The Goods and Services Tax (GST), hailed as a landmark reform in India’s indirect taxation landscape, is on the verge of a significant evolution. As the system matures, the focus shifts from implementation to optimisation, with 2025 expected to be a key year for long-awaited rationalization.

This process, aimed at simplifying the complex multi-tiered rate structure, will inevitably produce a new set of economic winners and losers. Analysing the potential trajectory of these changes shows that the greatest benefits are likely to go not to a single entity but to a range of stakeholders, from the ordinary consumer experiencing increased disposable income to major industries poised to achieve greater efficiency and competitiveness. This analysis explores who stands to gain the most from this upcoming fiscal transformation.

India’s proposed 2025 GST rationalisation is anticipated to offer substantial relief to common citizens and provide a significant boost to the broader economy.

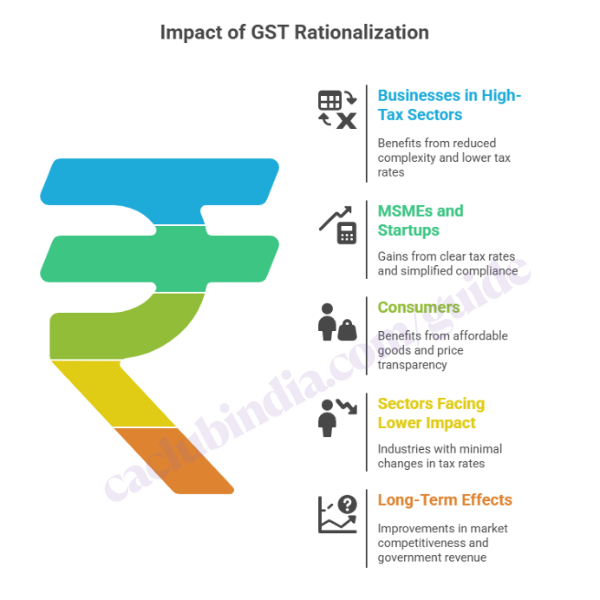

Key Beneficiaries

Businesses in High-Tax Sectors

The simplification of GST would deliver significant advantages to businesses in high-tax sectors. Industries such as FMCG, textiles, construction, and automobiles would experience reduced complexity and potentially lower tax rates. Furthermore, pan-India operations would benefit from streamlined compliance and a decrease in costly classification disputes, thereby lowering administrative overhead.

MSMEs and Startups

The rationalization of GST would significantly aid MSMEs and startups by introducing clear and uniform tax rates. This would reduce classification errors, simplify return filing processes, and decrease the financial burden associated with hiring compliance experts and implementing technology for ever-evolving tax regulations.

Consumers

GST rationalization is expected to yield significant consumer welfare gains. A potential merger of the 12% and 18% slabs into a lower rate would enhance the affordability of essential goods. Furthermore, a simplified tax regime promotes greater price transparency, empowering end-users with a clearer understanding of the tax component in product pricing.

Sectors Facing Lower Impact

- Limited Impact on High-Tax Sectors: Industries like luxury goods and sin products (e.g., tobacco, alcohol) will see little advantage, as their rates are expected to remain high for revenue and policy reasons.

- Status Quo for Low-Tax Sectors: Businesses already in the lowest tax slab will experience negligible changes in their taxation or compliance procedures.

Long-Term Effects

The long-term structural benefits would include a significant improvement in market competitiveness, as a simplified tax system streamlines operations for every player in the supply chain. Furthermore, heightened tax compliance is projected to boost government revenue, thereby creating fiscal space for expanded public welfare initiatives.

GST rationalization in 2025 mainly aims to benefit businesses, MSMEs, and consumers through lower compliance costs and potential rate cuts on common goods. However, the reforms will not directly assist sectors with already rationalized rates or those classified as luxury or sin goods. In a significant change, this latter category, including high-end cars, tobacco, and online gaming, may face a new, higher GST rate of 40%.