GSTR-9 is an annual return which has to be file by regular taxpayers to maintain accurate records of GST transactions. It provides a comprehensive summary of all outward and inward supplies made during the financial year. It summarizes information from the monthly or quarterly GSTR-1, GSTR-2A, GSTR-3B, and other relevant returns.

Important Update

| Table 8A has been updated to include invoices pertaining to the current financial year that appear in GSTR-2B for the April to October period of the subsequent financial year, based on the filing of the relevant GSTR-3B returns. |

Due Date to File GSTR-9

The due date to file GSTR-9 for FY 24-25 is 31st December 2025.

Basics of GSTR 9 Return

- The system auto-populates data based on GSTR-3B to the extent possible which the assessee can edit.

- The system also auto-populates ITC based on GSTR-2B as generated by the system based on GSTR-1 filed by your corresponding suppliers.

- GSTR-2B is a static auto populate invoices.

- Invoice wise ITC details of Table 8A of GSTR-9 is available in GST Portal.

- In case of any additional liability, the taxpayer can pay the same through Form GST DRC-03.

ITC in GSTR-9 for Cross-Year Invoices

Cross-Year Invoices here means those invoices which are related to purchases made in FY 2024-25 but whose ITC is claimed in the following FY 2025-26.

Changes in Reporting Data in Table 8A

| Financial Year | Source of Data for Table 8A | How Late-Filed Invoices Were Treated |

| FY 2022–23 | GSTR-2A | invoices reported by the supplier between April 23 – October 23 for FY 2022-23 were considered in Table 8A for FY 22-23. |

| FY 2023–24 | GSTR-2B | Invoices for FY 2023-24 which appear in GSTR-2B for April 24 to October 24 are not reflected in Table 8A. |

| FY 2024–25 | GSTR-2B with new rules | Table 8A now automatically includes invoices for FY 2024-25, even if they appear in GSTR-2B for the April to October 2025 – but only if you have filed your GSTR-3B for those later months (April-October 2025). |

Click here to know more about -Key Changes in GSTR-9.

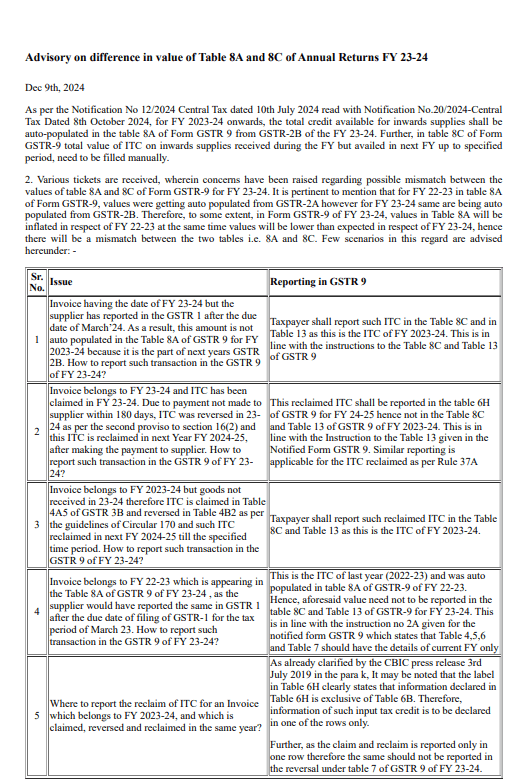

Issues while Reporting in GSTR-9 For FY 23-24: Explained

Conclusion

Businesses should monitor late-reported invoices and ensure accurate compliance with ITC provisions.

Click Here – GSTN Issues Detailed FAQs on GSTR-9/9C for FY 2024-25

FAQs

Yes, all GST registered taxpayers must file their GSTR 9.

No, government has made optional for businesses with an annual turnover of less than Rs 2 crore.

Yes, reporting the HSN Summary is mandatory from financial year 2021-22.