Dear friends,

I hereby convey my heartfelt wishes on the occasion of Chartered Accountants Day, and I hope that both the profession and the professionals will touch great heights in the forth coming years being the major contributor to the society’s economic well-being. So let us join hands and celebrate the Golden day of the year and take a pledge to serve our profession in a manner that enriches our nation by all means.

ICAI AT A GLANCE: CLICK HERE TO DOWNLOAD A PPT ON ICAI

The Institute of Chartered Accountants of India was established under the Chartered Accountants Act, 1949 passed by the Parliament of India with the objective of regulating accountancy profession in India. ICAI is the second largest professional accounting body in the world in terms of membership second only to AICPA. It prescribes the qualifications for a Chartered Accountant, conducts the requisite examinations and grants license in the form of Certificate of Practice. Apart from this primary function, it also helps various government agencies like RBI, SEBI,MCA, CAG,IRDA, etc. in policy formulation.

ICAI actively engages itself in aiding and advising economic policy formulation.

For example ICAI has submitted its suggestions on the proposed Direct Taxes Code Bill, 2010. It also has submitted its suggestions on the Companies Bill, 2009. The government also takes the suggestions of ICAI as expert advice and considers it favourably. ICAI presented an approach paper on issues in implementing Goods and Service Tax in India to the Ministry of Finance. In response to this, Ministry of Finance has suggested that ICAI take a lead and help the government in implementing Goods and Services Tax (GST). It is because of this active participation in formulation economic legislation, it has designated itself as a "Partner in Nation Building".

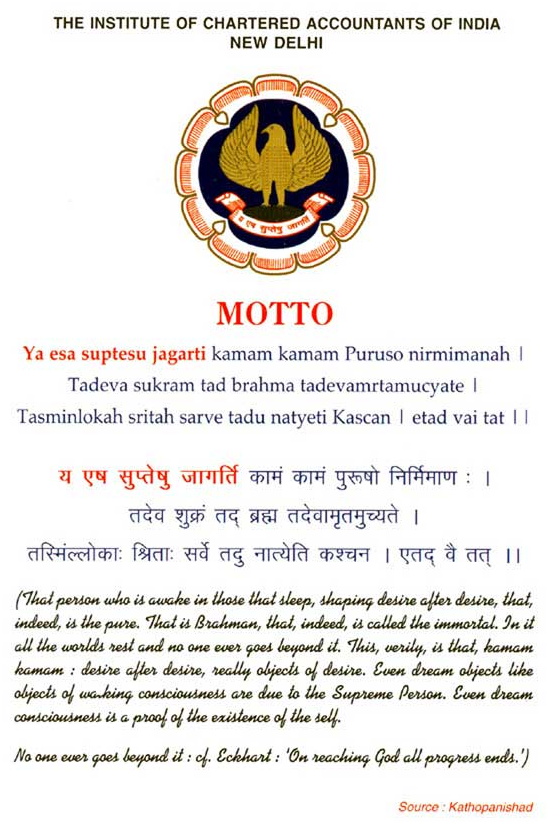

Emblem of ICAI as given by Sri Aurobindo:

Formation of ICAI:1 July 1949.

Objective: Regulate the auditing and financial accounting profession in India

Motto and mission:

(After click on this link Right click and save as—to download)

The Mission of the ICAI as stated by it is: “The Indian Chartered Accountancy profession will be the Valued Trustees of World Class Financial Competencies, Good Governance and Competitiveness.”

CLICK HERE TO KNOW ABOUT ICAI VISION 2030

CLICK HERE TO KNOW ABOUT ICAI HISTORY

Rising Membership and Student Strength

I am glad to inform you that the total membership strength has gone up to 2,18,233 as on May 22, 2013, from 1,92,513 as on April 1, 2012. There is an addition of 25,720 new members showing a phenomenal growth in membership strength by 13.36%. Further, it is again a credit to our profession that an incredibly large number of students, i.e., 11,11,267, have registered with us, out of which we have about 6,09,150 under CPT, about 3,08,400 under IPCC, about 24,130 under Intermediate (IPC) Direct Entry Scheme, and about 1,69, 600 in final.

All these makes CA unique:-

1) CA student gets respect from the date of joining (u are doing CA!) OMG.

2) PASS for 50% marks

3) Everyone asks how you are studying in which if you fail in one subject you have to write all again.

4) Joins Job (articleship) even before graduation.

5) Gets respect from top officials in very less age.

6) Do work even on Sundays and sleepless nights.

7) And the continuing professional education.

8) Even doctor cannot take patient illness but a CA will take client tension / complete care of client.

Once again Happy Chartered Accountants Day!

Chartered accountants being the partners in national building, the ones who are capable of raising our nation into a supreme power.

Happy Chartered accountants Day!

I am proud to be a CA student!

Thanks & regards

Ganesh babu K

CAclubindia

CAclubindia