Aadhar PAN link Step by Step

As a Chartered Accountant, We are getting numerous queries whether to link Aadhar with PAN for filing the Income tax returns and How to do it? Here I would like to clear that doubts by this article,

Now it is important to link your Aadhar with your PAN for filing your Income tax Returns, the Supreme Court judgement also clears the doubt and makes it is mandatory to link your Aadhar with your PAN even if there is no requirement to file your income tax returns. Further The Government of India notifies that Individuals who crossed above 80 years of age (Super senior Citizens), NRI's who doesn't have Aadhar are not required to link till further stands taken from the Government of India.

So let us see how the process to be followed for linking your Aadhar with PAN, I have tried here to clear all your doubts through the screen shots.

- Method 1: Steps to be followed if you remember the registered mobile number in Aadhar

- Method 2: Steps to be followed without the presence of Aadhar registered mobile number

- Method 3: Steps to be followed through SMS facility

Method 1: Aadhar pan link online steps to be followed through Income tax Portal:

Step 1:

Go to the Income tax Portal or Click on the Link https://www.incometaxindiaefiling.gov.in/

Now you can see the page as below:

Step 2:

Now use the Link Aadhar option which was marked in the image below:

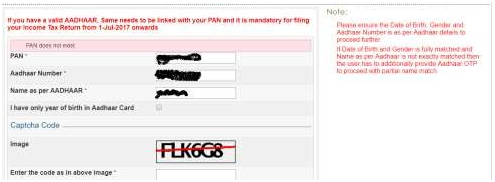

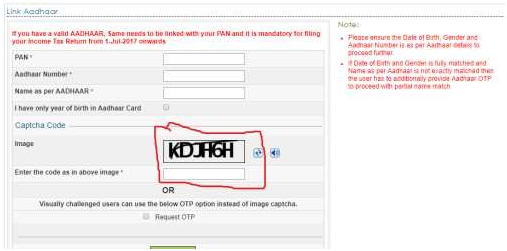

Now your page take forwarded you to the next screen where you can see PAN, Aadhar Number and Name as per Aadhar as below:

Step 3: Enter all your information required for linking your Aadhar:

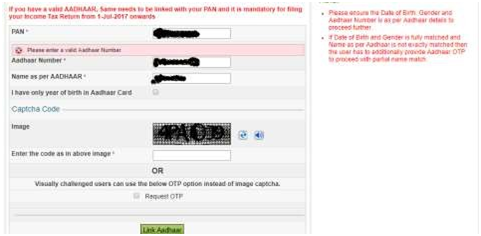

PAN: Enter your 10 digits PAN as per your PAN card

(You can see the Command 'PAN does not exist' If your PAN is not entered properly as per the PAN Card)

Aadhar Number: Enter your 12 digits Aadhar Number

(If your Entered Aadhar Number is wrong then the Command will be as 'Please enter a valid Aadhar Number')

Name as per Aadhar: Enter your name exactly as per your Aadhar

No need to worry about the little deviations from the PAN name with Aadhar Name

Example:

'Venkatesh S' as per your PAN and 'Venketesh' as per your Aadhar will be acceptable

Next relevant to the information - I have only year of birth in Aadhar Card: If your Aadhar card has only your Birth year – Click the check Box

Example:

Year of Birth - 1988 as per your Aadhar then you have click inside the check Box

No need to click on the check box In case Aadhar shows the complete date of Birth like 12-01- 1988

Step 4:

Confirm the above Information by entering the Captcha- an Alphanumeric Image displayed at your screen like below

Step 5:

After a click on the Link Aadhar tab and you can see the screen below

Further you have to click on 'I would like to generate Aadhar OTP to complete Aadhar Linking Process'

Then you will get two options like the screen shows below

If you have an OTP related to the linking process already through your registered 10 digits mobile number then

Click on option 1- 'I already have Aadhar OTP'

Enter the OTP and click on 'Submit Aadhar OTP'

If not received already then click on option 2 and then you will get the OTP through your registered mobile number.

Finally, your Aadhar linked with your PAN by getting confirmation as below

The aforesaid OTP will be received only through your mobile number what you have registered already for getting an AADHAR. If you couldn't remember the registered mobile number or if the same number not in use then you have to visit nearby Aadhar Help Centre to change that mobile number or request to change that mobile number by forwarding an appropriate form.

You can Link your Aadhar with your PAN even without the presence of registered mobile number with Aadhar by the following method.

Method 2: Only for those who have registered their PAN already in the Income Tax Portal

Step 1:

Click on the link https://www.incometaxindiaefiling.gov.in/

Choose Login Here if you are registered user if not registered yet your PAN in the Income tax portal then use the register yourself

The next page will be as

Enter all required information

User ID: your 10 digits PAN (We cannot change this) Password: As created by yourself (We can reset it if forget) Date of Birth: As per your PAN

Captcha code: As it is of your screen code – Lower and upper case sensitive

Step 2:

Click on Login and choose 'Profile Settings >Link Aadhar' at your next screen

Step 3:

The next screen will show your Name, Date of Birth and Gender as per the PAN records

Verify the mentioned Information as per PAN if everything is proper then enter the Aadhar Number and Name as per the Aadhar and click on the check box if your Aadhar has only the Birth year and Click on the 'Link Aadhar'.

Finally your Aadhar has been linked with your PAN now.

Method 3: Aadhar PAN link through Mobile SMS:

If you feel the above process taking much time then you can opt for the Link through SMS where the Income tax department has made the process by the below format

You need to send SMS to 567678 or 56161 as below UIDPAN Your Aadhar Number PAN

Example: UIDPAN 909080807070 ABCDE1234F

Check once whether you have entered 12 digits of Aadhar (only Numbers) and 10 digits of PAN (Alphanumeric). If all mentioned PAN information matches properly with Aadhar, then your request will be processed further and you will be getting a confirmation SMS.

Issues you may face:

Still, you are getting any of the errors with the Linking process even after following all or any of the methods above only because of the name mismatch, please try with your name mentioned in the Aadhar card issued by UIDAI at first irrespective of your change request made in the recent months. But this will applicable only for name mismatch not for Date of Birth or Gender mismatches. If any changes required in the PAN or Aadhar can also be updated through the provided links

I believe all your queries has been cleared by this article. Contact us for more clarification regarding this and we are ready to advice for all your needs.

The author can also be reached at sneshg@yahoo.in

About Author:

Senthil Ganesh is a practicing Chartered Accountant in Bangalore, India and also professionally graduated Cost and Management Account where he secured 27th All India Rank in the final examination of the Institute of Cost Accountants of India in December 2012 and 41st AIR in the Intermediate exam of the Institute of Cost Accountants of India.

Disclaimer: The contents of this article are solely for information and knowledge and does not constitute any professional advice or recommendation. Author does not accept any liability for any loss or damage of any kind arising out of this information set out in the article and any action taken based thereon.

CAclubindia

CAclubindia