Gratuity under the Income Tax Act, 1961, is a lump-sum payment made by an employer to an employee in recognition of their long-standing service. The taxability of this amount varies depending on whether the employee falls under the Payment of Gratuity Act, 1972 or not.

- For employees covered under the Gratuity Act → Tax exemption is based on a specific formula, subject to a ₹20 lakh limit.

- For employees not covered under the Gratuity Act → Exemption is calculated differently, but still capped at ₹20 lakh.

- Government employees → Fully tax-exempt with no upper limit.

The Payment of Gratuity Act, 1972 is a social security law that ensures employees receive a one-time gratuity payment from their employer as a reward for long-term service. It applies to workers in:

- Factories, mines, oilfields, plantations, ports, railways

- Shops, commercial establishments, and other eligible organizations

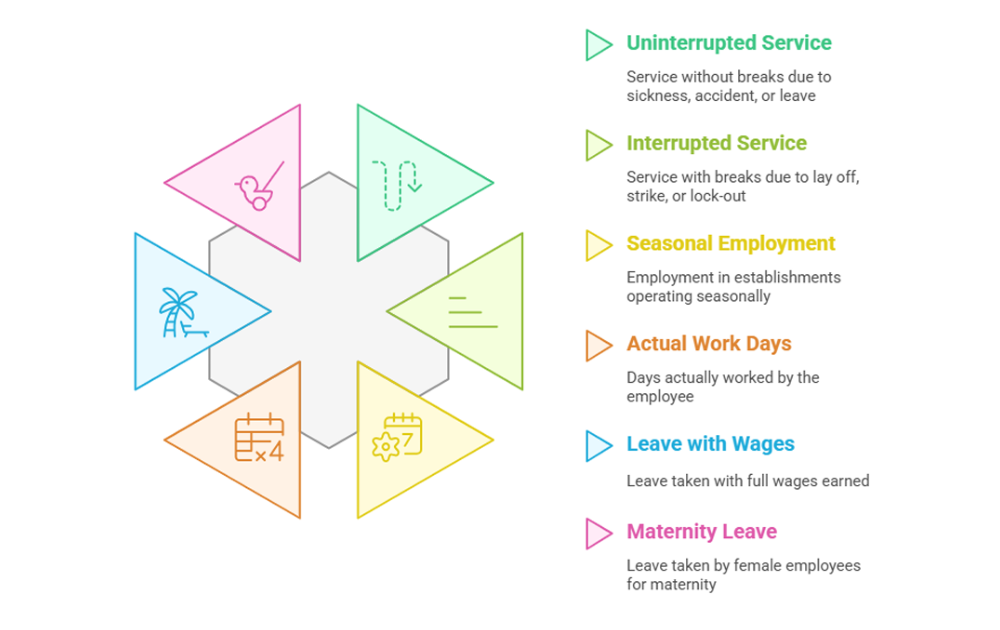

Continuous Service – Section 2A of the Payment of Gratuity Act, 1972

Factors Determining Continuous Service

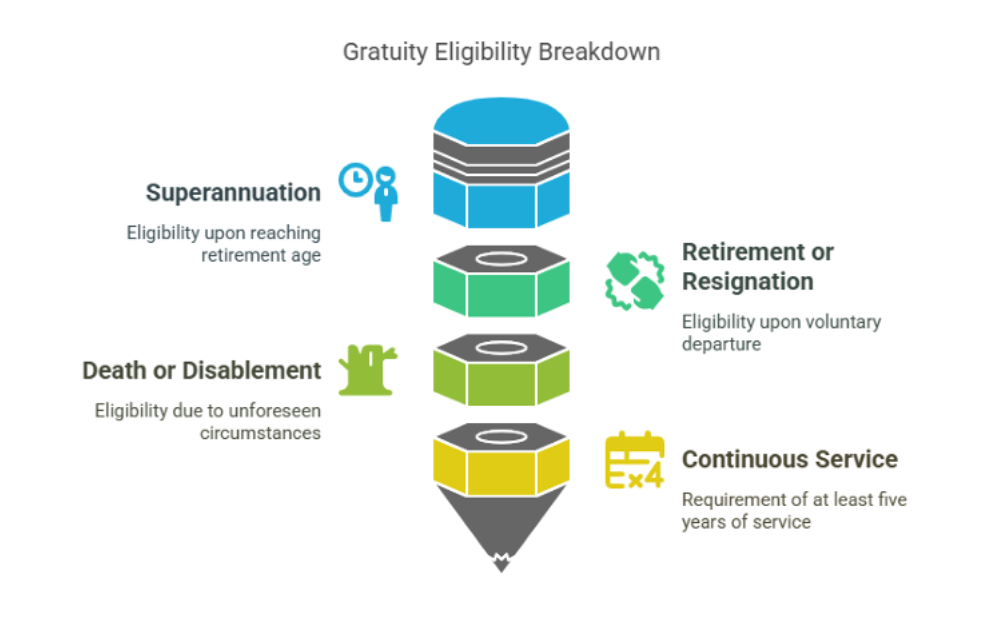

Payment Of Gratuity

Gratuity shall be payable to an employee on the termination of his employment after he has rendered continuous service for not less than five years.

(a) on his superannuation, or

(b) on his retirement or resignation, or

(c) on his death or disablement due to accident or disease:

Provided that the completion of continuous service of five years shall not be necessary where the termination of the employment of any employee is due to death or disablement:

Provided further that in the case of death of the employee, gratuity payable to him shall be paid to his nominee or, if no nomination has been made, to his heirs, and where any such nominees or heirs is a minor, the share of such minor, shall be deposited with the controlling authority who shall invest the same for the benefit of such minor in such bank or other financial institution, as may be prescribed, until such minor attains majority.

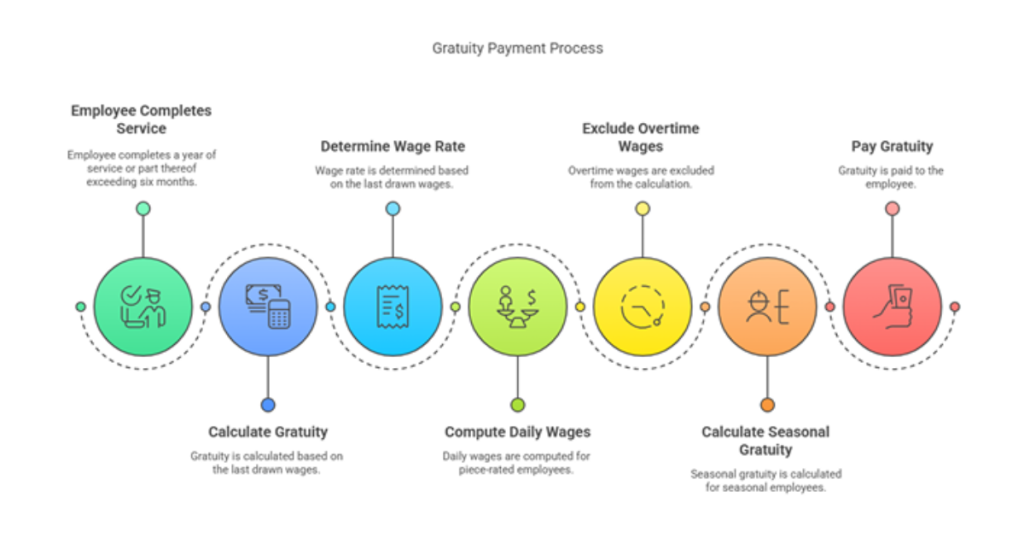

For every completed year of service or part thereof in excess of six months, the employer shall pay gratuity to an employee at the rate of fifteen days’ wages based on the rate of wages last drawn by the employee concerned :

Provided that in the case of a piece-rated employee, daily wages shall be computed on the average of the total wages received by him for a period of three months immediately preceding the termination of his employment, and, for this purpose, the wages paid for any overtime work shall not be taken into account:

Provided further that in the case of [an employee who is employed in a seasonal establishment and who is not so employed throughout the year], the employer shall pay the gratuity at the rate of seven days’ wages for each season.

Determination of the amount of gratuity

Payment made by an employer in appreciation of services rendered by employee Gratuity received during the period of service is FULLY TAXABLE.

Exemption of Gratuity for Non-Government employees

Covered by Payment of Gratuity Act,1972:

- Rs. 20,00,000

- Gratuity Actually Received

- 15 days of salary based on last drawn salary for each completed year of service or part thereof in excess of six months

Gratuity = Last Drawn Salary × 15/26 × Number of Completed Years of Service

(Salary for this purpose means:

Basic Salary + Dearness Allowance

No. Of days in a month for this purpose shall be taken as 26)

Not Covered by Payment of Gratuity Act,1972:

Exemption shall be least of the following—

- Rs. 20,00,000

- Gratuity Actually Received

- Half month’s salary for each completed year of service (calculated on the basis of average salary for ten months immediately preceding the month of retirement/death)

Gratuity=Average Salary of Last 10 Months × 1/2 × Number of Completed Years of Service

(Salary for this purpose means:

Basic Salary + Dearness Allowance (in terms of employment for retirement benefit)+ fixed commission on turnover)

Determination Of The Amount Of Gratuity

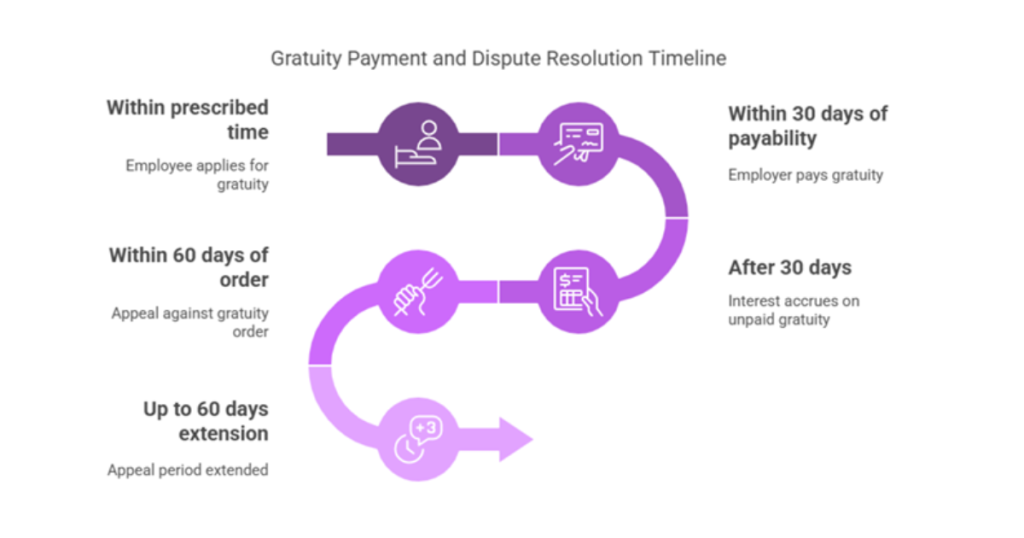

(1) A person who is eligible for payment of gratuity under this Act or any person authorised, in writing, to act on his behalf shall send a written application to the employer, within such time and in such form, as may be prescribed, for payment of such gratuity.

(2) As soon as gratuity becomes payable, the employer shall, whether an application referred to in sub-section (1) has been made or not, determine the amount of gratuity and give notice in writing to the person to whom the gratuity is payable and also to the controlling authority specifying the amount of gratuity so determined.

[(3) The employer shall arrange to pay the amount of gratuity within thirty days from the date it becomes payable to the person to whom the gratuity is payable. (3A) If the amount of gratuity payable under sub-section (3) is not paid by the employer within the period specified in sub-section (3), the employer shall pay, from the date on which the gratuity becomes payable to the date on which it is paid, simple interest at such rate, not exceeding the rate notified by the Central Government from time to time for repayment of long-term deposits, as that Government may, by notification specify :

Provided that no such interest shall be payable if the delay in the payment is due to the fault of the employee and the employer has obtained permission in writing from the controlling authority for the delayed payment on this ground.]

(4) (a) If there is any dispute as to the amount of gratuity payable to an employee under this Act or as to the admissibility of any claim of, or in relation to, an employee for payment of gratuity, or as to the person entitled to receive the gratuity, the employer shall deposit with the controlling authority such amount as he admits to be payable by him as gratuity.

[(b) Where there is a dispute with regard to any matter or matters specified in clause (a), the employer or employee or any other person raising the dispute may make an application to the controlling authority for deciding the dispute.]

[[(c)] The controlling authority shall, after due inquiry and after giving the parties to the dispute a reasonable opportunity of being heard, determine the matter or matters in dispute and if, as a result of such inquiry any amount is found to be payable to the employee, the controlling authority shall direct the employer to pay such amount or, as the case may be, such amount as reduced by the amount already deposited by the employer.]

[(d)] The controlling authority shall pay the amount deposited, including the excess

amount, if any, deposited by the employer, to the person entitled thereto.

[(e)] As soon as may be after a deposit is made under clause (a), the controlling authority shall pay the amount of the deposit —

(i) to the applicant where he is the employee ; or

(ii) where the applicant is not the employee, to the [nominee or, as the case may be, the guardian of such nominee or] heir of the employee if the controlling authority is satisfied that there is no dispute as to the right of the applicant to receive the amount of gratuity.

(5) For the purpose of conducting an inquiry under sub-section (4), the controlling authority shall have the same powers as are vested in a court, while trying a suit, under the Code of Civil Procedure, 1908 (5 of 1908), in respect of the following matters, namely :—

(a) enforcing the attendance of any person or examining him on oath ;

(b) requiring the discovery and production of documents ;

(c) receiving evidence on affidavits ;

(d) issuing commissions for the examination of witnesses.

(6) Any inquiry under this section shall be a judicial proceeding within the meaning of sections 193 and 228, and for the purpose of section 196, of the Indian Penal Code, 1860 (45 of 1860).

(7) Any person aggrieved by an order under sub-section (4) may, within sixty days from the date of the receipt of the order, prefer an appeal to the appropriate Government or such other authority as may be specified by the appropriate Government in this behalf:

Provided that the appropriate Government or the appellate authority, as the case may be, may, if it is satisfied that the appellant was prevented by sufficient cause from preferring the appeal within the said period of sixty days, extend the said period by a further period of sixty days.

[Provided further that no appeal by an employer shall be admitted unless at the time of preferring the appeal, the appellant either produces a certificate of the controlling authority to the effect that the appellant has deposited with him an amount equal to the amount of gratuity required to be deposited under sub-section (4), or deposits with the appellate authority such amount.]

(8) The appropriate Government or the appellate authority, as the case may be, may, after giving the parties to the appeal a reasonable opportunity of being heard, confirm, modify or reverse the decision of the controlling authority.

Gratuity Payment and Dispute Resolution Timeline

FAQs

Gratuity is shown as ‘income from other sources’ while calculating tax returns for the financial year under consideration. On the ITR 1 form, the gratuity amount post exempted amount deduction should be entered in the ‘Exempt Income’ section.

In the hands of non-Government employee, gratuity is exempt subject to the limits prescribed in this regard and PF receipts are exempt from tax, if the same are received from a recognized PF after rendering continuous service of not less than 5 years.

Can gratuity exemption be claimed more than once? As per the Income Tax Act, 1961, the exemption for gratuity can be claimed unlimited number of times until it does not exceed the maximum exemption limit i.e. Rs 20 lakh.

Tax Deducted at Source (TDS): If the gratuity exceeds the exempted limit of ₹20 lakh (as per the Union Budget 2025), the employer deducts TDS at the applicable tax rate before making the payment.