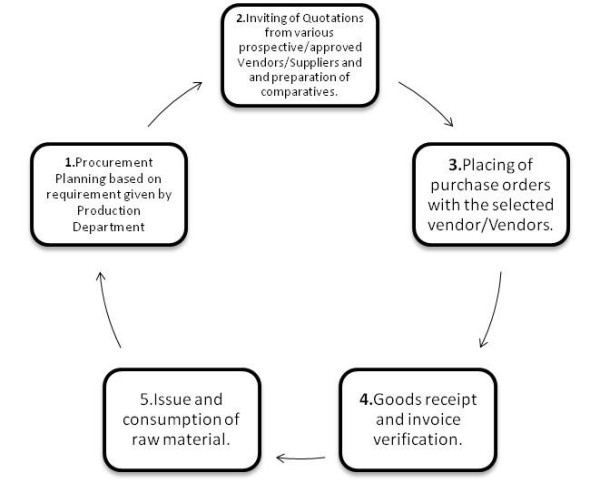

2. Graphical Presentation of Procurement Process

3. Procurement Process in detail

4. GR/IR Clearing Accounts

5. Explanation of accounting entries with the help of a case study.

a) Booking of Purchases

b) Dummy Accounts in Purchases

c) Excise Voice entry

d) Invoice Verification

6. Accounting in various other cases(VAT, Imported etc.)

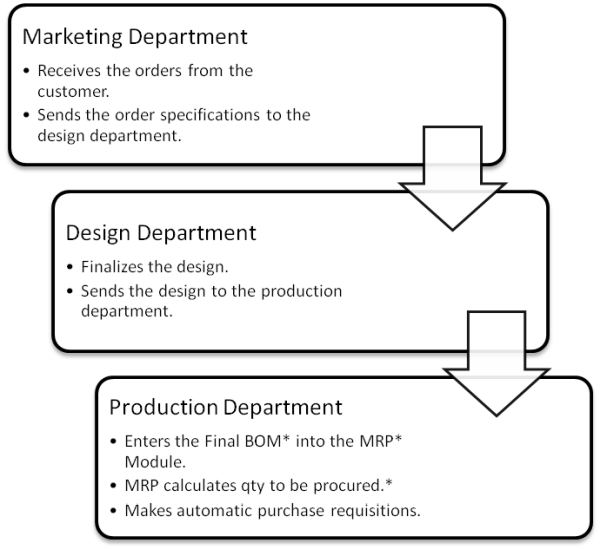

Pre-Procurement Process

The Procurement Process of Raw Material

Before diving in to the accounting for purchase it is very important to understand the Procurement Process.

Note: - Purchase requisition have been omitted from the above presentation because raw materials are consumed on tentative basis and are consumed regularly.

1. Procurement Planning(In case MRP Module is not taken).

Procurement planning is primarily done by the Purchase Department in case the company is not using the MRP module. This plan has the particulars of the various quantities of materials that have to be purchased during the coming month.

Procurement plan is made on the basis of the requirements of various materials sent in by the production department.

The following is a rough example of how quantity to be procured is arrived at : -

|

Procurement Plan for the Month of June10. |

Qty in Units |

|

Material Name & Code:- |

|

|

(a)Requirement from Production Department |

Xxx |

|

(b)Planned Closing Stock as on 30.6.2010 |

Xxx |

|

Less:- |

|

|

(c)(Estimated)Opening Stock as on 1.6.2010 |

(Xxx) |

|

(d)Stock in Transit estimated to be received during June10 |

(xxx) |

|

Qty required to be ordered during June (a+b-c-d) |

Xxx |

|

|

|

2. Invitation of quotations from various vendors and preparation of comparative statements.

When the requirement has been determined as per point 1.The invitations from various vendors are invited by the purchase department .The vendors then send in their offer letters to the purchase department containing various details such as quantity offered, price per unit, terms of payment, credit period allowed, quality specification, date till which the offer is valid etc.

On the basis of the offers received from the vendors the purchase department will then prepare a comparative statement in which the landed cost of various vendors will be computed. Landed cost is generally computed on per unit basis.

It is important that the comparative statements are prepared on a single platform/common basis. It would not be viable to compare only the price, one also has to take into consideration the quality offered by two different vendors.

The following is an Example of a comparative statement in which landed cost is being computed:-

|

Particulars |

Vendors-A |

Vendor-B |

|

Base price per unit |

Xxx |

Xxx |

|

(+)Excise Duty |

Xx |

Xx |

|

(+)VAT/CST |

Xx |

Xx |

|

(+)Freight |

Xx |

Xx |

|

(+)Finance Charges* |

Xx |

Xx |

|

Total Cost |

Xxxx |

Xxxx |

|

(-)Credit of Duties |

|

|

|

Excise Duty |

(xx) |

(xx) |

|

VAT |

(xx) |

(xx) |

|

Landed Cost Per Unit |

Xxx |

Xxx |

|

Rank Awarded |

A |

B |

*Finance Charges are usually charges such as Letter of credit opening charges etc.

The said comparative statement has to be approved by the purchase in charge of the said material.

The vendor which is awarded the highest rank is usually selected. But the orders might have to be placed to more than one vendor in case the quantity supplied by the first vendor is not enough to meet the requirement.

(Note that the above explanation covers two points of the procurement that is the invitation of quotations as well as selection of vendor/vendors).

3. Preparation of Purchase Orders

After deciding as to how much quantity is to be procured and identification of vendors for the same, the purchase orders are prepared by the purchase department.

It is requisite that a purchase order has details such as Quantity required, Material Description and material Code, Delivery Date, Various terms as to payment, freight, packing and forwarding, credit period, taxes involved, offer reference etc.

4. Goods receipt and Invoice Verification

This is that part of the process in which the accounting starts. The MIGO and MIRO transactions are executed in the SAP system. Accounting entries in this process are routed through GR/IR Clearing accounts. Goods receipt will further have many sub-processes and controls such as Gate entry, weighment, quality checking of samples etc. Invoicing can further have two parts such as excise entry and accounts entry. All of these procedures and entries have been explained later on in the booklet.

There are complications, no doubt, in SAP. It takes time and experience for one to understand the accounting involved in it. The more ground work you do, the better your understanding will become.

What are GR/IR Clearing Accounts?

GR/IR stands for Goods Receipt/Invoice Receipt.GR/IR clearing accounts are basically intermediate accounts found only in the SAP ERP Module.

How do GR/IR accounts function?

The Goods Received / Invoice Receipt (GR/IR) is a non-vendor specific liability account created in the Company's enterprise resource system (a.k.a. SAP) that functions as a clearing account for goods and minor services purchased on a three-way match purchase order. These may be a plain purchase order (PO), a contract release or a priority purchase order.

The three-way match mechanism enables the matching of information on the purchase order, receipt and invoice. The receipt is generally transacted in the system prior to the invoice. In SAP, the receipt of a good or service will charge (debit) an expense account and credit the GR/IR account. The entering of an invoice will charge the GR/IR account and credit the vendors' payable liability account. When the receipt and invoice quantities agree, the transactions offset and SAP will clear the GR/IR account. The system allows for price discrepancies within allowable tolerances. For transactions involving invoice prices that exceed the purchase order prices above the allowable tolerances, the GR/IR account should clear however approval will be needed later to pay the invoice.

Case Study of a Steel Company (you may consider this as an example only)

Company A Limited is a steel Company which makes Stainless steel Products such as sheets and sells them further in the market. A Limited has SAP environment .One of the main raw materials used by A Limited is Ferro Crome.

Now A Limited decides to buy raw material, that is, Ferro Crome in order to meet the demands by its Production Department.

The Purchase Department of A Limited will invite quotations from various Ferro Chrome vendors and after receiving their offers will make comparative statements and eventually select that vendor which meets the required quality standards and also offers the most competitive price.

The Purchase Department will then make a purchase order containing various details as to quantity, specifications and various other conditions. This P.O. will be sent to the vendor.

Now, suppose that the Purchase Department of A Limited selects B Limited, a Ferro Chrome vendor for the supply of its monthly requirement of Ferro Chrome of 2000 MT @ Rs. 60000 P.M.T., Excise Duty extra, CST Extra. Freight Vendor C Roadlines Limited was selected for delivering the said material to the premises of A Limited from the Factory of B Limited. C Roadlines Limited will be charging Rs. 500 P.M.T from A Limited from carriage services rendered by it to A Limited.

Now, in the usual business cycle this quantity of 2000 MT will not be supplied at once by B Limited. This P.O. will have a certain time period over which A Limited will keep receiving the goods via various consignments.

B Limited on receiving the intimation and a copy of P.O. sends its first consignment of goods. It sends 50 MT and C Roadlines carried the same to the premises of A Limited from the factory of B Limited.

The first step in receiving the material would be gate entry. The truck driver would show the documents usually being Invoice, Challan, Bill of lorry, etc., to the gate entry personnel of A Limited. The gate entry personnel will check the documents and then enter the purchase order in SAP. This is essentially done via running the MIGO transaction in SAP.

After entering various details such as delivery note number, truck number, quantity as per Invoice and posting the same, the gate entry personnel will take a print- out, out of gate entry document from SAP and attach it along with the documents and stamp the Invoice as well as the Bill of Lading as to the gate entry number, gate entry time and hand back the documents to the driver.

The truck driver will then take the documents to the weighbridge, where the gross weight of the truck will be done. The gross weight will be written on the Invoice and the driver will be intimated as to where he has to unload the goods. Before unloading of the goods the quality personnel will do a preliminary check to confirm that the goods are as per specification. After confirmation the goods will be unloaded and the truck will go back to weighbridge so that the Tare Weight can be calculated and subsequently the Net Weight. Then the Net Weight is calculated. A weigh-ment slip is generated containing details such as Gross Weight, Tare Weight and Net Weight (Gross Weight Tare Weight= Net Weight). It is attached along with the other documents and these are then sent to the Stores Department.

Now starts the real accounting part in SAP. The Stores personnel will check various details in the documents and make modifications in the gate entry if necessary and when done will post the material document to generate an SRR, that is, Stores Receiving Report. This SRR will carry a unique number know as Material Document Number in SAP and contain various other details such as truck number, gate entry number, GE date, purchase order number and date, material code in SAP, material description, specifications of material like percentage of various components such as Chrome, Carbon, Silicon, etc.

Ok, first lets go back and have look at what figures should be hitting the books of accounts.

B Limited sent 50 MT hence the following should be the contents of its invoice:-

|

Particulars |

Calculation |

Amount in Rs.(Total) |

Per Unit |

|

(a) Base Amount |

50MT x Rs.60000 |

30,00,000 |

60,000 |

|

(b) Add: Basic Excise Duty |

10 % of Base Amount |

3,00,000 |

6,000 |

|

(c) Add: EC & SHEC on BED |

3 % of BED |

9,000 |

180 |

|

(d) Sub Total |

(a + b + c) |

33,09,000 |

66,180 |

|

(e) Add: Central Sales Tax |

2% of (d) |

66,180 |

1323.6 |

|

Total Billed Amount |

(d + e) |

33,75,180 |

67503.6 |

|

Table 1 |

|||

Booking of purchases

Extract from Accounting Standard- 2.

The costs of purchase consist of the purchase price including duties and taxes (other than those subsequently recoverable by the enterprise from the taxing authorities), freight inwards and other expenditure directly attributable to the acquisition.

Calculation of Cost per Unit as per Accounting Standard- 2 : -

|

Particulars |

Calculation |

Amount in Rs. |

|

(I) Billed amount per Unit |

(As Above) |

67503.6 |

|

(II) Less: Cenvat Credit |

(B + C)above |

6180 |

|

Net Amount |

(I) - (II) |

61323.6 |

|

Freight Per Unit |

Rs. 500 |

500 |

|

Per Unit Amount at which purchases will be booked. |

|

61823.6 |

|

Table 2 |

||

The Excise duty which is paid by us during purchase is excluded from the cost of raw material because the credit of the said amount is available to us.

|

Particulars |

Dr. Amount in Rs. |

Cr. Amount in Rs. |

Remarks |

|

Raw Material A/c |

30,91,180 |

|

61823.6 PU*50 |

|

To GR/ IR Clearing Raw Material A/c |

|

30,66,180 |

61323.6 PU*50 |

|

To GR/ IR Clearing Freight A/c |

|

25,000 |

500PU*50 |

|

The following entry created a liability in the books of accounts of the Company. The above transaction is known as MIGO in SAP. Transaction Type:- WE |

|||

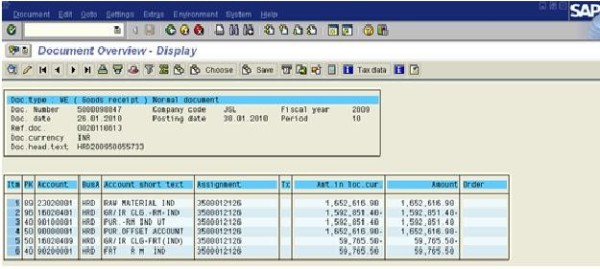

Dummy Accounts in Purchases

Now, many of you might have noticed that there are various dummy accounts in SAP. One of these accounts that comes into play during MIGO is Purchase A/c and Purchase Off-Set A/c.

The following would be the entry in SAP during MIGO. Note: - This entry is a contra entry passed along with the above entry. It is segregated by me here just for better understanding of the user.

|

Particulars |

Dr. Amount in Rs. |

Cr. Amount in Rs. |

|

Purchase Raw Material A/c |

30,66,180 |

|

|

Freight A/c |

25,000 |

|

|

To Purchase Off-Set A/c |

|

30,91,180 |

Note: - The net effect of this entry is NIL.

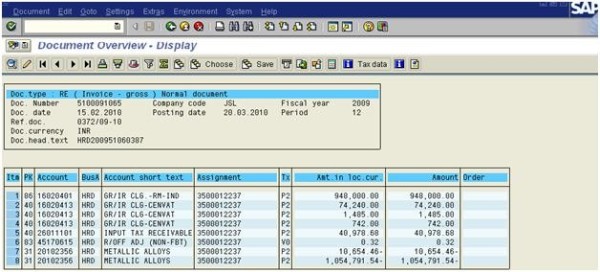

The following is the screen- shot of a similar journal entry in SAP (contra entry of the above two journal entries):-

Booking of Excise

Now, another thing I would like to bring to the readers notice is that A Limited is eligible to take the Cenvat credit of duty paid on purchases as and when the goods have been received by A Limited. Hence, after the Invoice has been cleared by the Quality Department it will be forwarded to the Excise Department. The concerned personnel will check the documents and calculate how much credit can be taken based on the Invoice.

The following entry is then passed:-

|

Particulars |

Dr. Amount in Rs. |

Cr. Amount in Rs. |

|

Basic Excise Duty A/c |

3,00,000 |

|

|

Education Cess A/c |

9,000 |

|

|

To GR/ IR Cenvat Clearing A/c |

|

3,09,000 |

|

Via the above entry we are taking credit of Duty paid by us on purchase. Note:- It is immaterial as to whether the payment has been made or not; the credit can be taken. Transaction Type:- ED |

||

After the above step the excise department will send the SRR to the Accounts Department. This marks the beginning of the invoice verification process.

Here I would like the user to take a break and notice in particular the usefulness of SAP. How the mere implementation of SAP has resulted in flawless segregation of duties among the personnel of A Limited.

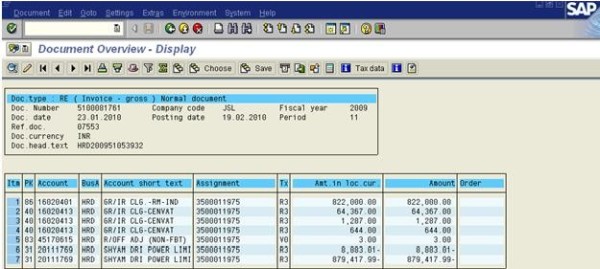

Invoice Verification

Now, the accounts department will carry out the Invoice verification process. It will, after verification of documents, pass the following entry:-

|

Particulars |

Dr. Amount In Rs. |

Cr. Amount in Rs. |

Remarks |

|

GR/ IR Raw Material A/c |

30,66,180 |

|

This is the same amount by which the GR/ IR Account was first credited earlier. |

|

GR/ IR Cenvat Clearing A/c |

3,09,000 |

|

Same as above |

|

To B Limited |

|

33,75,180 |

Total Amount Payable to the vendor as per Invoice. Check the Invoice above. The amount matches exactly! |

|

The above transaction code is MIRO in SAP. Transaction type:-RE |

|||

The following is a screen- shot of a similar entry in SAP:-

Now the payment of this amount credited to the vendor will depend upon the payment terms as mentioned in the purchase order against which the goods are being supplied by B Limited. Various payment modes are available in the commercial world today. The vendor may ask for a certain Period Letter of credit, etc. For example:- 60 Days irrevocable Letter of Credit. The accounting for payment to vendor is simply debiting of the Vendor A/c and crediting of the Bank A/c.

Booking of Freight Invoice

Now upon the verification of the freight Invoice the following entry shall be passed in the books of accounts:-

|

Particulars |

Dr. Amount in Rs. |

Cr. Amount in Rs. |

Remarks |

|

GR/ IR Freight A/c |

25,000 |

|

This is the same amount by which the GR/ IR was first credit during MIGO |

|

To C Roadlines Limited A/c |

|

25,000 |

|

|

Transaction type:- RE. |

|||

I hope that I have succeed in giving you an in- depth view of how purchases are accounted for in SAP and how the various entries are routed without going into any technicalities of the functioning of SAP. C.A. aspirants should be aware that all these entries are automatically generated. All that the user has to do is make a data entry. However, whatever has been discussed till now is a hypothetical case, primarily discussing procedures followed in Steel Industry. The complexities of various types of industries will alter the process flow according to their convenience.

Now let us discuss a few other cases :-

Accounting in case of Value Added tax

In the presence of Value Added Tax instead of Central Sales Tax there will be a few changes in the above treatment. The reader should be aware that the purchaser can get credit of VAT paid on purchases. Hence as per AS- 2 the raw material should be valued exclusive of VAT component, that is, it will be recorded at Base Purchase Amount plus any Freight Amount.

The same is illustrated below:-

|

Particulars |

Amount in Total |

Amount per Unit |

|

Sub-Total (d) from Table no.1 above |

33,09,000 |

|

|

Add: Value Added Tax (4%) |

1,32,360 |

|

|

|

34,41,360 |

|

|

Less:- Components of which credit can be taken |

|

|

|

(a) Excise Duty and Ed. Cess |

3,09,000 |

|

|

(b) Vat |

1,32,360 |

|

|

Net Amount exclusive of freight |

30,00,000 |

60,000 |

|

Add: Freight Amount |

25,000 |

500 |

|

Amount at which purchases are booked |

30,25,000 |

60,500 |

|

Table 3 |

||

Hence from the above table you can see that purchases will be booked at Rs. 60,500 PU.

Accordingly the entries will modify as under:-

At the time of Goods Receipt: - MIGO

|

Particulars |

Dr. Amount in Rs. |

Cr. Amount in Rs. |

Remarks |

|

Raw Material A/c |

30,25,000 |

|

60500*50 |

|

To GR/ IR Clearing Raw Material A/c |

|

30,00,000 |

60000*50 |

|

To GR/ IR Clearing Freight |

|

25,000 |

500*50 |

At the time of Invoice Verification and Entry: - MIRO

|

Particulars |

Dr. Amount in Rs. |

Cr. Amount in Rs. |

Remarks |

|

GR/ IR Clearing Raw Material A/c |

30,00,000 |

|

The Vat component is transferred to Input tax Receivable Account. |

|

GR/ IR Cenvat Clearing A/c |

3,09,000 |

|

|

|

Input Tax Receivable A/c |

1,32,360 |

|

|

|

To B Limited. |

|

34,41,360 |

The following is a screen- shot of the said entry in SAP:-

Invoice Verification in case of variable purchase rates:-

Now let us consider another complication that comes up in normal case of business:-

Sometimes the rates at which purchases are made are dependent upon some conditions which are mentioned in the purchase orders. In that case the rates mentioned in the purchase orders would become provisional.

Also, the Invoice amount may be altered at the time of Invoice verification due to various possible reasons such as quality discrepancies, variable rates which may be at the time charged higher.

In that case, the Invoice is passed at a lesser amount and a debit note should be raised against the vendor. The following would be the impact of this in Books of Accounts:-

|

Particulars |

Dr. Amount in Rs. |

Cr. Amount in Rs. |

Remarks |

|

B Limited ( Vendor)A/c |

Xxx |

|

GR/ IR Clearing Accounts dont play a role in this entry. |

|

Purchase Off Set A/c |

Xxx |

|

|

|

To Raw Material A/c |

|

Xxx |

|

|

To Purchase Raw Material a/c |

|

Xxx |

|

|

To Input Tax Receivable a/c |

|

Xxx |

The reverse of the above entry will be passed in case the Invoice is passed at a higher amount. Consider the same accounting entry in case the freight Invoice has to be entered at a greater or lesser rate.

Entries in cases of Imported Purchases:-

1.1 At the time of receipt of material:-

|

Particulars |

Dr. Amount in Rs. |

Cr. Amount in Rs. |

|

Raw Material A/c |

xxxx |

|

|

To GR/IR Clearing Raw material a/c |

|

xxxx |

|

To GR/IR Clearing Freight A/c |

|

xxxx |

|

To GR/IR IHC a/c |

|

xxxx |

|

To GR/IR Clearing Custom Duty a/c |

|

xxxx |

1.2 Dummy Entry* at the time of goods receipt:-

|

Particulars |

Dr. Amount in Rs. |

Cr. Amount in Rs. |

|

Purchase raw material a/c |

xxxx |

|

|

Freight a/c |

xxxx |

|

|

IHC a/c |

xxxx |

|

|

Custom Duty a/c |

xxxx |

|

|

To Purchase Off-set a/c |

|

xxxx |

|

|

|

|

1.3 Booking of CVD Component:-

|

Particulars |

Dr. Amount in Rs. |

Cr. Amount in Rs. |

|

|

CVD a/c |

xx |

|

|

|

To GR/IR Cenvat A/c |

|

xx |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.4 Invoice Entry:-

|

Particulars |

Dr. Amount in Rs. |

Cr. Amount in Rs. |

|

GR/IR Raw Material A/c |

|

|

|

GR/IR Freight a/c |

|

|

|

GR/IR IHC a/c |

|

|

|

GR/IR Custom Duty a/c |

|

|

|

GR/IR Cenvat a/c |

|

|

|

To Raw material Vendor a/c |

|

|

|

To Freight Vendor a/c |

|

|

|

To IHC Vendor a/c |

|

|

|

To Commissioner of Excise a/c |

|

|

*The dummy entry relating to purchase off-set account is reversed during the year end. During the year the debit balances in the Freight A/c, IHC A/c basically act as MIS.

I hope the above article has been able to give you an in- depth knowledge of accounting for purchases in SAP environment. Though I have made an effort to cover everything I know, if at any point of time you feel that the article could be better, please do send your suggestions.

Written by:-

Ramanreet Singh,

http://in.linkedin.com/in/ramanreet

http://ramanreet.caclubindia.com/

CAclubindia

CAclubindia