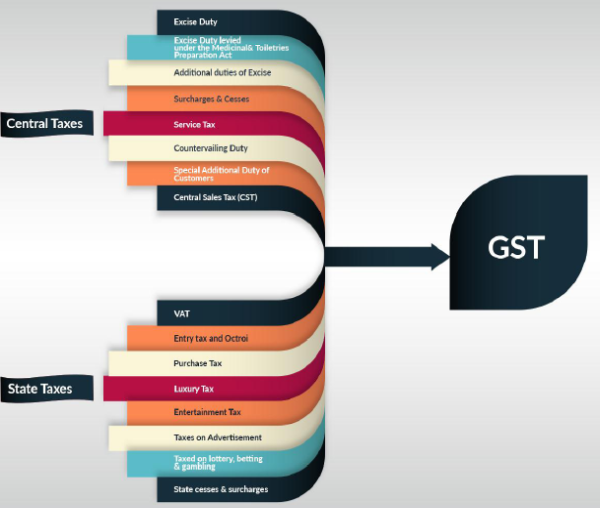

The Goods and Services Tax (GST) promises to bring a single unified tax regime for India, which will consolidate many different taxes into a single tax regime.

Some of the taxes to be subsumed to GST

a. VAT

b. Service Tax

c. Excise

d. Entertainment Tax

e. Entry Tax

Figure 1 Indirect Taxes Subsumed to GST

A single tax regime will bring predictability and lower operating costs for businesses because the GST will reduce the overall tax burden by reducing the impacts of cascading taxes and allow the cross-utilization of tax credits across the supply chain.

How would this help or benefit a mid-size business in India? Midsized businesses in India can be either in manufacturing, retail or services and cover a variety of different sectors. As stated earlier these businesses would see overall costs decrease because of the reduction of the negative impacts of cascading taxes in their supply chain.

In the case of a manufacturing corporate, the change to GST will allow the business to be more efficient because it will no longer have to source goods in a single state. The ability to make interstate sourcing will be much more cost efficient under the GST because there will be a removal of non-recoverable CST and most likely the tax checkpoints which impact interstate trade. Trucks can spend days at different checkpoint which create uncertainty and unpredictability in a supply chain. Contrast this with countries like the Malaysia and China, which have national supply chains and national value added taxes.

When the GST is introduced, a manufacturing firm when it wants to buy supplies will pay its vendors and the vendors will pay and remit the tax. The tax will be due in the destination state where the goods are delivered and the goods can be transported across state lines easily and efficiently.

Manufacturers would also benefit from having to file GST returns for each state rather than having to file returns for the different locations they operate across multiple states. This can lead to dramatically fewer returns.

However, if the business is primarily in the services sector then there will be an increase in its prices because the standard GST rate is 18% instead of the present 15%. For the service provider, there is an increase in the number of returns because returns are filed monthly under the GST. The benefit for the service provider is the recovery of the taxes it pays on goods to provide services for example office equipment can now become fully recoverable in the GST as opposed to previously.

Retailers are in an interesting position because in the old system they bore the brunt of the impact of a cascading tax because the central excise became a cost they had to pass on to consumers, which increased their prices and because of thin margins can encourage tax non-compliance. Generally speaking, on many goods at a store there is some portion of central excise built into the price of goods and then there can be VAT levied between 5% and 15% depending on the state and the item. This leads to an average incidence of tax close to 25% or more for many goods. Retailers now can benefit from reduced costs because of the recovery of the taxes which have been used to purchase the items for the shelves and recovery of Service Tax.

With this simplification, there is a complexity which emerges. The challenge is how does the manufacturing business make tax part of its business process so it does not become a hindrance. Under the GST, a business must declare its outward supplies by the 10th, receive its inward supplies by the 15th and file a return by the 20th.

Figure 2 Tax Calendar to follow every month as per new GST Regime

Now the business must ensure it is issuing tax invoices and uploading data to the GSTN on a regular and continuous basis rather than trying to wait until the 10th of the following month to make the upload. Similarly, the business tracks its purchases and reconciles received invoices against purchase data sent to the Goods and Services Tax Network (GSTN). This is an on-going cycle and the business has to be able to ensure it has quality data for its sales transactions and can effectively review and validate its purchase data.

Businesses will want to be able to have a complete picture of their tax returns lifecycle so it can be helpful if they have a single place where they can consolidate their tax data, workflows and returns processing. A dashboard or central hub can ensure the business can coordinate its activities internally and with any external tax partners.

Similarly, although the GST allows tax credits to be re-used the business above cannot simply charge GST. Each business determines and records for every transaction if the supply has incurred:

CGST

SGST

IGST

Also, they have to select which rate applies to a transaction from the several possible rates:

0%

Exempt

5%

12%

18%

28%

And account for any cesses which can be levied on a product.

For example, under the GST law, if a manufacturer were to sell machinery at 1 lakh to another factory and the manufacturer is in Maharashtra and the buyer is in Madhya Pradesh it would be incorrect to charge:

9% - SGST – Rs. 9,000

9% - CGST – Rs. 9,000

It would also be incorrect to charge

9% - IGST – Rs. 9,000

9% - CGST – Rs. 9,000

On this interstate supply, rather the manufacturer would have to charge:

18% IGST – Rs. 18,000

Although the total amount of tax is unchanged at Rs.18,000 the reporting of the components need to be correct to ensure proper compliance and input tax credits for the purchaser.

Service providers need to know which of the place of supply rules to follow for its services and correctly record the tax amounts and tax portions. Without correctly understanding and applying the rules in a consistent manner it will be difficult for a business to provide accurate tax data on a constituent basis.

Overall the goal should be to know the tax treatments and apply them on a consistent basis because this will allow you to help customers secure input tax credits and not impact business by having to revisit tax issues. Mid-size businesses with established clients should work with advisors to understand the GST and map out the possible tax treatments and then determine which portions can be automated and select a technology partner.

The technology partner should enforce desired tax treatments are made at time of invoicing and allow for the consolidation, tracking and remittance of all of the tax specific data required for returns.

enComply allows you to quickly file your returns and allows your partners to collaborate to file returns.

This eliminates the endless exchange of emails, phone calls and spreadsheets because your data lives in a single place. Now you have a solution, which matches the unitary nature of the GST: enComply https://www.encomply.com/

CAclubindia

CAclubindia