It is applicable to both public and private limited company. No Company shall directly or indirectly advance any loan, including any loan represented by a book debt, to any of its Directors or to any other person in whom the Director is interested, or give any guarantee or provide any security in connection with loan taken by Director or such other person

It means:-

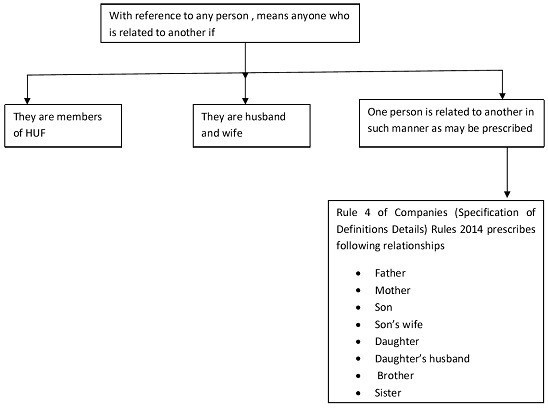

a. No Company advances any loan to director of the lending company, or of a company which is its holding company or any partner or relative of any such director.

b. No Company advance any loan to any firm in which any such director or relative is a partner.

c. No Company advance any loan to any private company of which any such director is a director or member.

d. No Company advances any loan to Any body corporate at a general meeting of which not less than twenty five per cent. Of the total voting power may be exercised or controlled by any such director, or by two or more such directors, together.

e. No Company advance any loan to anybody corporate, the Board of directors, managing director or manager, whereof is accustomed to act in accordance with the directions or instructions of the Board, or of any director or directors, of the lending company.{ A body corporate does not include a co-operative society. But it includes a foreign company}

Exceptions

Loans given to managing director in accordance with the terms of his appointment, loans to employees in accordance with the conditions of service applicable to all employees of the company or where a scheme is framed and which scheme is approved by the members by way of special resolution.

Loan given in ordinary course of business. It means if company is engaged in lending activity on regular basis and doesn’t lend only to directors & its relative but also to others

It will not attract sec-185.

PENALITY ON NON COMPLIANCE

On Lending Company: minimum fine of Rs.5 lacs but which may extend to Rs.25 lacs;

On Recipient Director: imprisonment upto six months or minimum fine of Rs.5 lacs but which may extend to Rs.25 lacs, or with both.

IN CASE OF: LOAN GIVEN BY HOLDING COMPANY TO SUBSIDAIRY COMPANY

Sec-185 will be attracted if conditions given above are not satisfied. BUT there are certain exception to loan given by holding and subsidiary company under rule 10 of the companies rules,2013:

a. Any loan made by a holding co to its wholly owned subsidiary co or any guarantee given or security provided by a holding co in respect of any loan made to its wholly owned subsidiary co is exempted from the requirements under this section; and

b. Any guarantee given or security provided by a holding company in respect of loan made by any bank or financial institution to its subsidiary company is exempted from the requirements under this section

Provided that such loans made under sub-rule 1 and 2 are utilised by the subsidiary company for its principle business activities

IN SHORT,

1. First Examine whether the basic provision of 185 is attracted by examining shareholding pattern of holding and subsidiary company.

2. Then if provisions of sec 185 is attracted, than one should examine whether such loan is exempted under Rule 10 of the Companies (Meetings of Board and its Powers) Rules, 2014.

CAclubindia

CAclubindia