Overview:

Question paper for this attempt was quiet easy as compared to earlier attempts. Focus was to cover as many concepts as possible.

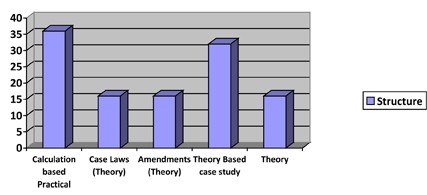

Structure:

(1) Practical v/s Theory v/s Case laws v/s Amendments:

Question 1 & 2: Calculation based Practical questions

Question 3: Recent Case laws (Theory)

Question 4: Amendments (More of theory)

Question 5 & 6: Theory based case studies

Question 7: Theory

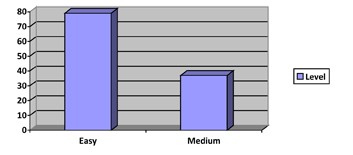

Difficulty Level:

Easy: 79 Marks (Including options)

Medium: 37 Marks (Including options)

Nearly questions worth 80 marks were highly manageable without much difficulty.

Length:

Length of paper was standardized one. Questions were of either 5 marks or 4 marks. However some students found the paper bit lengthy.

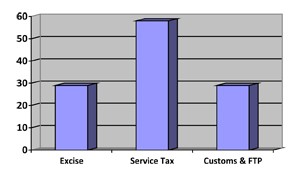

Section -wise Analysis:

Excise: 29 Marks

Service tax: 58 Marks

Customs & FTP: 29 Marks

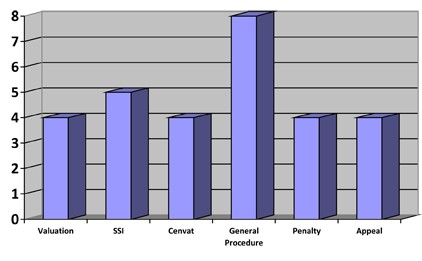

Chapter-wise Analysis (Excise) (29 Marks):

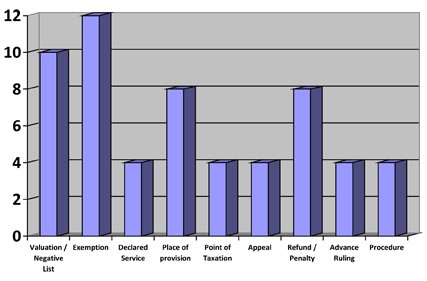

Chapter-wise Analysis (Service Tax) (58 Marks):

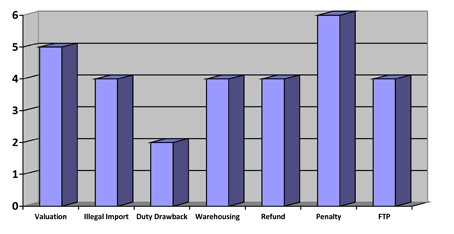

Chapter-wise Analysis (Customs & FTP) (29 Marks):

Advice:

- Making Own Notes: Questions were asked in such a manner to maximum concepts as possible. Hence students are advised to cover all topics. Since IDT is a vast subject, making notes will help to cover all topics and revise it before exams.

- Case Laws and Amendments: As always direct question on case law and amendments for 16 marks each were asked. Hence it is important to cover them in detail. Further questions on case law and amendments were from chapters like Penalty, Appeals, refund Etc.

To view the question paper : Click here

To enrol

Indirect Tax Laws (CA-Final)

subject of the author : Click here

CAclubindia

CAclubindia