SUMMARY - HOW TO DO IT: ASSESSMENT YEAR 2022-23

The Clause 44 of the Form 3CD is effective for Assessment Year 2022-23 i.e. for the Financial Year 2021-22 because the compliance of this clause was kept in abeyance till 31/03/2022 but for all the reports submitted after that date the clause is mandatory. At present the audit work is in full swing hence.

The ICAI has issued revised Guidance Note dated 14th Aug. 2022 on 19th Aug 2022 and with respect to the Clause Number 44.

We can summarise the practical main points related to this compliance as follows:-

|

S.No. |

Description |

|

1. |

The whole Expenditures including capital Expenditures i.e. purchases of Fixed Assets are to be given in consolidated form. No separate figures are required to be reported. Specially note here that the details of revenue and capital Expenditure, both are required to be given. |

|

2. |

Depreciation need not to be reported. |

|

3. |

Transactions which are not Supply of Services or supply of Goods as per Schedule III of CGST Act, 2017 need not be given. For example, Salary. All such type of Expenditure which are covered under schedule III are not required to be reported under clause 44. |

|

4. |

Non-GST expenditures such as Expenditures on Petroleum products are to be bifurcated under “Exempted supply”. |

|

5. |

Total payments to registered entities in col. No. 6 means total of Col. 3, 4 and 5. Here there is no need to go for exact meaning of “payments”. |

|

6. |

In Col. No.7 Expenditures related to Entities not Registered under GST is Given. All the expenditure related to the unregistered dealers are to be given in Col.No.7. |

|

7. |

The total of Col. No. 6 and 7 should match with the Col. No.2. |

|

8. |

A suitable disclaimer can be made in deserving cases where such information is supplied by the assesssee but in my opinion such disclaimer should not be made on routine and if assesssee has provided reasons for the same the reasons should also be included in the report. |

Since the audits for the Financial Year 2021-22 are under process hence we should study how to report and comply this clause and how the Assesssee under audit will submit the data under this clause.

The primary duty of submission of the details is of Auditee and for verification of the information supplied under this clause can be verified form the GSTR-2A, GSTR-2B, AIS and other records available with the dealer.

Most of the information required for this clause is already available with the Law makers in the form of GSTR-2A and AIS because most of the Expenditures on which GST has been paid is already available on records and rest is Exempted and Non-GST payers. In most of the cases What is the use of this new information in Form 3CD is better known to the lawmakers but since the clause is there hence the Assesssee and Auditor has to follow and comply it.

In the next pages I have explained the data to be collected and filled in Clause 44 and related working calculation to be kept for records.

Let us see an Example with certain notes

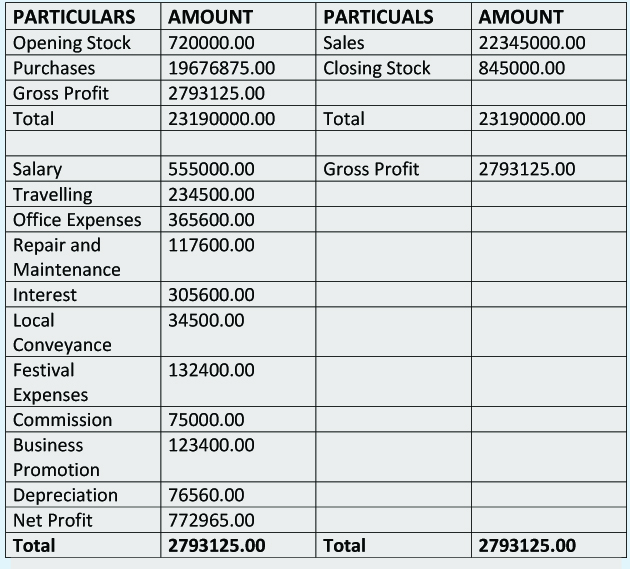

WORKING AND CALCULATION TRADING AND PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDING ON 31-3-2022

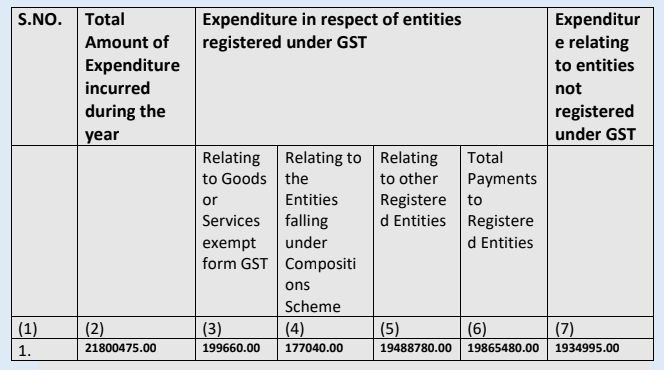

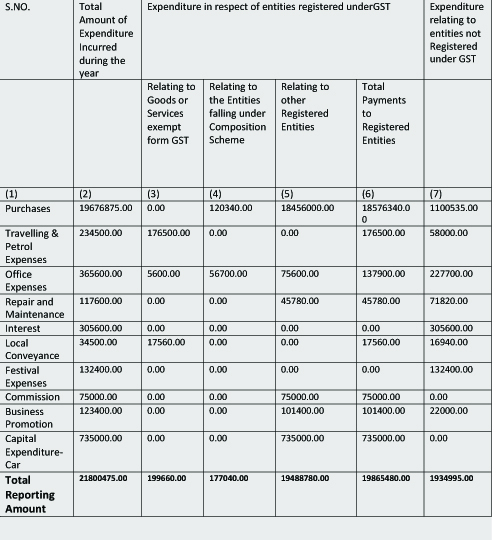

CALCULATION FOR PRESENTATION IN CLAUSE 44 OF FORM 3CD

CAclubindia

CAclubindia