Now our second Question comes into picture which is How to finance the Working Capital

For this it is important for us to know that there are further two categories of Working Capital on the basis of Time

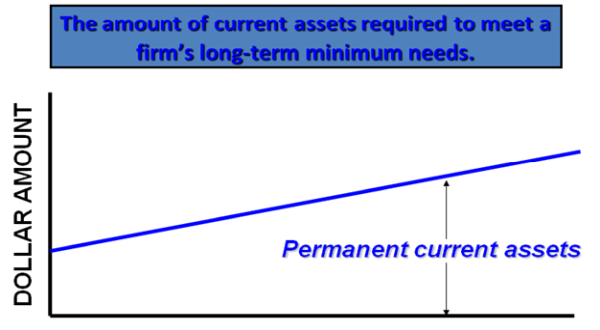

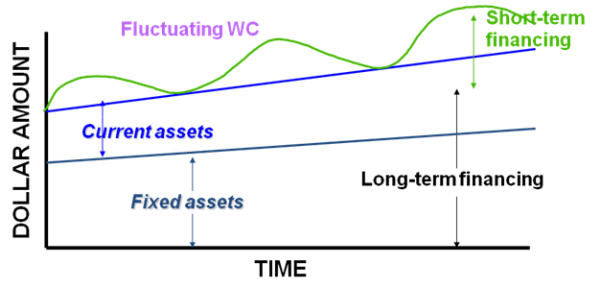

1.Permanent Working Capital: Permanent Working Capital is that working capital that a business require to carry on minimum business activities.

2.Temporary Working Capital: Temporary working capital is that working capital which varies with seasonal requirements. Sometime it is also called Variable or fluctuating Working capital.

This capital is required over and above Permanent Working Capital.

Permanent Working Capital

Temporary Working Capital

Now the issue before us is how to finance Permanent Working Capital and Temporary Working Capital.

�

But for this we need to know how many types of financing are available in the market:

1. Short Term Sources: Factoring of receivable, short term bank credit like OD, CC limit, Trade credit and commercial paper etc.

2. Long Term Sources: Long term loans from Banks and financial institutions, Equity share capital, preference share capital and Debentures.

Now there are three approaches to finance the Permanent Working Capital and Temporary Working capital with the above available sources of finance:

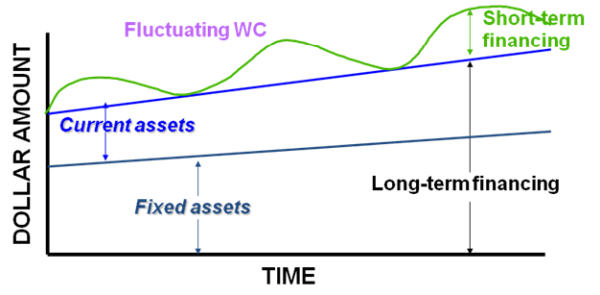

1. Matching Approach:

a.) Fixed assets and the non-seasonal portion of current assets (Permanent Current Asset) are financed with long-term debt and equity (long-term profitability of assets to cover the long-term financing costs of the firm).

b.) Seasonal needs are financed with short-term loans (under normal operations sufficient cash flow is expected to cover the short-term financing cost).

c.) Seasonal orders require the purchase of inventory beyond current levels.

d.) Increased inventory is used to meet the increased demand for the final product.

e.) Sales become receivables.

f.) Receivables are collected and become cash.

g.) The resulting cash funds can be used to pay off the seasonal short-term loan and cover associated long-term financing costs.

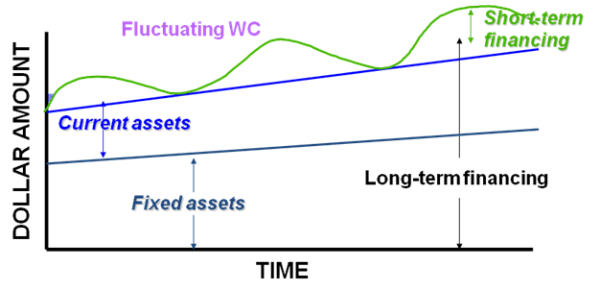

2. Conservative Approach:

a.) Fixed assets and the non-seasonal portion of current assets are financed with long-term debt and equity (long-term profitability of assets to cover the long-term financing costs of the firm).

b.) Seasonal needs are financed with the combination of Long Term Debt & Equity and short-term loans.

c.) Here risk is low as temporary WC is also financed by Long term loans.

3.Aggressive Approach:

a.) In this approach fixed assets is financed by Long term Debt and equity and the non-seasonal portion of current assets are financed with the combination of long-term debt and equity and short term loans.

b.) Seasonal needs are financed with short term loans.

c.) Here risk is High as Permanent C

CAclubindia

CAclubindia