NEFT (National Electronic Funds Transfer) is India’s trusted electronic funds transfer system. It enables individuals and businesses to move money securely between bank accounts across the country. As an RBI-regulated platform, it provides a reliable and widely accessible digital payment solution for all transaction sizes.

Key Highlights of NEFT

| Operated by RBI | Supervised by the Reserve Bank of India for secure transactions. |

| 24×7 Availability | Works round the clock, including weekends and holidays. |

| Flexible Transfer Limits | No minimum amount (banks may apply their own rules), and no maximum cap (subject to bank policies). |

| Batch Processing | Transactions are settled in hourly cycles for smooth processing. |

| Low/Zero Cost | Many banks offer NEFT for free, especially via digital channels. |

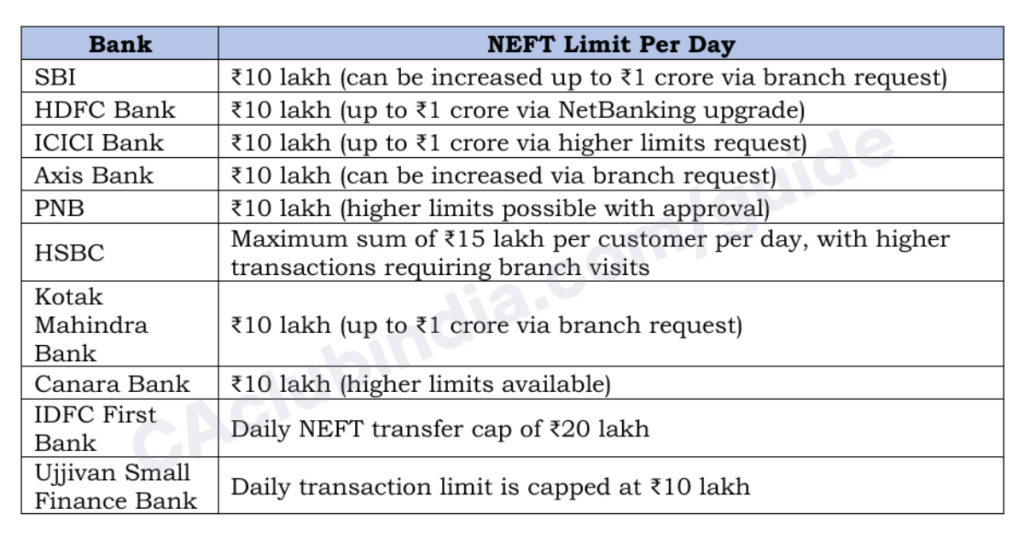

NEFT Limits

The Reserve Bank of India (RBI) does not enforce any upper limit on NEFT

(National Electronic Funds Transfer) transactions, allowing transfers of any

amount in principle.

However, individual banks may impose their own daily or per-transaction limits depending on factors such as account type (retail, corporate, etc.), transfer mode (online banking, mobile banking, or branch transactions), and internal risk management policies.

NEFT Charges

While NEFT transactions are generally cost-effective, some banks may impose fees for transfers initiated at a branch. These charges vary depending on the bank and the transaction amount.

Online NEFT (Internet Banking/Mobile Banking):

- For Individuals (Savings Account Holders): Generally NIL (Free).

- For Other Account Types (e.g., Current Accounts) or Banks Discretion: While many banks have made online NEFT free across the board, some might still levy nominal charges for non-savings accounts. It’s always best to check with your specific bank.

Offline NEFT (Through Bank Branch)

When you go to a bank branch to initiate an NEFT transfer, banks typically charge a fee based on the transaction amount. These charges are usually in slabs and are subject to GST. Here’s a common range of charges you might encounter (these are indicative and vary by bank):

- Up to ₹10,000: ₹2.50 + GST

- Above ₹10,000 and up to ₹1 Lakh: ₹5 + GST

- Above ₹1 Lakh and up to ₹2 Lakh: ₹15 + GST

- Above ₹2 Lakh: ₹25 + GST

NEFT (National Electronic Funds Transfer) is a secure and convenient method for transferring money between banks in India. The daily NEFT limit provides flexibility, catering to both small and large transactions with ease.

Suitable for personal and business use, NEFT operates with minimal charges and no RBI-mandated upper limit. Its round-the-clock availability and real-time tracking make it a vital component of digital banking, supporting India’s shift toward a cashless economy.

FAQs

RTGS is better for large and urgent transactions due to real-time settlement, on the other side NEFT is ideal for smaller, regular transactions processed in half-hourly batches.

The RBI has not set any limit for NEFT but individual banks impose their own daily limits.

Non-crediting may occur due to server issues, incorrect details, or transactions initiated after banking hours. Contact your bank for assistance.