WHAT ON EARTH IS TAXES?

With layman’s dialect tax is usually a compulsory contribution that all one who brings in an income as well as comes in the taxpaying area has got to pay on the authorities since authorities has got to launch a lot of responsibilities just like they must operate authorities hostipal wards, Knowledge in city as well as authorities universities as well as Indian native authorities majorly consumes upon nationwide defence as well as main structure projects as well as ought to pay salaries for you to authorities personnel just like law enforcement officials guy, passport workplaces and others authorities organisations.

Somebody has got to pay tax from the income this individual brings in. The harder a person brings in greater he's to pay tax.

THE REASON WHY SAVE TAXES?

Just about every personal thinks that will taxpaying is usually a problem as well as it’s a typical man propensity that he would certainly locate strategies to help save tax. Thus you will need to keep in mind ones tax saving limits.

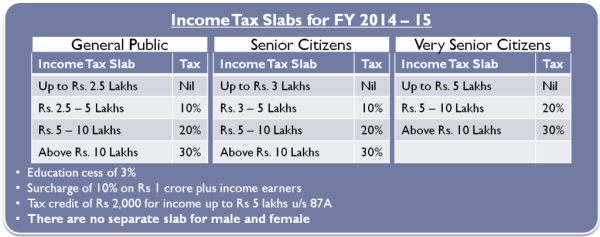

TAXES SLABS PERTAINING TO SALARIED INDIVIDUAL

THERE ARE NUMEROUS PIECES UNDERNEATH WHICH USUALLY Any SALARIED INDIVIDUAL CAN DECREASE THEIR TAXABLE PROFITS.

Let’s see why at length by having an instance in order that it could be simple connect.

Manish’s yearly income can be 12, 00, 000(twelve lakhs) consequently let’s analyze their taxable cash flow in short

Via 0-2, 50, 000 he's to pay nothing

Via 2, 50, 000-5, 00, 000 he's to pay 10% (25, 000)

Via 5, 00, 000 for you to 10, 00, 000 he's to pay 20 %( 1, 00, 000)

Via 10, 00, 000-12, 00, 000 he's to pay 35 %( 58, 000)

Thus immediately after putting their taxable cash flow he's to pay tax of just one, eighty five, 000 although their taxable cash flow may decrease if he's created expenditure beneath portion:

1)80(C)- Within this portion he's used approximately 1, 50, 000 as well as one more 50, 000 if he's created opportunities in brand-new type of pension program.

Thus if this individual spends rupees 2, 00, 000 beneath portion 80(C) the federal government would certainly take into account that is certainly yearly cash flow is 10 lakhs instead of 12 lakhs.

Let’s assume that will Manish has created opportunities 0f 2 lakhs in 80(C) consequently right now their tax could be computed given that their income is 2 lakhs.

2) Area 80(D) -- Federal, don't forget that all personal has got to keep some medical expenditures along with the climbing expense associated with medical expenditures has granted an overall discount associated with fifty five, 000(25, 000 for the one who borne the expenditures as well as their loved ones (spouse as well as 2 children) as well as one more 35, 000 with regard to his/her mother and father (senior citizens) with regard to medical care insurance quality paid for.

Thus let’s assume that will Manish can be having to pay medical care insurance quality associated with eighty five, 000, consequently in this case this individual doesn’t has got to pay almost any tax approximately fifty five, 000(exempted) as well as he's to pay tax only about the added 35, 000 plus the tax pace is being computed per the area.

Right now, this taxable income continues to be lessened additional from 10 lakhs for you to 9, forty-five, 000 (10, 00, 000-55, 000).

Area 80(e) thinking about the need for education and learning and much more significantly higher education, authorities has created regulations beneath portion 80(e).

In line with portion 80E the quantity of awareness paid for upon education and learning loan can be minimal associated with discount as well as there isn't a restrict for the total always be subtracted.

The volume of awareness upon education and learning loan differs from bank for you to bank and also upon the quantity of loan consumed. Let’s assume this individual Manish has taken an education and learning loan associated with 9 lakhs with regard to 5 decades from SBI bank.

In such cases he's to pay a pastime through the pace 11. 75% (10. 00% starting rate+ 1. 75%) we. elizabeth. 1, 05750.

Thus, in this case their complete taxable income may additional decrease from 9, forty-five, 000 for you to 8, 39, 250(9, forty-five, 000-1, 05750)

YOU NEED TO NOTE-*** FASCINATION WITH TRAINING MORTGAGE SEEMINGLY TAXES COST-FREE LIMITED TO Any STOP REGARDING 7 DECADES. AFTER 7 DECADES IT COULD BE TAXABLE.

E.G - For a education and learning loan from the 12 months 2015 with regard to decade and that means you don’t ought to pay almost any tax about the quality with regard to next 7 decades we. elizabeth. until eventually 2022. You simply pay tax about the rate of interest with regard to 36 months we. elizabeth. from 2023 for you to 2025.

SEGMENT 80(G) -- This portion launched through the authorities promotes people to give away a lot more because donation is necessary for the progress associated with poor people as well as who need money.

Within portion 80(G) if shawls by hoda donates are made in the direction of regarded authorities business as well as recognised NGO’S next the quantity of donation could be advertised with regard to discount. The total that could be exempted from tax can be 10% associated with major income.

Let’s assume that will Manish has donated 10% associated with their major income to some recognised authorities NGO we. elizabeth. 1, 20, 000(10% 0f 12, 00, 000) consequently their taxable income would certainly additional decrease from 8, 39, three hundred for you to 7, 19, 250(8, 39, 250-1, 20, 000)

Right now their taxable income can be 7, 19, three hundred

Working out associated with tax payable through Manish.

THROUGH 0 FOR YOU TO 2, 50, 000 NIL

THROUGH 2, 50, 000 for you to 5, 00, 000(10%) twenty five, 000

THROUGH 5, 00, 000 for you to 7, 19, 250(20%) 43, 850

FULL 68, 850

FINISH

Manish’s taxable income has been 1, eighty five, 000 although as soon as this individual created opportunities beneath portion 80(C), 80(E), 80(D), 80(G) this individual only was required to pay tax associated with 68, 850 and thus their detract income has been enhanced. He to pay a lesser amount of taxation's.

CAclubindia

CAclubindia