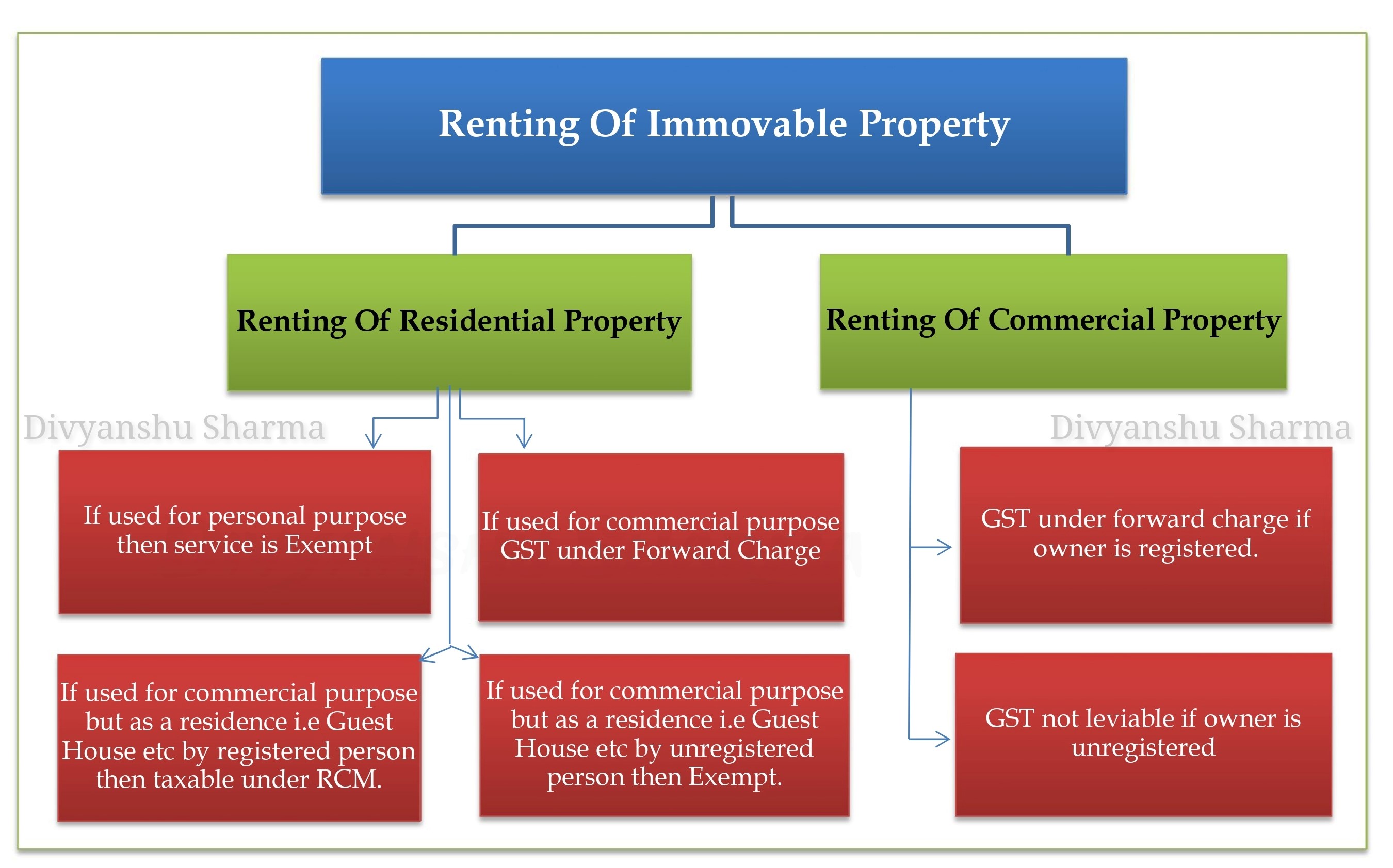

In this article, we will discuss renting of both commercial & residential property.

1. GST on Renting of Residential Dwelling

A) If the residential dwelling is used for commercial purpose like office then GST is payable on Forward charge basis.

B) If the residential dwelling is used for personal purpose then the service is exempt for both registered & unregistered.

C) If a Residential dwelling is used for commercial purpose but as a residence i.e Guest house etc. by registered person then it’s taxable under RCM.

D) If a Residential dwelling is used for commercial purpose but as a residence i.e Guest house etc. by unregistered then it is exempt.

2. Renting of Commercial Property. (Shop, Godown)

A) GST is payable under forward charge if owner is registered under GST.

B) GST not leviable If owner is unregistered.

CAclubindia

CAclubindia