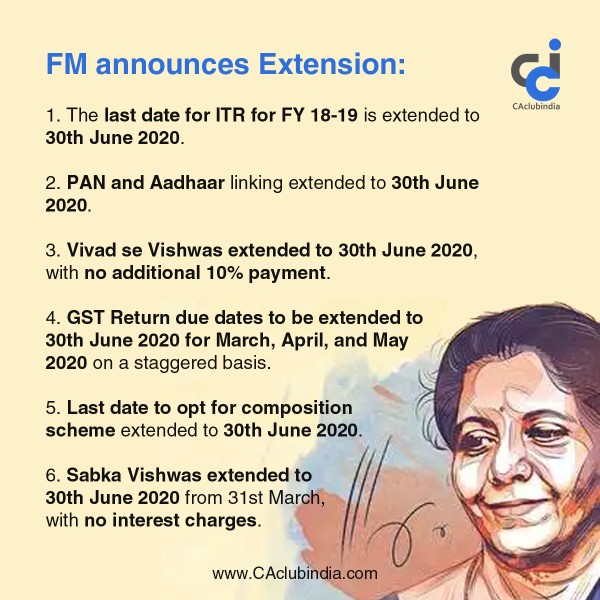

The Hon'ble FM due to the outbreak of COVID-19 announced the extension of various statutory due dates for the taxpayers via a video press conference. The taxpayers had been demanding extension due to the inconvenience caused amidst the COVID-19 outbreak. Various compliance dates have been extended to the 30th of June 2020 and relaxations have been given in form of reduced interest rates. The ITR due date for FY 18-19 has been extended to 31st March 2020 and GSTR due dates for the month of March, April, and May 2020 have been extended to 30th June 2020 in a staggered manner. Here are the various extensions and relaxations that the FM has announced.

INCOME TAX:

1. The last date for filing Income Tax Return ITR for FY 18-19 is extended to 30th June 2020.

2. Interest Rates for delayed ITR payments have been reduced to 9% from 12%.

3. On delayed deposits of TDS, interest will be charged at a reduced rate of 9%. Although there is no extension as to the due dates of filing TDS Return.

4. Dates of all the orders/notices/appeal filing have been extended to the 30th June 2020.

5. PAN and Aadhaar linking have now been extended to 30th June 2020 previously the due date was 31st March 2020.

6. The Vivad se Vishwas Scheme which was introduced in the Budget by the FM for settlement of Income Tax Disputes has now been extended to 30th June 2020, with no additional 10% payment.

GST:

7. The due dates to file GSTR-3B due in March, April, and May 2020, have been extended to 30th June 2020 although that will be done in a staggered manner.

8. Due date to file GSTR 9 and 9C for FY18-19 has been extended to the 30 th June 2020.

9. No late fees, interest, penalty will be charged for companies with less than 5cr turnover on delayed filing of return.

10. The Last date to opt for composition scheme under GST has also been extended to 30th June 2020.

11. No Late fees and penalty for companies with more than 5cr turnover but interest will be charged at a reduced rate of 9%.

12. The Sabka Vishwas Scheme has been extended to 30th June 2020, with no interest charges.

13. Dates of all the orders/notices/appeal filing have been extended to the 30th June 2020.

COMPANIES:

14. In respect of MCA 21 Registry moratorium i.e period from(1st April to 30th September), no additional fees for late filing will be charged.

15. Board Meetings Period to be relaxed by a period of 60 days till next two quarters.

16. CARO 2020 will now be made effective from the year 2020-21.

17. If no meeting is held with Independent director in 2019-20, it is not be considered a violation..

18. For newly incorporated companies, the commencement of business form can be filed with an additional time of 6 months.

19: If a company's director does not comply with the minimum mandatory period to stay in India u/s 149 of Companies act, it will not be treated as a violation.

20: The requirement to create a Deposit reserve of 20% of deposits maturing during the FY 2020-21 before 30th April 2020 shall be allowed to be complied with till 30th June 2020.

21. The requirement to invest 15% of debentures maturing during a particular year in specified instruments before 30th April 2020, maybe done so before 30th June 2020.

Banking Regulations:

22. Minimum Balance requirement does not have to be maintained in bank accounts for the next 3 months.

23. Debit cardholders can withdraw cash without paying any charges from any ATM for 3 months

Are you satisfied with the announcement of the Finance Minister?

CAclubindia

CAclubindia