|

Manu |

Hi Vinu! |

|||||||||||||||||||||||||||

|

Vinu |

Hi Guruji!! |

|||||||||||||||||||||||||||

|

Manu |

Guruji? |

|||||||||||||||||||||||||||

|

Vinu |

Yes! Today you are going to teach me about Leverage concepts in Financial Management. So you are my Guru now :) |

|||||||||||||||||||||||||||

|

Manu |

With pleasure! I love teaching and it’s my passion. Straight to the topic! Leverage is one of the beautiful and important concept in Financial Management. |

|||||||||||||||||||||||||||

|

Vinu |

I know, that Lever is a technical tool. But how it is used in Financial Management? |

|||||||||||||||||||||||||||

|

Manu |

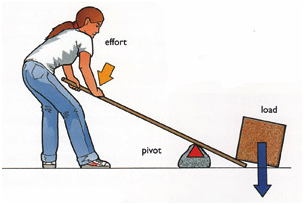

That’s a good observation. What is the purpose of Lever? |

|||||||||||||||||||||||||||

|

Vinu |

As for as I understand, Lever can be used for lifting heavy weight by giving less pressure. |

|||||||||||||||||||||||||||

|

Manu |

Yes! Exactly and this would be the process! |

|

||||||||||||||||||||||||||

|

Vinu |

Yes! |

|||||||||||||||||||||||||||

|

Manu |

In the same way, you can also achieve better profits in your business by following principles of lever. i.e., leverage |

|||||||||||||||||||||||||||

|

Vinu |

How? |

|||||||||||||||||||||||||||

|

Manu |

If you have more fixed costs in your business, you can make more profits! |

|||||||||||||||||||||||||||

|

Vinu |

|

What? That sounds very strange and how do you say that? More fixed cost is a cost. Higher cost will reduce the profits. |

||||||||||||||||||||||||||

|

Manu |

I agree! But still, more fixed cost means, you can make more profits! |

|||||||||||||||||||||||||||

|

Vinu |

I just can’t digest that! Please explain me with some numbers! |

|||||||||||||||||||||||||||

|

Manu |

Ok! Assume a sales for 2013-14 |

|||||||||||||||||||||||||||

|

Vinu |

Ok! Let it be Rs.100 Crs |

|||||||||||||||||||||||||||

|

Manu |

Fine, assume cost for the sales. |

|||||||||||||||||||||||||||

|

Vinu |

Let it be Rs.90 Crs |

|||||||||||||||||||||||||||

|

Manu |

Fine! It means, you are going to make a profit of Rs.10 Crs |

|||||||||||||||||||||||||||

|

Vinu |

Yes!

|

|||||||||||||||||||||||||||

|

Manu |

Now it’s time to split your costs! |

|||||||||||||||||||||||||||

|

Vinu |

Like? |

|||||||||||||||||||||||||||

|

Manu |

Based on nature! |

|||||||||||||||||||||||||||

|

Vinu |

As fixed and variable? |

|||||||||||||||||||||||||||

|

Manu |

Yes! |

|||||||||||||||||||||||||||

|

Vinu |

Ok! Out of Rs.90 Crs, let Rs.80 Crs be variable cost. |

|||||||||||||||||||||||||||

|

Manu |

So your fixed cost is Rs.10 Crs only! |

|||||||||||||||||||||||||||

|

Vinu |

Yes. |

|||||||||||||||||||||||||||

|

Manu |

Then please split your cost and work out your profits |

|||||||||||||||||||||||||||

|

Vinu |

|

|||||||||||||||||||||||||||

|

Manu |

So when your sales is Rs.100 Crs, your profit is Rs.10 Crs. This is because, your cost is Rs.90 Crs. Now tell me, what will be your profit, when your sales doubles? |

|||||||||||||||||||||||||||

|

Vinu |

Hmmm? When Sales is Rs.100 Crs, profit is Rs.10 Crs. So obviously, when sales touches Rs.200 Crs, profit should be Rs.20 Crs. |

|||||||||||||||||||||||||||

|

Manu |

No! It need not be! |

|||||||||||||||||||||||||||

|

Vinu |

Why? |

|||||||||||||||||||||||||||

|

Manu |

Compute in a table format and tell me! |

|||||||||||||||||||||||||||

|

Vinu |

|

|||||||||||||||||||||||||||

|

Manu |

No! You are wrong! |

|||||||||||||||||||||||||||

|

Vinu |

Why? |

|||||||||||||||||||||||||||

|

Manu |

Your fixed cost got to be fixed. But you considered that also as a variable cost! |

|||||||||||||||||||||||||||

|

Vinu |

Ya! Let me correct it!

|

|||||||||||||||||||||||||||

|

Manu |

Now look at your profit! |

|||||||||||||||||||||||||||

|

Vinu |

Hey!!!! It is Rs.30 Crs. How did this happened? |

|||||||||||||||||||||||||||

|

Manu |

It happened because of your fixed cost. When your sales increased, variable cost also increased in the same proportion. i.e., your existing level of variable cost is 80% (80/100) and it continued to be at 80% (160/200) when your sales increased to Rs.200 Crs. But your fixed cost remained fixed at Rs.10 Crs. |

|||||||||||||||||||||||||||

|

Vinu |

Yes! Very true. |

|||||||||||||||||||||||||||

|

Manu |

That’s why it is said, Variable cost will become fixed and Fixed cost will become variable. |

|||||||||||||||||||||||||||

|

Vinu |

|

??? |

||||||||||||||||||||||||||

|

Manu |

Variable cost per unit will be constant but Fixed cost per unit will change depending upon your sales. |

|||||||||||||||||||||||||||

|

Vinu |

Yes! Yes! |

|||||||||||||||||||||||||||

|

Manu |

Now come back! I said your profit will go up when you have more fixed costs right? |

|||||||||||||||||||||||||||

|

Vinu |

Yes! |

|||||||||||||||||||||||||||

|

Manu |

Change your cost assumptions! Increase your Fixed Cost and see what the effect on your profit is, without changing the total cost. What are yourexistingcosts? |

|||||||||||||||||||||||||||

|

Vinu |

|

|||||||||||||||||||||||||||

|

Manu |

Now make alteration to this composition. Increase your fixed cost without changing the total cost. |

|||||||||||||||||||||||||||

|

Vinu |

Ok! I’ll assume Variable Cost as Rs.50 Crs Fixed Cost as Rs.40 Crs So my total cost will continue at Rs.90 Crs |

|||||||||||||||||||||||||||

|

Manu |

Work out your existing and proposed profits |

|||||||||||||||||||||||||||

|

Vinu |

|

|||||||||||||||||||||||||||

|

Manu |

Look at your profit! |

|||||||||||||||||||||||||||

|

Vinu |

|

It jumped from 10 Crs. to 60 Crs. When sales increased from 100 Crs to 200 Crs. |

||||||||||||||||||||||||||

|

Manu |

Also note your profit jumped from 30 Crs to 60 Crs at your 200 Crs sales level. |

|||||||||||||||||||||||||||

|

Vinu |

Yes! When my fixed cost was 10 Crs, I could achieve only Rs.30 Crs profit on sales of Rs.200 Crs. But it jumped to 60 Crs, when my fixed cost had become 40 Crs. |

|||||||||||||||||||||||||||

|

Manu |

True! Can you tabulate this? |

|||||||||||||||||||||||||||

|

Vinu |

|

|||||||||||||||||||||||||||

|

Manu |

The above table shows, When you had low fixed cost, the increase in profits for increase in sales is low. But, when you added higher fixed cost, proportionate increase in profit when compared with increase in sales is very high. |

|||||||||||||||||||||||||||

|

Vinu |

True! Do you mean to say, that companies should have more fixed cost to make more profit? |

|||||||||||||||||||||||||||

|

Manu |

|

|||||||||||||||||||||||||||

|

Vinu |

Then? |

|||||||||||||||||||||||||||

|

Manu |

Your total cost should be as low as possible and if you have major portion as fixed cost, then it will give you more profits if the company can achieve more sales. |

|||||||||||||||||||||||||||

|

Vinu |

How that works? |

|||||||||||||||||||||||||||

|

Manu |

If you have more fixed cost, then it means you have less variable cost. |

|||||||||||||||||||||||||||

|

Vinu |

Yes! |

|||||||||||||||||||||||||||

|

Manu |

If you subtract variable cost from sales, you will get contribution. |

|||||||||||||||||||||||||||

|

Vinu |

Yes! |

|||||||||||||||||||||||||||

|

Manu |

Understand, contribution is called as contribution, because it only contributes to pay your fixed cost, tax and profits to the owners. |

|

||||||||||||||||||||||||||

|

Vinu |

True! True! |

|||||||||||||||||||||||||||

|

Manu |

So, the message is if you have more contribution and if you have more fixed cost, you tend to make more profits. |

|||||||||||||||||||||||||||

|

Vinu |

Only this point buzzes me. When you have more contribution and more fixed cost, how can your profit can be more? |

|||||||||||||||||||||||||||

|

Manu |

It is because, when your contribution increases with increase in sales, fixed cost would stand fixed. It is not going to increase. So you have more contribution and less fixed cost. Hence, obviously more profits. That’s why your profit will have disproportionate increase when compared with increase in sales. |

|||||||||||||||||||||||||||

|

Vinu |

Ok! Ok! |

|||||||||||||||||||||||||||

|

Manu |

But you have to be very careful with Fixed Cost.The cost structure of the company should be dependent on business environment. |

|||||||||||||||||||||||||||

|

Vinu |

Why’s that? |

|||||||||||||||||||||||||||

|

Manu |

If the business environment is very conducive and if there is scope for achieving growth in sales, then business entities can take more fixed cost. Because, when you take more fixed cost, it means you have less variable cost. With increase in sales, VC will also move along with sales and so you will have more contribution. |

|||||||||||||||||||||||||||

|

Vinu |

Yes! More contribution for every additional sales but fixed cost will be fixed. So we can have more profits! |

|||||||||||||||||||||||||||

|

Manu |

Exactly! But, it will work absolutely in opposite direction when your sales comes down. Because, when sales comes down, you contribution will also come down but not your fixed cost. |

|||||||||||||||||||||||||||

|

Vinu |

Correct! Even a marginal fall in sales can affect us, I think! |

|||||||||||||||||||||||||||

|

Manu |

Yes! Assume 30% fall in your sales, when your fixed cost is Rs.40 Crs and sales is Rs.100 Crs. |

|||||||||||||||||||||||||||

|

Vinu |

Ok! Let me tabulate

|

|||||||||||||||||||||||||||

|

Manu |

Look at that! For 30% decrease in Sales, you are going to report Loss of Rs.5 Crs 30% decrease in sales is causing 150% fall in your profits. i.e., resulting in loss. It is also because of Fixed Cost! |

|||||||||||||||||||||||||||

|

Vinu |

So Fixed Cost is double sided weapon! |

|||||||||||||||||||||||||||

|

Manu |

Yes! It can work for you in good times and work against you in bad times! |

|||||||||||||||||||||||||||

|

Vinu |

But where is the concept of leverage here? |

|||||||||||||||||||||||||||

|

Manu |

Fine. Let me introduce you the leverage concepts. For that we have to split fixed costs further! |

|||||||||||||||||||||||||||

|

Vinu |

Like? |

|||||||||||||||||||||||||||

|

Manu |

Fixed Costs into

|

|||||||||||||||||||||||||||

|

Vinu |

Should I break our cost numbers? |

|||||||||||||||||||||||||||

|

Manu |

Do it please for Rs.100 Crs Sales. |

|||||||||||||||||||||||||||

|

Vinu |

This one? |

|||||||||||||||||||||||||||

|

Manu |

Yes! |

|||||||||||||||||||||||||||

|

Vinu |

|

|||||||||||||||||||||||||||

|

Manu |

Perfect! You have assumed Operating Fixed Cost as Rs.20 Crs and Non-Operating Fixed Costs as Rs.20 Crs |

|||||||||||||||||||||||||||

|

Vinu |

Yes! |

|||||||||||||||||||||||||||

|

Manu |

Now look at your Contribution. It is 50% of Sales. |

|||||||||||||||||||||||||||

|

Vinu |

Yes! |

|||||||||||||||||||||||||||

|

Manu |

Understand, contribution is something, which you can get at the same level comparable with other players in Industry. Because, it is decided by Sales and Variable Cost which may be common for everyone in the industry. |

|||||||||||||||||||||||||||

|

Vinu |

Like? |

|||||||||||||||||||||||||||

|

Manu |

Like Selling Price, Raw Material Cost and other Variable Costs. |

|||||||||||||||||||||||||||

|

Vinu |

Ok! |

|||||||||||||||||||||||||||

|

Manu |

Your ability to make profit is decided by your Fixed Costs after Contribution. In this case, you have Contribution of Rs.50 Crs whereas your EBIT is Rs.30 Crs. Why did this happened? |

|||||||||||||||||||||||||||

|

Vinu |

Because of Operating Fixed Cost of Rs.20 Crs. |

|||||||||||||||||||||||||||

|

Manu |

Yes! This tells us about Operating Leverage. Your Operating Fixed Cost determines Operating Leverage. |

|||||||||||||||||||||||||||

|

Vinu |

Oh! |

|||||||||||||||||||||||||||

|

Manu |

Your Contribution was Rs.50 Crs whereas EBIT was Rs.30 Crs. It means, your Contribution was 1.67 Times of EBIT. |

|||||||||||||||||||||||||||

|

Vinu |

Yes. Contribution / EBIT = 50/30 = 1.67 Times. |

|||||||||||||||||||||||||||

|

Manu |

Exactly and this is the computation for Operating Leverage! |

|||||||||||||||||||||||||||

|

Vinu |

But what does that communicate? |

|||||||||||||||||||||||||||

|

Manu |

It means, when your sales increases by 1 Time, your EBIT will increase by 1.67 Times. |

|||||||||||||||||||||||||||

|

Vinu |

That’s great! I want to check that! |

|||||||||||||||||||||||||||

|

Manu |

Try when your sales increases to 200 Crs |

|||||||||||||||||||||||||||

|

Vinu |

Ok!

|

|||||||||||||||||||||||||||

|

Manu |

Look at your EBIT growth. |

|||||||||||||||||||||||||||

|

Vinu |

Yes! EBIT has grown by 50 (80 – 30). 50/30 = 1.67 Times. EBIT has grown by 1.67 Times. Exactly as provided by Operating Leverage. |

|||||||||||||||||||||||||||

|

Manu |

Yes Vinu! At higher level, CFOs will be interested in knowing what will be the impact on EBIT if their sales increases / decreases and they will be making use of Operating Leverage to know that! |

|||||||||||||||||||||||||||

|

Vinu |

Acha!! |

|||||||||||||||||||||||||||

|

Manu |

So, if your Operating Leverage is high, it would mean you have higher fixed cost. So if your sales increases, your EBIT will grow by Operating Leverage Multiples. |

|||||||||||||||||||||||||||

|

Vinu |

True! |

|||||||||||||||||||||||||||

|

Manu |

But what is more important for the investors is EBT and not EBIT. |

|||||||||||||||||||||||||||

|

Vinu |

Yes! Now I could follow! EBT is decided by Non-Operating Fixed Cost like Interest Charges. |

|||||||||||||||||||||||||||

|

Manu |

Yes! Your EBIT will get reduced by Non-Operating Fixed Cost and will give you EBT. The relationship between EBIT and EBT is called as Financial Leverage. |

|||||||||||||||||||||||||||

|

Vinu |

Let me put up the numbers. |

|||||||||||||||||||||||||||

|

Manu |

Please do it. |

|||||||||||||||||||||||||||

|

Vinu |

|

|||||||||||||||||||||||||||

|

Manu |

Above table says, your EBIT was 3 Times of EBT. |

|||||||||||||||||||||||||||

|

Vinu |

True. EBIT/EBT = 30/10 = 3 Times |

|||||||||||||||||||||||||||

|

Manu |

This is called Financial Leverage. |

|||||||||||||||||||||||||||

|

Vinu |

What’s the impact? |

|||||||||||||||||||||||||||

|

Manu |

It says, 2/3rd of your EBIT was eaten away by Non-Operating Fixed Costs. More importantly, it says, if your EBIT increases by certain proportion, then your EBT will increase by 3 Times of that proportion. |

|||||||||||||||||||||||||||

|

Vinu |

Shall I check that with our table? |

|||||||||||||||||||||||||||

|

Manu |

Please! Check what will be the effect on your EBT, when your EBIT increases due to increase in sales to Rs.200 Crs. |

|||||||||||||||||||||||||||

|

Vinu |

|

|||||||||||||||||||||||||||

|

Manu |

Look at your growth in EBIT. It had grown from 30 to 80. Growth by 50. If you express it in times – it is 50/30 = 1.67 Times. |

|||||||||||||||||||||||||||

|

Vinu |

Yes! We have discussed this already! Operating leverage will tell us the growth in EBIT in times. |

|||||||||||||||||||||||||||

|

Manu |

Yes. Financial Leverage actually says, EBT will grow by 3 Times of Growth in EBIT Times. i.e., 3 x 1.67 Times = 5 Times. |

|||||||||||||||||||||||||||

|

Vinu |

Oh!! |

|||||||||||||||||||||||||||

|

Manu |

What was your existing EBT? |

|||||||||||||||||||||||||||

|

Vinu |

Rs.10 Crs |

|||||||||||||||||||||||||||

|

Manu |

As per Financial Leverage, your EBT should grow by 5 Times. i.e., 10 x 5 = 50 |

|||||||||||||||||||||||||||

|

Vinu |

Yesss!!! It had grown to Rs.60 Crs. i.e., 10 + 50 = 60 |

|||||||||||||||||||||||||||

|

Manu |

That’s the job of Financial Leverage. It will tell you, how your EBT will react, when your sales changes. When your sales changes, automatically, you will know what will be the effect on EBIT through Operating Leverage. Once you know the effect on EBIT, you can find the effect on EBT through Financial Leverage. |

|||||||||||||||||||||||||||

|

Vinu |

Can we know the effect on EBT for change in Sales directly? |

|||||||||||||||||||||||||||

|

Manu |

Yes! We can find the direct effect of change in sales on profit through Combined Leverage. |

|||||||||||||||||||||||||||

|

Vinu |

How that is derived? |

|||||||||||||||||||||||||||

|

Manu |

Contribution / EBT gives you combined leverage. For your existing sales, contribution is 50 and EBT is 10. |

|||||||||||||||||||||||||||

|

Vinu |

It means, Contribution / EBT = 50 /10 = 5 Times is the Combined Leverage. |

|||||||||||||||||||||||||||

|

Manu |

Yes! It says, when sales increases, EBT will increase by Combined Leverage Times. |

|||||||||||||||||||||||||||

|

Vinu |

Let me check! Existing Sales – 100 Crs Proposed Sales – 200 Crs Sales increased 1 Time. EBT should increase by 5 Times of 1 Time. ie., EBT should increase by 5 Times. (5 x 1) Existing EBT is Rs.10 Crs Increase by 5 Times = 10 x 5 = 50 Crs Yes!!!! Proposed EBT in our table and this computation matches. It is Rs.60 Crs (10+50) |

|||||||||||||||||||||||||||

|

Manu |

It would match. CFOs use this tool to know what will be direct impact in EBT when your sales changes. In our example, existing sales and EBIT was Rs.100 Crs and Rs.10 Crs. CFOs will not go further detailed computation, if they have Combined Leverage on hand. If they know Combined Leverage is 5 Times, then automatically they can come to a conclusion that, if there sales increases to 200 Crs, then their EBT will become Rs.60 Crs. |

|||||||||||||||||||||||||||

|

Vinu |

Wonderful! |

|||||||||||||||||||||||||||

|

Manu |

This might look like simple computation. Yes! It is simple. But it saves lots of times and provide instant tools for people at the top management level to make quick decisions. |

|||||||||||||||||||||||||||

|

Vinu |

True! |

|||||||||||||||||||||||||||

|

Manu |

It helps management to understand how their profits will react to change in sales. If operating leverage is high, it means they have high operating fixed cost. So in good times, they tend to make more EBIT. In bad times, they should take efforts to reduce the operating fixed costs as variable cost so they don’t suffer fall in EBIT. |

|||||||||||||||||||||||||||

|

Vinu |

Correct! |

|||||||||||||||||||||||||||

|

Manu |

Similarly, if financial leverage is high, they can make more profits when their sales increases. But they have to be careful, when their sales reduces. In such period, higher financial leverage is a strong warning indicator for the company to reduce non-operating fixed costs. |

|||||||||||||||||||||||||||

|

Vinu |

Yes Manu! |

|||||||||||||||||||||||||||

|

Manu |

To conclude, If you have higher leverages, you tend to make more profits in good times and suffer badly in bad times. So your costing structure should be flexible enough to convert the costs into fixed and variable depending upon changing circumstances. |

|||||||||||||||||||||||||||

|

Vinu |

Yes Manu! Now I could understand the importance of Leverage. Thank you! But the session got a bit lengthier! |

|||||||||||||||||||||||||||

|

Manu |

If you have to understand something, you should spend some time. But I am sure, it is worth spending. |

|||||||||||||||||||||||||||

|

Vinu |

Yes Manu! Thank you very much. |

|||||||||||||||||||||||||||

The author can also be reached at:

nrajca@gmail.com

Click here to access my online classes on Financial Management (English) (CA-IPCC)

CAclubindia

CAclubindia