Selling property in India involves tax implications under the Income Tax Act, 1961. Understanding the nuances of capital gains taxation is crucial for effective financial planning.

Capital Gain refers to the profit or gain arising when a capital asset is sold for a price higher than its purchase price.

It is the difference between the selling price and the purchase (or acquisition) price of the asset.

Classification of Capital Gains

| Type of Gain | Holding Period | Tax Rate |

| Short-Term Capital Gain (STCG) | Less than 24 months | As per income tax slab |

| Long-Term Capital Gain (LTCG) | 24 months or more | 20% with indexation or 12.5% without indexation (for properties acquired on or after July 23, 2024) |

For properties acquired on or after July 23, 2024, taxpayers have the option to choose between:

- 12.5% LTCG tax without indexation, or

- 20% LTCG tax with indexation

Types of Capital Gains

Short-Term Capital Gain (STCG)

A Property held for 24 months or less before selling. This is taxed at normal slab rates.

No indexation benefit is available for Short Term Capital Gain.

Long-Term Capital Gain (LTCG)

A Property held for more than 24 months. Long term Capital Gain is Taxed at 20% with indexation and 12.5% without Indexation. Here Indexation benefits are available.

Definitions

| Term | Meaning |

| Sale Consideration | Actual amount received or fair market value (FMV) if underreported. |

| Cost of Acquisition | Original purchase price. |

| Cost Inflation Index (CII) | Used to adjust the purchase price for inflation. |

| Improvement Cost | Capital expenses (e.g., building a floor, not repairs). Indexed similarly. |

Grandfathering Provision for Assets Acquired Before July 23, 2024

For properties purchased before July 23, 2024, taxpayers were given an option:

- Pay 12.5% tax without indexation, or

- Pay 20% tax with indexation.

This provision aimed to provide relief to those who had acquired properties under the old tax regime.

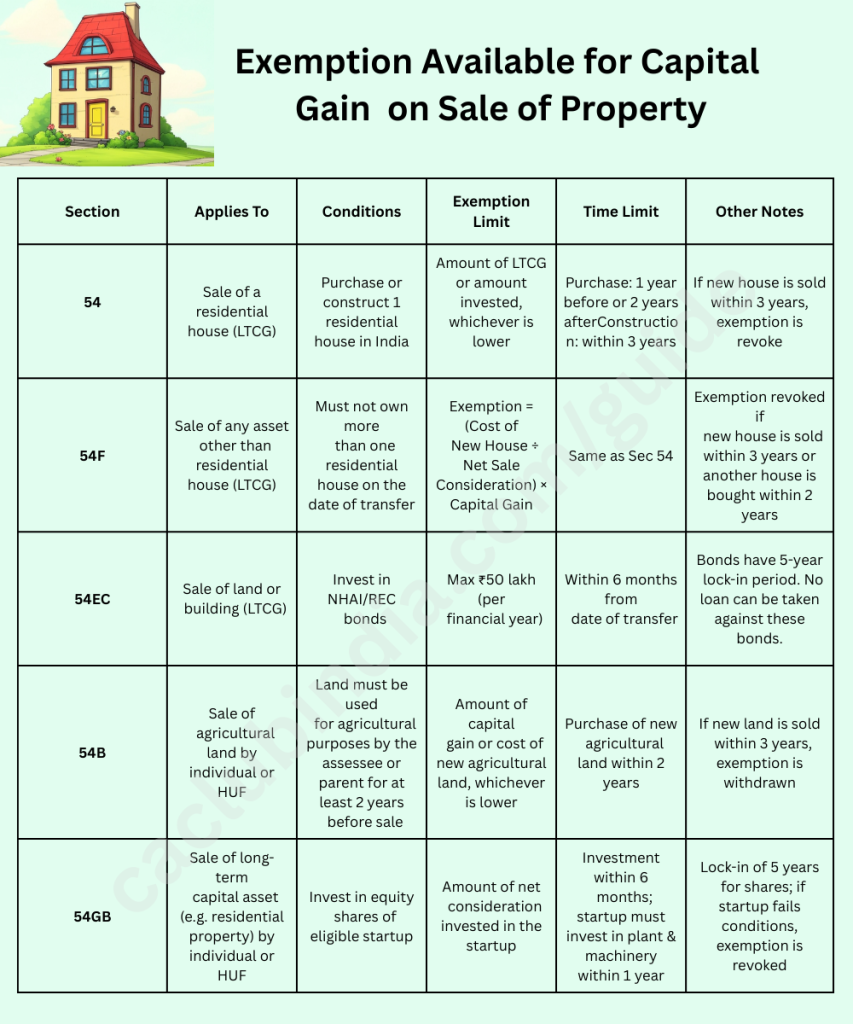

Exemption Available for Capital Gain on Sale of Property

Capital Gain on Jointly Owned Property

When a property is owned jointly (by 2 or more persons), capital gains on its sale are also shared proportionately.

Capital Gain on Inherited Property (Gift / Will / Inheritance)

A property that is received through inheritance, gift, or will, capital gains are taxable at the time of sale, not at the time of receiving it.

How is Capital Gain Calculated on Inherited Property?

| Particulars | Calculation |

| Cost of Acquisition | Consider the cost to the original owner (not zero) |

| Period of Holding | Includes the holding period of the previous owner |

| Indexation | Allowed from the year the previous owner acquired the property |

Surcharge On Capital Gain

Surcharge is applicable on capital gains, but only if the total income exceeds certain thresholds. Below is the calculation of Surcharge.

| Total Income (including Capital Gains) | Normal Income (Slab/Other Income) | LTCG / STCG under 111A / 112A |

| ₹50 lakh – ₹1 crore | 10% | 10% |

| ₹1 crore – ₹2 crore | 15% | 15% |

| ₹2 crore – ₹5 crore | 25% | Capped at 15% for capital gains |

| Above ₹5 crore | 37% | Capped at 15% for capital gains |

Note: For long-term capital gains (LTCG) under section 112, section 112A, and short-term capital gains under 111A, the surcharge is capped at 15%, even if total income exceeds ₹2 crore or ₹5 crore.

FAQs

Capital Gain = Sale Price – Indexed Cost of Acquisition – Improvement – Transfer Expenses

Indexation applies only to LTCG. For inherited property, cost to the previous owner is used.

Inheritance is not taxable, but sale of inherited property is:

You get the benefit of indexation from the year the previous owner bought the property.

Yes, buyer must deduct TDS @1% on sale price if property value exceeds ₹50 lakh (Sec 194-IA).

Yes, if invested in different portions of LTCG in different eligible options. Both exemptions can be claimed simultaneously.

Yes, if the sale doesn’t go through and you forfeit the advance, it is taxable under “Income from Other Sources” (Section 56).