As per Notification 17/2017 of Central Tax major changes have been introduced in the way GSTR-3B is to be filed. This article will bring out important points of this Notification as they related to filing of GSTR-3B.

GSTR-3B is not in lieu of GSTR-3

Earlier Rule 61(5) specified that GSTR-3B is to be filed in lieu of GSTR-3. Which meant that if you are filing GSTR-3B, you need not file GSTR-3.

The words 'in lieu of' have been removed in the amended Rule 61(5). This means

• A tax payer has to file GSTR-3B

• A tax payer also has to file GSTR-3

GSTR-3B can be filed by two means

Amended Rule provide for filing of returns

• Directly (on GSTN) or

• Through a Facilitation Centre (or GSP/ASPs like Tally & SahiGST)

Auto Generation of GSTR-3

A new rule 61(6) provides that once GSTR-3B has been filed, GSTR-3 will be auto-generated by GSTN.

• GSTR-3 will be generated after due date for furnishing GSTR-2

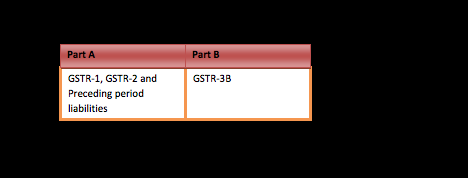

• Part A of GSTR-3 will be auto-generated based on information provided in

GSTR1 and GSTR2 Other liabilities of preceding tax periods

• Part B of GSTR-3 will be auto-generated based on information provided in GSTR-3B

Discrepancy between GSTR-3 and GSTR-3B

Tax liability in GSTR-3 and GSTR-3B will be matched and

• If tax liability in GSTR-3 is higher than what is declared in GSTR-3B, tax payer will have to modify Part B of GSTR-3 and discharge the shortfall in liability

• If tax liability in GSTR-3 is less than what is declared in GSTR-3B, the surplus will be credited to electronic credit ledger of the taxpayer.

Due date for July 2017 Filing

| GST Return Type | Purpose | Due Date/Date for filing |

| GSTR-3B for July | Consolidated Return and Payment for the month of July | 20th August 2017 |

| GSTR-1 for July | Outward Supplies | 1st to 5th September, 2017 |

| GSTR-2 for July | Inward Supplies | 6th to 10th September, 2017 |

| GSTR-3 for July | Summary return based on GSTR-1, GSTR-2 and GSTR-3B | 11th to 15th September, 2017 |

Due date for August 2017 Filing

| GSTR-3B for August | Consolidated Return and Payment for the month of August | 20th September 2017 |

| GSTR-1 for August | Outward Supplies | 16th to 20th September, 2017 |

| GSTR-2 for August | Inward Supplies | 21st to 25th September, 2017 |

| GSTR-3 for August | Summary return based on GSTR-1, GSTR-2 and GSTR-3B | 26th to 30th September, 2017 |

Relevant Rules reproduced

Old

61(5) Where the time limit for furnishing of details in FORM GSTR-1 under section 37 and in FORM GSTR-2 under section 38 has been extended and the circumstances so warrant, return in FORM GSTR-3B, in lieu of FORM GSTR-3, may be furnished in such manner and subject to such conditions as may be notified by the Commissioner.

Amended

61(5) Where the time limit for furnishing of details in FORM GSTR-1 under section 37 and in FORM GSTR-2 under section 38 has been extended and the circumstances so warrant, the Commissioner may, by notification, specify that return shall be furnished in FORM GSTR- 3B electronically through the common portal, either directly or through a Facilitation Centre notified by the Commissioner.

New Rule Inserted

61(6) Where a return in FORM GSTR-3B has been furnished, after the due date for furnishing of details in FORM GSTR-2 :

(a) Part A of the return in FORM GSTR-3 shall be electronically generated on the basis of information furnished through FORM GSTR-1, FORM GSTR-2 and based on other liabilities of preceding tax periods and PART B of the said return shall be electronically generated on the basis of the return in FORM GSTR-3B furnished in respect of the tax period;

(b) the registered person shall modify Part B of the return in FORM GSTR-3 based on the discrepancies, if any, between the return in FORM GSTR-3B and the return in FORM GSTR-3 and discharge his tax and other liabilities, if any;

(c) where the amount of input tax credit in FORM GSTR-3 exceeds the amount of input tax credit in terms of FORM GSTR-3B, the additional amount shall be credited to the electronic credit ledger of the registered person.

The author is a veteran entrepreneur and has spent the last two decades working in the field of compliance automation. He can also be reached at @dktejwani.

CAclubindia

CAclubindia