GST audit is an examination of a taxpayer’s records, returns, and other documents by tax authorities (or a chartered accountant/Cost Accountant in some cases) to ensure compliance with Goods and Services Tax (GST) laws. The audit verifies the accuracy of:

- Tax payments

- Input Tax Credit (ITC) claims

- Filing of returns (GSTR-1, GSTR-3B, GSTR-9, etc.)

- Adherence to invoicing and e-way bill rules

Key Areas Checked in a GST Audit

- Reconciliation of GSTR-1, GSTR-3B, and GSTR-9.

- ITC claims vs. supplier-reported data (GSTR-2A/2B).

- E-way bill & E-invoice compliance.

- Tax payment delays or short payments.

- Place of Supply rules for interstate transactions.

- Reverse Charge Mechanism (RCM) compliance.

- Refund claims (exports, inverted duty structure).

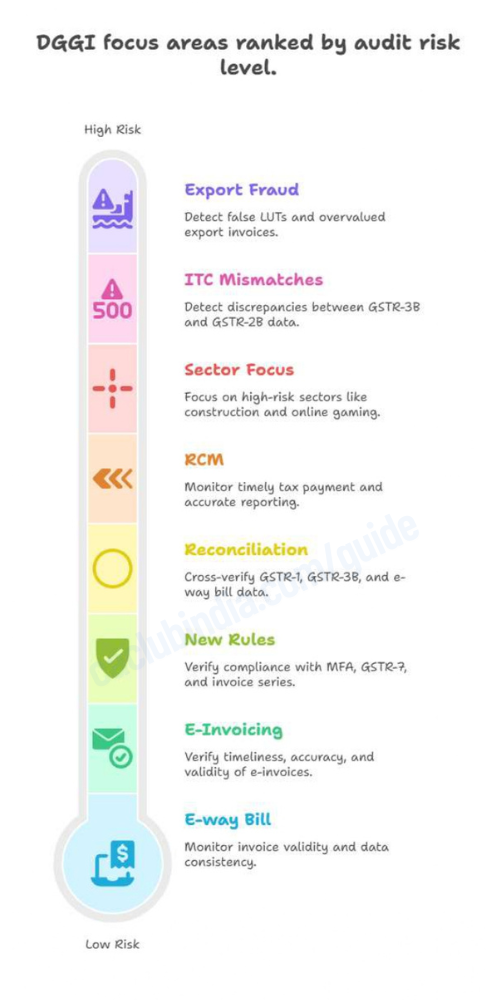

In the upcoming financial year, the Directorate General of GST Intelligence (DGGI) is expected to intensify scrutiny on GST compliance, targeting high-risk areas to prevent revenue leakage and curb tax evasion. Based on recent enforcement trends and policy updates, here are the major focus areas for audits and investigations:

E-Invoicing Compliance Under DGGI’s Scrutiny

The DGGI is placing heightened scrutiny on e-invoicing compliance, particularly as the mandate now covers businesses with ₹5 crore+ turnover and imposes stricter 30-day reporting for ₹10 crore+ entities (effective April 2025). Authorities will rigorously examine IRN generation timeliness, accurate IRP reporting, and IRN validity, as non-compliance risks ITC disallowance for recipients and penalties for suppliers, while mismatches between e-invoices and GSTR-1 filings may trigger audits or demand notices.

Input Tax Credit (ITC) Mismatches and Fraudulent Claims

The DGGI is intensifying its focus on Input Tax Credit (ITC) mismatches and fraudulent claims, leveraging advanced data analytics to detect discrepancies between GSTR-3B claims and GSTR-2B auto-populated data. Key scrutiny areas include fake ITC claims (invoices without actual supply), wrongful availment or non-reversal of credit (ineligible items, blocked credits, or unreversed ITC for lost/stolen goods or unpaid invoices beyond 180 days), and vendor compliance—ensuring suppliers have filed returns and paid taxes, with Rule 86B enabling ITC blocking for non-compliant vendors. Non-compliance may lead to ITC reversals, penalties, or audits.

Reconciliation of Returns with Books of Accounts

The DGGI is expected to rigorously examine reconciliation gaps between outward supplies declared in GSTR-1 and GSTR-3B against books of accounts, with material discrepancies potentially triggering audits. This scrutiny extends to cross verifying e-way bill data with GST returns to detect possible supply underreporting or unreported transactions.

E-way Bill Compliance

Starting January 1, 2025, e-way bills can only be generated for invoices issued within the previous 180 days, a rule the DGGI will closely monitor to prevent misuse of outdated invoices. Additionally, the DGGI is expected to scrutinize discrepancies between e-way bill data, GSTR-1 filings, and sales registers to identify potential underreporting of supplies or other irregularities.

Compliance with New Rules and Amendments

From FY 2025-26, Multi-Factor Authentication (MFA) has been made mandatory for all GST portal users, and the DGGI is expected to verify compliance with this security requirement. Additionally, tax deductors must now file GSTR-7 sequentially without skipping any periods, a rule the DGGI will monitor closely.

Further, all registered taxpayers must adopt a fresh invoice series starting April 1, 2025, and the DGGI will likely ensure adherence to this mandate. The department will also continue scrutinising the correct reporting of HSN codes on invoices, which remains mandatory based on the taxpayer’s aggregate turnover.

Sector-Specific Scrutiny

While not officially confirmed for FY 2025-26, the DGGI is likely to maintain its focus on sectors historically prone to tax evasion, such as construction, real estate, online gaming, and businesses dealing with high-value transactions, based on past enforcement trends.

Reverse Charge Mechanism (RCM) Compliance

Businesses subject to Reverse Charge Mechanism (RCM) must ensure timely tax

payment and accurate reporting in GSTR-3B, with the DGGI expected to closely

monitor compliance with these requirements.

Export-Related Fraud

The DGGI will likely intensify scrutiny over false Letters of Undertaking (LUT) submitted to claim tax-free status on zero-rated supplies (exports/SEZ supplies), ensuring that only eligible taxpayers—those with genuine export transactions— avail this benefit.

Authorities may closely examine export invoices to detect overvaluation of goods or services aimed at fraudulently claiming higher GST refunds, particularly in high-risk sectors prone to such manipulation.

Conclusion

The Directorate General of GST Intelligence (DGGI) is the central investigative authority under CBIC, mandated to combat GST evasion and ensure tax compliance. It specialises in detecting fraud through intelligence gathering, forensic audits, and data analytics. The agency conducts raids, issues summons, and initiates legal action against offenders. DGGI also works closely with state tax departments and other agencies to investigate complex cases of tax fraud, fake invoicing, and input tax credit (ITC) scams.

Businesses must remain vigilant as DGGI intensifies scrutiny on high-risk sectors like e-commerce, export-import, and MSMEs. Compliance with GST laws, proper invoice matching, and timely return filing are critical to avoid penalties or prosecution. Regular internal audits and reconciliation of GSTR-1, GSTR-3B, and e-way bills can help mitigate risks. Staying updated with DGGI’s enforcement trends and CBIC notifications is essential for smooth business operations under GST.